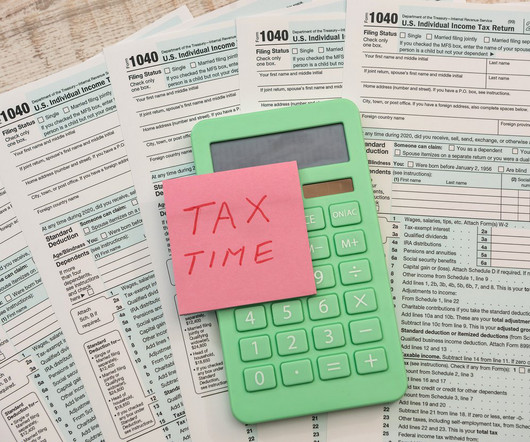

Bookkeeping Document Checklist: Collect and Organize Your Financial Documents

LedgerDocs

JULY 6, 2023

We have compiled a checklist of information to share with your bookkeeper: Business Documents: Business licenses and permits Employer Identification Number (EIN) Articles of Incorporation or Organization Operating Agreement or Bylaws (if applicable) Any relevant registrations or certifications Financial Statements: Balance Sheet Income Statement Cash (..)

Let's personalize your content