How To Do Accounts Receivable Reconciliation

Nanonets

MAY 21, 2024

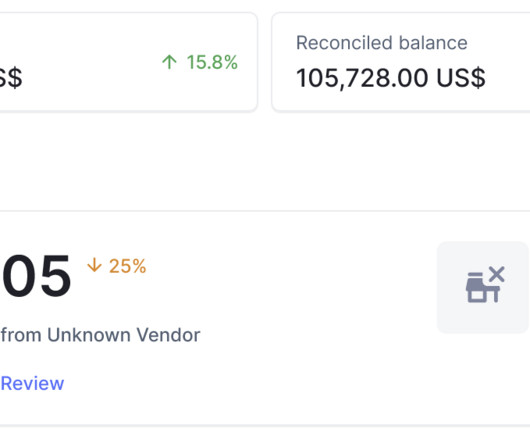

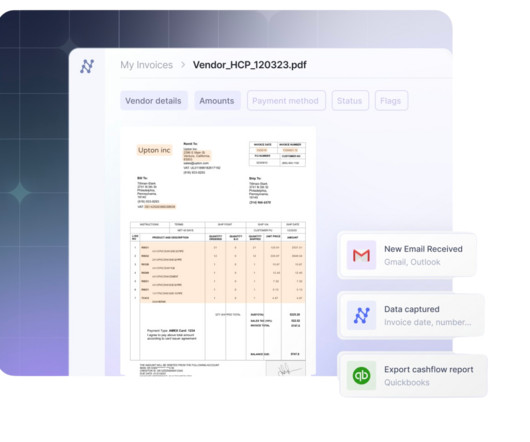

Improving cash flow management: Accurate accounts receivable balances enable businesses to better manage their cash flow by ensuring timely collection of outstanding payments from customers. Accounts Receivable Reconciliation Gather Documentation: Collect all relevant documents (invoices, credit memos, payments).

Let's personalize your content