What is Accounts Receivable Automation, and how can you leverage it for your business?

Cevinio

FEBRUARY 1, 2024

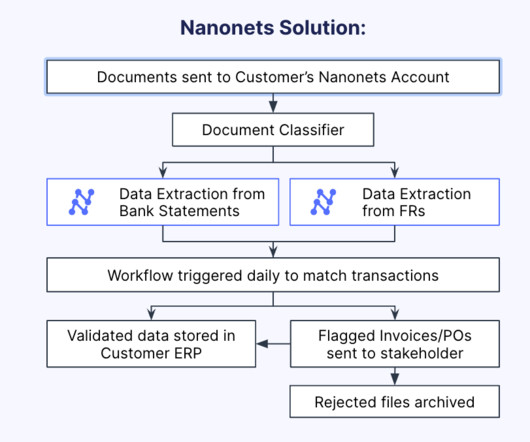

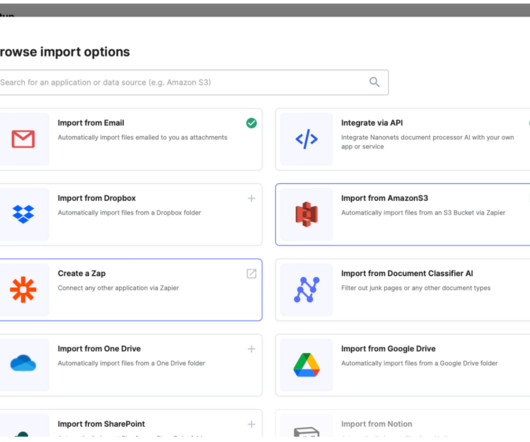

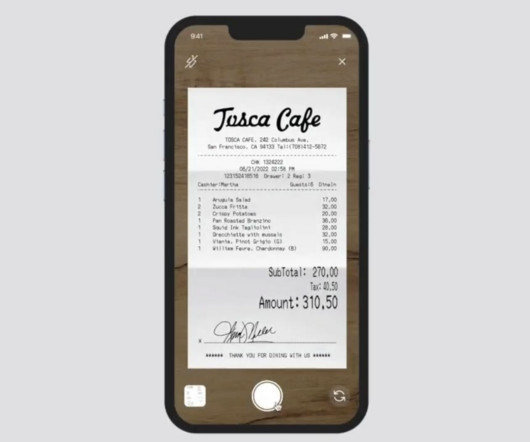

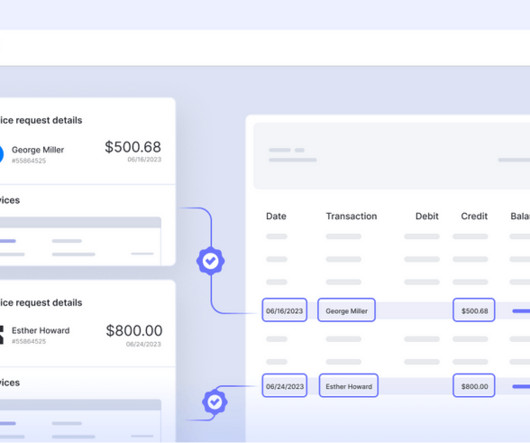

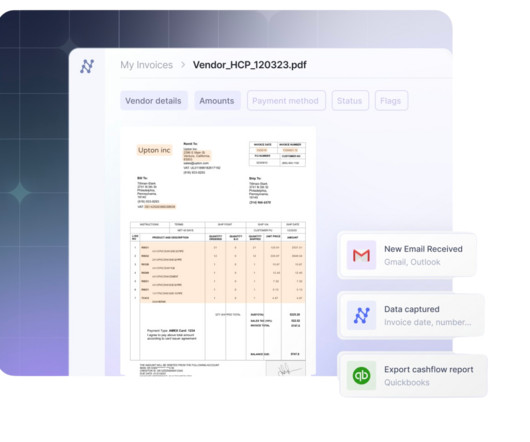

The AR process includes tasks such as sending invoices, asking for confirmation that an invoice has been duly received, requesting payment of invoices that are becoming due, following up on overdue payments, reconciling payments received, and updating customer records. What are the different types of Accounts Receivable Automation solutions?

Let's personalize your content