FASB approves income tax reporting standard

Accounting Today

AUGUST 30, 2023

The Financial Accounting Standards Board voted to require companies to tell the public more about the taxes they pay, starting as early as 2025.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accounting Today

AUGUST 30, 2023

The Financial Accounting Standards Board voted to require companies to tell the public more about the taxes they pay, starting as early as 2025.

Accounting Today

AUGUST 15, 2022

(..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Live Demo - Supercharge your Month End Close

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Counto

DECEMBER 16, 2024

Objectives of an External Audit: Accuracy of Financial Statements: Ensuring financial statements are prepared correctly in accordance with accounting standards such as the International Financial Reporting Standards (IFRS). From multicurrency accounting to tax filing, Counto handles it allwith unlimited transactions.

Live Demo - Supercharge your Month End Close

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Counto

MARCH 24, 2025

Choosing The Right Reporting Frequency: Monthly Vs. Quarterly Vs. Yearly When it comes to financial reports, timing matters. But whats the right reporting frequency for your business monthly, quarterly, or yearly? All your financials handled. Combine accounting and tax filing in a single plan.

Counto

FEBRUARY 23, 2025

With streamlined customs procedures, tax benefits, and reduced import/export duties, these zones provide an attractive environment for companies looking to expand their global reach. Businesses can: Store imported goods without paying immediate taxes or duties. Reduced paperwork, enhancing financial reporting efficiency.

Counto

MARCH 23, 2025

Staying financially organised and compliant with local regulations is critical, and thats where professional accounting services can make all the difference. From daily bookkeeping to tax filings and financial reporting, these services help SMEs like yours maintain control, make smarter decisions, and grow with confidence.

Counto

NOVEMBER 7, 2024

In this post, we’ll cover some essential accounting practices and tips that can help streamline financial management for F&B businesses in Singapore. Importance of Accurate Bookkeeping and Financial Reporting Accurate bookkeeping forms the foundation of any successful business. Streamline tax filings and avoid penalties.

Counto

MARCH 23, 2024

Understanding Singapore Financial Reporting Standards (SFRS) for SMEs Navigating Singapore’s financial reporting standards is crucial for SMEs. At Counto, we’re committed to simplifying complex concepts like the Singapore Financial Reporting Standards (SFRS) to empower your business.

Counto

MARCH 18, 2025

Bookkeeping and Financial Reporting Bookkeeping costs depend on factors like transaction volume and reporting frequency. Common bookkeeping services include: Recording daily financial transactions Bank reconciliations Generating financial statements such as profit and loss reports Ensuring accurate expense tracking 2.

Counto

MARCH 23, 2025

Automated Tax Calculations AI ensures your corporate tax and GST filings are accurate and up to date, helping you avoid penalties. Customisable Service Packages Whether you need basic bookkeeping or advanced financial reporting, our solutions grow with you.

Counto

NOVEMBER 28, 2024

AI Automation : Counto’s AI-powered platform automates key tasks like data entry, reconciliation, and financial reporting. Faster Migrations : With automation, businesses can transfer financial data more quickly, reducing downtime during the migration. This cuts down on manual work and speeds up the migration process.

Counto

DECEMBER 7, 2024

Only Checking Financial Statements Annually Why This Happens: Many SMEs in Singapore only review financial statements once a year, often because they feel its only necessary during tax season or after a year has passed. Our expert accountants deliver comprehensive servicesfrom bookkeeping to tax filingat transparent rates.

Counto

JANUARY 21, 2025

Understanding the Differences Accounting Firms: Accounting firms are professional organisations that provide a wide range of services designed to meet the diverse financial needs of businesses of all sizes. This broad skill set ensures that your business receives well-rounded financial guidance and advice.

Counto

MARCH 6, 2025

Maintaining organised financial statements and a sound company structure can streamline the fundraising process. For instance, new tax incentives and financial development programmes have been announced to boost market participation. Tax Compliance Adhering to corporate tax regulations is crucial for securing funding.

Billah and Associates

JANUARY 27, 2021

Corporate tax deadlines are a little different than personal tax deadlines. For tax purposes, corporations can have year-ends that are not December 31st. Corporate tax return filings are due 6 months after the year-end For eg, a December 31, 2022 year-end would have a June 30, 2023, due date.

Counto

NOVEMBER 12, 2024

Accounting Software Simplifies budgeting, expense tracking, and financial reporting. Ensures compliance with Singapore’s tax regulations and provides insights into financial performance. Tax Efficiency Understand the tax implications of scaling. Discover how we can streamline your taxes and accounting today.

Counto

FEBRUARY 8, 2024

Mark Your Calendar: 2024 Tax Deadlines for Singapore Businesses As we step into 2024, it’s good practice to mark your calendar for the year’s compliance deadlines. Preparing Financial Statements: All companies must compile financial statements within 6 months after FYE, adhering to Singapore Financial Reporting Standards (SFRS).

Accounting Today

APRIL 22, 2024

BEPS Pillar Two will affect a significant number of companies by establishing an effective global minimum tax rate of 15%.

Counto

SEPTEMBER 12, 2024

Financial Reporting: Experts prepare accurate financial reports, providing you with the insights needed for informed decision-making. Tax Compliance: Specialists handle tax filings and compliance, reducing the risk of errors and ensuring adherence to regulations. Expert Financial Insights 3.1

Counto

NOVEMBER 7, 2024

Understanding Singapore’s Tax Requirements for F&B Businesses Running a food and beverage (F&B) business in Singapore presents unique opportunities and challenges, especially when it comes to understanding Singapore’s tax requirements. Example : A restaurant with annual turnover of S$1.5

Counto

OCTOBER 7, 2024

Tax Implications of Intangible Assets: What SMEs in Singapore Need to Know In Singapore’s competitive business environment, small and medium-sized enterprises (SMEs) constantly seek strategies to gain a foothold. These non-physical resources can significantly impact your company’s financial standing and tax responsibilities.

Accounting Tools

SEPTEMBER 1, 2023

Related Courses Accounting for Income Taxes What are Deferred Income Taxes? Deferred income taxes are taxes that a company will eventually pay on its taxable income , but which are not yet due for payment. This means that the deferred income taxes line item generally does not impact short-term liquidity ratios.

Counto

JANUARY 7, 2025

Changes to Corporate Tax Rates Adjustments to corporate tax rates may be introduced in 2025 as part of government measures to promote economic growth and address fiscal needs. What to Expect: Possible changes to existing tax incentives. New guidelines for tax credits and rebates.

Counto

DECEMBER 13, 2024

Example : A newly registered private limited company opens a corporate bank account by submitting the required documents, such as its business profile and shareholder details. Registering for Goods and Services Tax (GST) If your companys annual revenue exceeds S$1 million , registering for GST is a mandatory post-incorporation requirement.

Counto

NOVEMBER 27, 2024

Navigating Account Migrations: Key Considerations for Singapore SMEs For Singapore SMEs , account migrations are crucial to improving operational efficiency, enhancing financial reporting, and keeping up with evolving business needs. At Counto, we prioritise your bottom line.

Counto

MARCH 19, 2024

Filing Requirements for Private Limited Companies: All You Need to Know As a Singapore business owner, it is important to understand filing requirements for private limited companies to ensure tax compliance. The process includes declaring chargeable income after deducting tax-allowable expenses, capital allowances, and reliefs.

Counto

MARCH 23, 2025

One Platform for All: Simplifying Accounting, Tax & Secretarial Tasks for SMEs in Singapore Running an SME in Singapore means constantly balancing multiple rolesfrom managing daily operations to navigating regulatory requirements. Simplified Tax Compliance Tax compliance is essential for every Singapore SME, but it can be complex.

Counto

SEPTEMBER 12, 2024

Adopt Effective Accounting Software Simplify Financial Management: Implement accounting software like QuickBooks or Xero to streamline your bookkeeping. These tools automate tasks such as recording transactions, generating invoices, and creating financial reports. Analyse Financial Reports Regularly 4.1

Counto

OCTOBER 8, 2024

AI-Powered Processing: Counto’s platform processes your financial data quickly, providing timely insights and reports. Example: A tech startup needed financial clarity before an investor meeting. The insights gained from financial analysis allowed them to allocate resources effectively, leading to a successful launch.

Counto

APRIL 4, 2024

At Counto, we recognise the importance of seamless financial management across borders, which is why all our accounting plans include free multi-currency support. The Importance of Multi-Currency Accounting in Financial Reporting 1. Other Considerations to Ensure Accurate Multi-currency Reporting 1.

Counto

DECEMBER 14, 2023

Favorable Tax Regime One of the most compelling reasons to incorporate in Singapore is its attractive tax regime. The country offers a competitive corporate tax rate, tax incentives for specific industries, and no capital gains tax.

Counto

DECEMBER 13, 2024

Our expert accountants deliver comprehensive servicesfrom bookkeeping to tax filingat transparent rates. Deviation from Standard Accounting Practices: Failing to follow accounting norms can result in inaccurate financial reporting. Effective debt management is crucial for long-term financial stability.

Counto

JANUARY 6, 2024

Singapore has emerged as a preferred destination for setting up holding companies, thanks to several compelling advantages: Tax Efficiency : Singapore boasts a favourable tax environment, with attractive tax rates on capital gains and foreign-sourced dividends.

Accounting Tools

APRIL 22, 2023

Related Courses S Corporation Tax Guide Types of Business Entities What is a Subchapter S Corporation? A Subchapter S corporation is a form of corporate organization under which the obligation to pay income taxes is passed through to the shareholders of the organization.

Counto

JANUARY 11, 2024

Guide to Filing Financial Statements for Business Owners in Singapore Filing financial statements is a crucial annual requirement for businesses in Singapore. Once you’ve filed your financial statements with ACRA, it’s important to: File annual returns, which should be done after filing financial statements.

Counto

JANUARY 19, 2023

Singapore has gained a reputation as a premier destination for business due to its strong economy and generous tax incentives. On the financial side, ACRA has been established to oversee financial reporting and the facilitation of enterprises. ACRA vs IRAS: What Is the Difference Between Them?

Counto

JANUARY 19, 2023

Singapore has gained a reputation as a premier destination for business due to its strong economy and generous tax incentives. On the financial side, ACRA has been established to oversee financial reporting and the facilitation of enterprises. ACRA vs IRAS: What Is the Difference Between Them?

Counto

SEPTEMBER 7, 2024

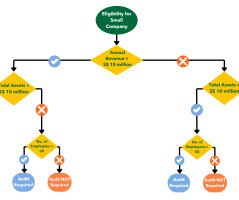

An audit is an independent examination of a company’s financial statements by a licensed auditor. The purpose is to ensure that the financial statements accurately reflect the company’s financial position and comply with the Singapore Financial Reporting Standards (SFRS) and the Companies Act.

AvidXchange

MARCH 22, 2024

These include: • Month- and year-end closes • Audit and tax season • Budgeting season • Holidays and personal time off (PTO) During these periods, time management tips for accounting and finance professionals are especially important. And topic number two is tax and audit season. It creates a lot of bottlenecks.”

Counto

DECEMBER 15, 2024

Balancing internal project deadlines with mandatory regulatory filings, such as tax submissions and annual returns, is essential for smooth operations and avoiding penalties. List Tasks : Detail the tasks involved in the project, alongside important compliance activities like financial report preparation or corporate tax filings.

Counto

NOVEMBER 4, 2024

Tax Compliance : Necessary for reporting profits to the Inland Revenue Authority of Singapore (IRAS) and ensuring compliance with local tax regulations. Supports Regulatory Compliance : Ensures adherence to local tax laws and accounting standards. Taxes : Corporate tax obligations.

Counto

JANUARY 13, 2025

Beyond the social good, charitable donations can also provide significant financial benefits. Under Singapore’s tax laws, businesses can claim a tax deduction of up to 2.5 Here’s how you can ensure compliance with tax regulations and maximise your charitable giving: 1.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content