What is a Bank Reconciliation Statement & How to do it?

Nanonets

APRIL 15, 2024

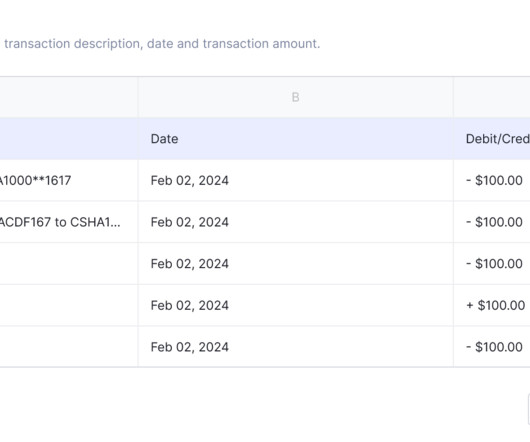

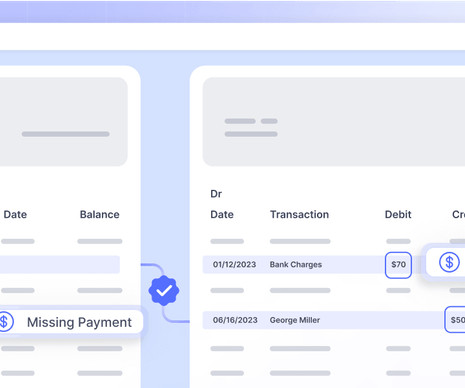

It typically outlines outstanding checks, deposits in transit, bank fees, errors, and any other differences between the two sets of records. This includes deposits, withdrawals, checks issued, electronic transfers, bank fees, interest earned, and any other relevant transactions. Looking out for a Reconciliation Software?

Let's personalize your content