Six practice apps to make FY24 your best yet

Xero

MARCH 30, 2023

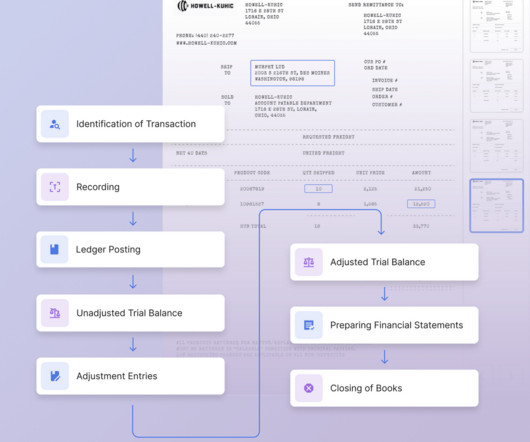

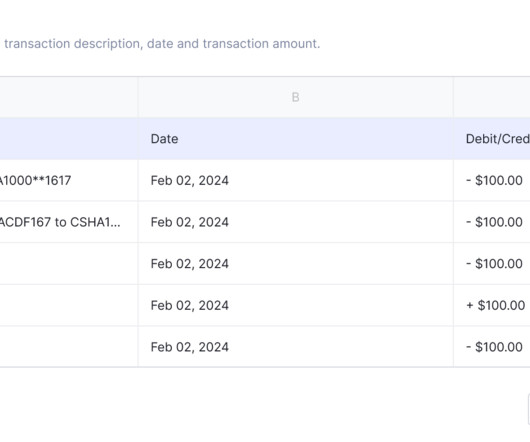

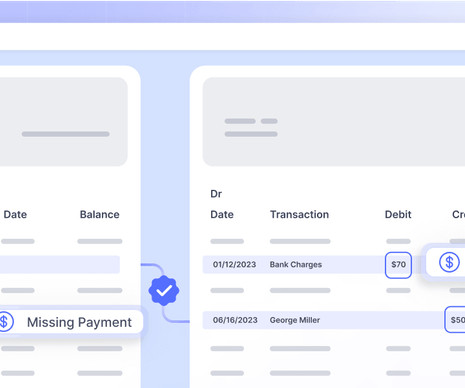

You can also use the New Proposal Editor to automatically collect deposits from new clients to minimise business risk and keep your cash flow in check. The deposit payment will be clearly stated on the proposal and invoice. So ensuring you have streamlined, transparent and automated processes around data entry and outputs is critical.

Let's personalize your content