Bookkeeping Document Checklist: Collect and Organize Your Financial Documents

LedgerDocs

JULY 6, 2023

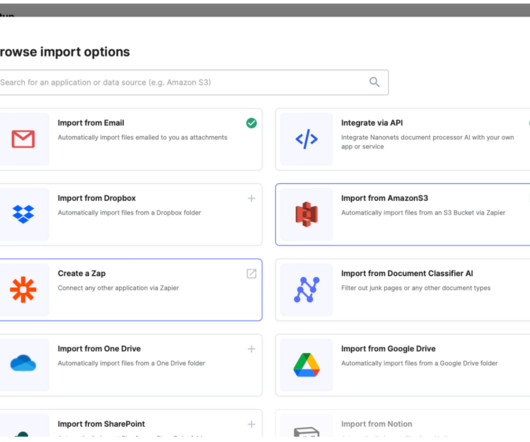

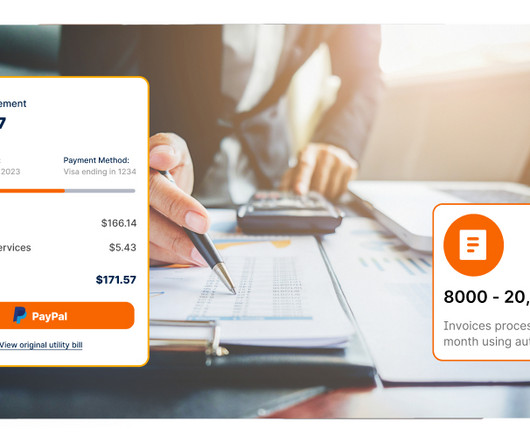

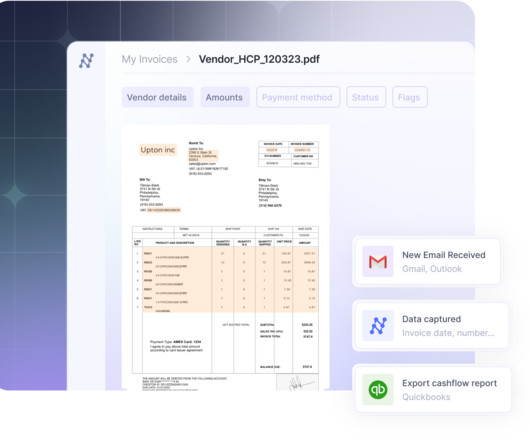

But collecting and organizing these documents can be a daunting task. Intellectual property registrations (trademarks, patents, copyrights) Effective Document Management can be a hassle, but LedgerDocs is here to help. Start your free trial today and see how simple effective document management can be.

Let's personalize your content