Accounting 101: Techniques to Prioritizing Growth

Insightful Accountant

JUNE 14, 2023

Arc Business Management and National Xero Ambassador Tate Henshaw drills down on why it is time for you to open your mind up to new techniques to help your firm.

Insightful Accountant

JUNE 14, 2023

Arc Business Management and National Xero Ambassador Tate Henshaw drills down on why it is time for you to open your mind up to new techniques to help your firm.

SSI Healthcare Rev Cycle Solutions

JUNE 14, 2023

Claim edits mastery: Leveraging best edits and best practices to expedite payments [Live Webinar] Although often overlooked, claim edits play a critical role in thwarting denials and accelerating payments. Your ability to efficiently manage and promptly correct edits, utilizing a claim scrubber or billing application, has substantial implications on your cash flow.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nanonets

JUNE 14, 2023

Introduction In today's digital age, managing an avalanche of emails can be an overwhelming task, especially for businesses dealing with hundreds or thousands of emails daily. However, these emails often contain vital information, from purchase orders and invoices to customer queries or even insights that could help streamline your business operations.

Insightful Accountant

JUNE 14, 2023

How Rewind helped the Executive Geek make data loss a non-event for its non-profit clients.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Accounting Tools

JUNE 14, 2023

Related Courses How to Conduct a Compilation Engagement How to Conduct a Review Engagement How to Conduct an Audit Engagement What is a Financial Statement Review? A financial statement review is a service under which the accountant obtains limited assurance that there are no material modifications that need to be made to an entity's financial statements for them to be in conformity with the applicable accounting framework (such as GAAP or IFRS ).

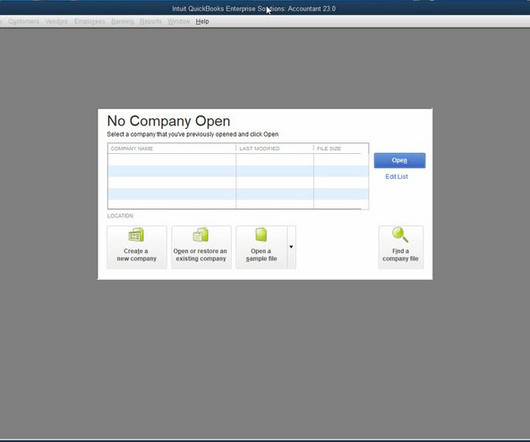

Insightful Accountant

JUNE 14, 2023

Murph takes you step by step through repairing the QuickBooks Application in the first part of his two-part series.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

CloudZero

JUNE 14, 2023

In a not altogether friendly economic environment, digital-native businesses are looking for as much control and predictability in the cloud as possible. Finding durable savings, building cost-efficient cloud infrastructure, and laying cultural foundations for long-term cloud sustainability have never been more core to business success.

Accounting Tools

JUNE 14, 2023

Related Courses Business Combinations and Consolidations Divestitures and Spin-Offs Mergers and Acquisitions Goodwill is an intangible asset generated from the acquisition of one entity by another. It cannot be generated internally; it can only be recognized through the acquisition of another business. Goodwill is the difference between the price paid by the acquirer for a business and the amount of that price that cannot be assigned to any of the individually-identified assets and liabilities a

Tipalti

JUNE 14, 2023

A payout API allows businesses to integrate payment processing into their website or app. Learn about the functionality of payment APIs and REST and SOAP API features.

Accounting Tools

JUNE 14, 2023

Related Courses Cost Accounting Fundamentals Cost Management Guidebook What is a Discretionary Fixed Cost? A discretionary fixed cost is an expenditure for a period-specific cost or a fixed asset , which can be eliminated or reduced without having an immediate impact on the reported profitability of a business. There are not many discretionary fixed costs, but they can be quite large, and so are worth considerable ongoing review by management.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Nanonets

JUNE 14, 2023

I wouldn’t be exaggerating if I said an average person sends/receives at least 10 invoices per week. With the growing digitalization, businesses are dealing with massive volumes of invoices every day. Traditionally, invoice processing has been a manual and time-consuming process, that needs significant resources and is prone to errors. With the advent of AI and Natural Language Processing, invoice processing can now be automated and streamlined, leading to improved efficiency and accuracy

Accounting Tools

JUNE 14, 2023

Related Courses Accounting for Inventory How to Audit Inventory How to Conduct an Audit Engagement What are Inventory Audit Procedures? If your company records its inventory as an asset and it undergoes an annual audit , then the auditors will be conducting an audit of your inventory. Given the massive size of some inventories, they may engage in quite a large number of inventory audit procedures before they are comfortable that the valuation you have stated for the inventory asset is reasonable

Cloud Accounting Podcast

JUNE 14, 2023

We're back from the AICPA Engage conference sharing takeaways. Also, we're talking about all the latest generative AI developments in accounting, plus the recent PwC scandal in Australia. Sponsors LiveFlow - [link] Zoho - [link] Helcim - [link] Chapters (00:00) - PREVIEW: The PwC scandal (00:46) - Blake and David are back from AICPA Engage (02:08) - Blake shares his mom's tax return horror story (10:13) - Thoughts on the AICPA's 100th Town Hall podcast episode (16:10) - How can AICPA grow Engage

Accounting Tools

JUNE 14, 2023

Related Courses Bookkeeping Guidebook How to Audit Receivables New Controller Guidebook What is the Direct Write Off Method? The direct write off method involves charging bad debts to expense only when individual invoices have been identified as uncollectible. This method can be considered a reasonable accounting method if the amount that is written off is an immaterial amount, since doing so has minimal impact on an entity's reported financial results, and so would not skew the decisions of a p

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

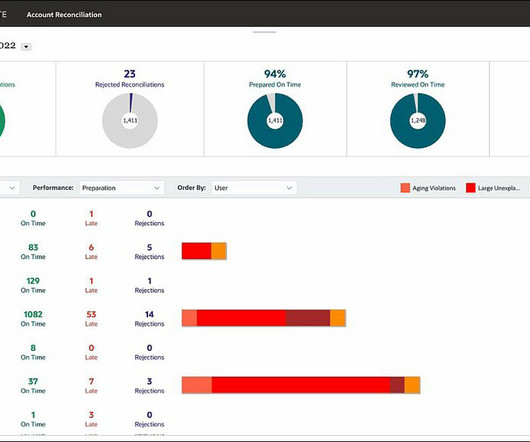

Insightful Accountant

JUNE 14, 2023

NetSuite Account Reconciliation is built on Oracle technology to improve financial statement accuracy and expedite accounting period close.

Accounting Tools

JUNE 14, 2023

Related Courses Accountants' Guidebook GAAP Guidebook How to Account for Research and Development The accounting for research and development involves those activities that create or improve products or processes. The core accounting rule in this area is that expenditures be charged to expense as incurred. Examples of activities typically considered to fall within the research and development functional area include the following: Research to discover new knowledge Applying new research findings

CloudZero

JUNE 14, 2023

CloudZero just closed at $32M Series B fundraising round in the weakest funding environment since the dawn of the pandemic. The round was led by Innovius Capital and Threshold Ventures, with continued support from existing investors Matrix Partners, Underscore VC, and G20 Ventures.

Accounting Tools

JUNE 14, 2023

Related Courses Accountants’ Guidebook Bookkeeper Education Bundle Bookkeeping Guidebook What is a Suspense Account? A suspense account is an account used to temporarily store transactions for which there is uncertainty about where they should be recorded. Once the accounting staff investigates and clarifies the purpose of this type of transaction, it shifts the transaction out of the suspense account and into the correct account(s).

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

NACM

JUNE 14, 2023

Listen to the latest episode of NACM's Extra Credit podcast to learn how automation can help credit departments navigate the spike in bankruptcies. ?️ With the pandemic free-money era officially coming to an end, many businesses on the margin are starting to struggle. As a result, corporate bankruptcies are on the rise. Commercial C.

Accounting Tools

JUNE 14, 2023

Related Courses How to Audit Payroll Optimal Accounting for Payroll Payroll Management A commission is a fee that a business pays to a salesperson in exchange for his or her services in either facilitating or completing a sale. Calculating a sales commission depends on the structure of the underlying commission agreement. The following factors typically apply to the calculation: Commission Rate The commission rate is the percentage or fixed payment associated with a certain amount of sale.

Accounting Tools

JUNE 14, 2023

Related Courses Business Ratios Guidebook The Interpretation of Financial Statements What is the Cash Turnover Ratio? The cash turnover ratio is used to determine the proportion of cash required to generate sales. The ratio is typically compared to the same result for other businesses in the same industry to estimate the efficiency with which an organization uses its available cash to conduct operations and generate sales.

Accounting Tools

JUNE 14, 2023

Related Courses Accounting for Inventory How to Audit Inventory Inventory Management What is Inventory Shrinkage? Inventory shrinkage is the excess amount of inventory listed in the accounting records , but which no longer exists in the actual inventory. Excessive shrinkage levels can indicate problems with inventory theft, damage, miscounting, incorrect units of measure, evaporation, or similar issues.

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Accounting Tools

JUNE 14, 2023

Related Courses Accounting for Inventory Business Ratios Guidebook Inventory Management What is Days’ Sales in Inventory? Days' sales in inventory (DSI) indicates the average time required for a company to convert its inventory into sales. A small number of days' sales in inventory indicates that a company is more efficient at selling off its inventory, while a large number indicates that it may have invested too much in inventory, and may even have obsolete inventory on hand.

Accounting Tools

JUNE 14, 2023

Related Courses Corporate Finance Treasurer's Guidebook What is an Imputed Interest Rate? An imputed interest rate is an estimated interest rate used instead of the established interest rate associated with a debt. An imputed rate is used because the established rate does not accurately reflect the market rate of interest , or there is no established rate at all.

Accounting Tools

JUNE 14, 2023

Related Courses Business Ratios Guidebook Key Performance Indicators What is a Key Performance Indicator? A key performance indicator (KPI) is a core metric used by a business to monitor its progress toward achieving key goals and financial outcomes. KPIs will vary by industry, due to differences in their operational and financial structures. Among the more common KPIs related to finances are a firm's gross margin , net profit , current ratio , and debt to equity ratio.

Accounting Tools

JUNE 14, 2023

Related Courses Bookkeeping Guidebook How to Audit Receivables New Controller Guidebook What is the Percentage of Receivables Method? The percentage of receivables method is used to derive the bad debt percentage that a business expects to experience. The technique is used to populate the allowance for doubtful accounts , which is a contra account that offsets the accounts receivable asset.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Accounting Tools

JUNE 14, 2023

Related Courses Business Ratios Guidebook The Interpretation of Financial Statements What is the Acid-Test Ratio? The acid-test ratio compares a company’s most short-term assets to its short-term liabilities. The intent of this ratio is to evaluate whether a business has sufficient cash to pay for its immediate obligations. If not, there is a significant risk of default.

Accounting Tools

JUNE 14, 2023

Related Courses Auditor Independence What is a Financial Interest? A financial interest is an ownership stake in an equity security or debt security issued by an entity, including the rights and obligations to acquire such an interest. An auditor is deeply interested in the types and amounts of financial interests he or she holds in an attest client , since these investments can impact the auditor’s level of independence in relation to the client.

Accounting Tools

JUNE 14, 2023

Related Courses How to Audit Cash How to Audit Equity How to Audit Fixed Assets How to Audit Inventory How to Audit Liabilities How to Audit Receivables How to Conduct an Audit Engagement What are Substantive Procedures? Substantive procedures are intended to create evidence that an auditor assembles to support the assertion that there are no material misstatements in regard to the completeness, validity, and accuracy of the financial records of an entity.

Accounting Tools

JUNE 14, 2023

Related Courses Forensic Analytics Guide to Data Analytics for Audits How to Conduct an Audit Engagement What is Audit Data Analytics? Audit data analytics involves the analysis of complete sets of data to identify anomalies and trends for further investigation, as well as to provide audit evidence. This process usually involves an analysis of entire populations of data, rather than the much more common audit approach of only examining a small sample of the data.

Advertiser: Paycor

Before you can achieve success, you have to define it. Objectives and Key Results (OKRs) give you the framework to do just that. Paycor’s free guide includes a step-by-step process leaders can use to work toward – and achieve – their loftiest business goals.

Let's personalize your content