Helping clients pick the right business structure

Accounting Today

MAY 13, 2025

Accountants and tax professionals need to be ready to help their clients choose the right type of business entity.

Accounting Today

MAY 13, 2025

Accountants and tax professionals need to be ready to help their clients choose the right type of business entity.

Accounting Department

MAY 13, 2025

Running a business means wearing many hats, but as your company grows, certain tasks become too difficult to manage in-house. One of the most challenging areas for growing businesses is accounting. Between compliance, financial reporting, and keeping the books clean, managing finances in-house can quickly shift from practical to overwhelming.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

MAY 13, 2025

A report by the Association of Chartered Certified Accountants found 54% of North American respondents say they have career ambitions to be entrepreneurs.

Outsourced Bookeeping

MAY 13, 2025

Managing the finances effectively is important for the growth and success of any e-commerce business. When company grows, finance management becomes complicated. E-commerce outsourced accounting helps in saving overhead costs, enhances accuracy, and also offers specialized proficiency which allows you to focus on your core business processes. If you are also an e-commerce company struggling with your accounts, then this blog is for you.

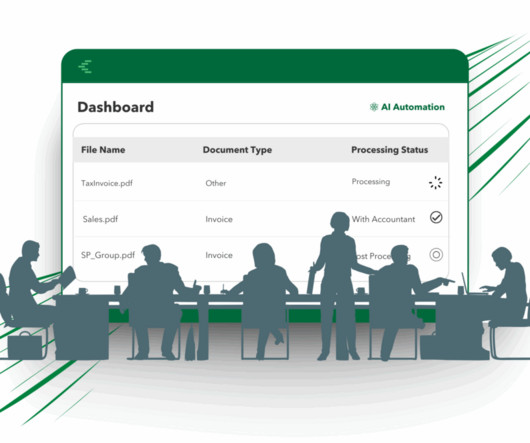

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Accounting Today

MAY 13, 2025

The Federal Accounting Standards Advisory Board wants input on accounting issues and questions related to reorganizations and abolishments amid DOGE cuts.

Counto

MAY 13, 2025

Share Transfer vs. Share Allotment in Singapore: What Every Business Owner Should Know As a small business owner in Singapore, there may come a point where you want to bring in a new shareholder or adjust existing ownership among current investors. But the way you go about it makes a legal, financial, and even accounting services -related difference.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Counto

MAY 13, 2025

How to Handle Income Tax as a Sole Proprietor in Singapore As a small business owner operating as a sole proprietor in Singapore, handling your income tax effectively is part of keeping your business financially sound. While the sole proprietorship model is straightforward, it still demands discipline in tracking income, categorising expenses, and keeping accurate records all of which fall under solid accounting practices.

Accounting Today

MAY 13, 2025

Sage announced a series of new features and enhancements for its latest release of Sage Intacct, many of which center around AI.

Intuit

MAY 13, 2025

In 1983, a young 12-year-old named Alex Balazs embarked on a journey that would shape the trajectory of his entire career. His inquisitive mind and passion for technology led his parents to enroll him in a programming class. Little did he know, at that same moment in time, Scott Cook was laying the foundation of what would become a monumental force in the tech world: Intuit.

Accounting Today

MAY 13, 2025

Valuations this year; handling interviewees; AI and accounting ed.; and other highlights from our favorite tax bloggers.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Stephanie Peterson

MAY 13, 2025

By Superior Virtual Bookkeeping LLC Serving Murrieta, Temecula, Wildomar, Menifee & BeyondTax season may be over, but that doesnt mean youre in the clear. As a solo business owner providing virtual accounting services to professionals across industries; from law firms to contractors to real estate agents, Ive seen how easily a well-meaning business can get flagged for a tax audit.

Accounting Today

MAY 13, 2025

The Chartered Institute of Management Accountants updated its CGMA Professional Qualifications Syllabus for 2026 to emphasize finance business partnering and applied problem solving.

oAppsNet

MAY 13, 2025

In todays fast-paced business environment, managing contracts efficiently is crucial for maintaining smooth operations, meeting deadlines, and ensuring compliance. As organizations grow, the complexity and volume of contracts increase, making it harder to manage agreements manually or with disconnected tools like email, spreadsheets, and Word documents.

Accounting Today

MAY 13, 2025

GOP leaders proposed a $30,000 cap on the federal income tax deduction for state and local taxes.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

SSI Healthcare Rev Cycle Solutions

MAY 13, 2025

Optimizing Clean Claim Rates: A Key Strategy for Financial Efficiency Home / May, 13 2025 The healthcare industry faces significant workforce and staffing challenges that strain operational efficiency and financial stability. One critical area that can alleviate these pressures is to optimize clean claim rates (CCR). By enhancing CCR, healthcare organizations can streamline processes, reduce administrative burdens, and improve revenue streams.

Counto

MAY 13, 2025

Preparing for Singapores Mandatory E-Invoicing in 2025: A Practical Guide for SMEs As a small business owner in Singapore, you’ve likely heard about the governments move toward mandatory e-invoicing via InvoiceNow. Starting May 2025, the Inland Revenue Authority of Singapore (IRAS) will progressively require GST-registered businesses to adopt e-invoicing under the InvoiceNow framework.

Accounting Today

MAY 13, 2025

Campaign pledges like no taxes on tips and overtime pay, plus new tax breaks for car buyers and seniors, are the centerpiece of a multitrillion-dollar package.

Counto

MAY 13, 2025

Know Your Market: How to Analyse Competitors Before You Launch Starting a business in Singapore means stepping into a competitive and well-connected market. Whether youre launching a consultancy, product brand, or online service, understanding the competition is not optional its foundational to everything from pricing to marketing to your choice of accounting services.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Accounting Today

MAY 13, 2025

The House Ways and Means Committee held a hearing to mark up the "one, big beautiful bill" extending expiring provisions of the TCJA and adding other tax breaks.

Counto

MAY 13, 2025

Best Time to Start a Business in Singapore: A Guide for First-Time Founders Starting a business in Singapore is exciting, but timing can make a real difference. Whether youre planning a consultancy, a retail venture, or a digital service, the question remains: whens the right time to launch? This guide offers practical advice for first-time founders in Singapore who want to align their start with strong financial footing, reliable accounting services , and long-term growth. 1.

Accounting Today

MAY 13, 2025

House Republicans' release of the tax provisions in their massive fiscal bill provides a crucial initial reading of what party leaders think could pass.

Let's personalize your content