Tech News: EY and AuditBoard release risk assessment tools

Accounting Today

OCTOBER 27, 2023

Plus, Gusto and FreshBooks jointly release FreshBooks Payroll; and other accounting technology news.

Accounting Today

OCTOBER 27, 2023

Plus, Gusto and FreshBooks jointly release FreshBooks Payroll; and other accounting technology news.

Accounting Department

OCTOBER 27, 2023

Join your host, Kevin Drye, and Director of Marketing, Andrea Boccard, as they take a deep dive into the art of appreciating your workforce.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

OCTOBER 27, 2023

The 2023 Accounting MOVE Project report focuses on how women can navigate the shifting workplace in the accounting profession.

Intuit

OCTOBER 27, 2023

Tell us about your career journey to Intuit. How did you learn about the Apprenticeship Pathway Program ? Anything you would like to share about that experience? I learned about the Apprenticeship Pathway Program through G{Code}, an organization that teaches the basics of web development to women and non-binary POC. It was a challenging but life-changing experience.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Accounting Today

OCTOBER 27, 2023

Small businesses are experiencing the weakest sales since 2020, according to a new report from Xero, despite signs of an improving economy.

Ace Cloud Hosting

OCTOBER 27, 2023

In a world where numbers and spreadsheets often take center stage, it’s time for accountants and financial enthusiasts to let their hair down and embrace the cinematic side of life.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

FundThrough

OCTOBER 27, 2023

Cash flow issues can feel like an uphill battle for many business owners, especially when you’re waiting on unpaid invoices. We get it – as both both finance leaders and entrepreneurs ourselves, we know all too well how cash flow can make or break a business. As traditional methods like lines of credit become more […] The post Invoice Financing: Breaking Down the Basics and Real-World Success Stories appeared first on FundThrough.

Accounting Today

OCTOBER 27, 2023

The Internal Revenue Service is providing a way for businesses to withdraw incorrect claims for the Employee Retention Credit, but what about the claims that have been paid out already?

Accounting Tools

OCTOBER 27, 2023

Related Courses Accountants’ Guidebook Cost Accounting Fundamentals There are a number of differences between cost accounting and financial accounting , which are noted below. In brief, the key differences between cost and financial accounting are that cost accounting is inwardly focused on management decisions, while financial accounting is focused on issuing financial statements to outside parties.

Accounting Today

OCTOBER 27, 2023

Partners at the Ernst & Young in the U.K. saw their share of profits drop for the first time in three years as the Big Four face economic uncertainty.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Accounting Tools

OCTOBER 27, 2023

Related Courses Fraud Examination Fraud Schemes How to Audit for Fraud What is Window Dressing? Window dressing is actions taken to improve the appearance of a company's financial statements. Window dressing is particularly common when a business has a large number of shareholders , so that management can give the appearance of a well-run company to investors who probably do not have much day-to-day contact with the business.

Accounting Today

OCTOBER 27, 2023

The business model of a CPA firm has shifted, and many firms are still not acknowledging that.

Accounting Tools

OCTOBER 27, 2023

Related Courses Fixed Asset Accounting How to Audit Fixed Assets What is Group Depreciation? Group depreciation is the practice of assembling several similar fixed assets into a single group, which is used in aggregate as the cost base for depreciation calculations. Assets should only be assembled into a group if they share similar characteristics and have approximately the same useful lives.

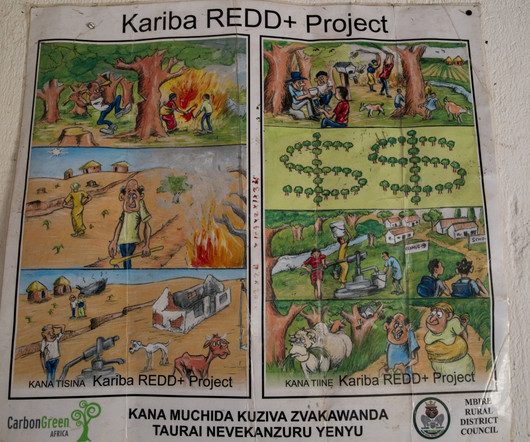

Accounting Today

OCTOBER 27, 2023

An investigation found significant flaws in accounting behind carbon credits from Zimbabwe-based Kariba.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

AvidXchange

OCTOBER 27, 2023

Jamestown Associates is one of the nation’s premier political consulting firms, handling high-profile campaigns for TV, video, radio and mail. With a collection of award-winning editors, designers and top-tier political strategists, Jamestown has won countless industry awards and continues to thrive within the political landscape. From the initial client briefing to the execution of a media buy, Jamestown’s dedication to its clients’ success is apparent throughout its entire process, including

Accounting Today

OCTOBER 27, 2023

REDW relocates Albuquerque office; Eide Bailly names nonprofit Project Chimps winner of its annual Resourcefullness Award; and more news from across the profession.

Billing Platform

OCTOBER 27, 2023

The next evolution of pricing models is not only here but revolutionizing how companies are billing for the products and services provided. Sometimes referred to as pay-as-you-go billing, usage-based pricing, or metered billing – a consumption-based pricing model charges based on what you use or consume. This provides customers with the potential to save a significant amount of money.

Accounting Today

OCTOBER 27, 2023

Your competitors of the future are probably not who you think they are.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Insightful Accountant

OCTOBER 27, 2023

MyCorporation has been a reliable resource for accountants looking to complete business filings for their clients for more than 25 years.

Cloud Accounting Podcast

OCTOBER 27, 2023

A recent report alleges Supreme Court Justice Clarence Thomas failed to disclose that a $267,000 recreational vehicle loan from a friend was forgiven, raising questions about potential tax issues and scrutiny around the justice's financial practices. Need CPE? Get CPE for listening to podcasts with Earmark: [link] Subscribe to the Earmark Podcast: [link] Get in Touch Thanks for listening and the great reviews!

Accounting Tools

OCTOBER 27, 2023

What is a Profit Center? A profit center is a business unit or department within an organization that generates revenues and profits or losses. Management closely monitors the results of profit centers, since these entities are the key drivers of the total results of the parent entity. Management typically uses profit center results to decide whether to allocate additional funding to them, and also whether to shut down low-performing units.

NACM

OCTOBER 27, 2023

?️ On today's episode of NACM's Extra Credit podcast.?♂️ Burnout has become a corporate vampire, draining the life out of employees through emotional exhaustion and lost productivity.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Accounting Tools

OCTOBER 27, 2023

Related Courses Working Capital Management Working capital is calculated by subtracting current liabilities from current assets. It is used in several ratios to estimate the overall liquidity of a business; that is, the ability to meet obligations when due. At a high level, the calculation of working capital is as follows: Current assets - Current liabilities = Working capital The working capital figure will likely change every day, as additional accounting transactions are recorded in the accou

Accounting Fun

OCTOBER 27, 2023

Tax Return of the Living Dead Silence of the ledgers Friday 31st January Rosemary's Bookkeeper The Taxorcist Auditor Dogs VATman begins Psycho tax inspector Phantom of the Tax Office Little shop of HMRC

Accounting Tools

OCTOBER 27, 2023

Related Courses Bookkeeping Guidebook New Controller Guidebook What is Account Analysis? Account analysis involves an examination of the detailed line items comprising an account. Account analysis is particularly common for those accounts included in the balance sheet , since these are real accounts whose balances continue from year to year. Without proper account analysis, these accounts tend to build up amounts that should have been purged at some point in the past.

Accounting Tools

OCTOBER 27, 2023

Related Courses How to Conduct an Audit Engagement What is an Unqualified Opinion? An unqualified opinion is an audit report that has been issued with no reservations regarding the state of an audit client's financial statements. In this opinion, the auditor follows a standard opinion format to state that the financial statements are a fair representation of the financial results and condition of a client, in accordance with the applicable accounting framework (such as GAAP ).

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Accounting Tools

OCTOBER 27, 2023

Related Courses The Balance Sheet What is a Loan Payable? A loan is an arrangement under which the owner of property allows another party the use of it (usually cash ) in exchange for an interest payment and the return of the property at the end of the lending arrangement. The loan is documented in a promissory note. If any portion of the loan is still payable as of the date of a company's balance sheet , the remaining balance on the loan is called a loan payable.

Accounting Tools

OCTOBER 27, 2023

Related Courses Bookkeeping Guidebook Corporate Cash Management How to Audit Cash What is an Uncleared Check? An uncleared check is a check that has not yet been paid by the bank on which it was drawn. Such a check has already been recorded by the payee and presented to its bank. There is a clearing cycle that must then be completed that lasts several days.

Accounting Tools

OCTOBER 27, 2023

Related Courses Fixed Asset Accounting How to Audit Fixed Assets What is Composite Depreciation? Composite depreciation is the application of a single straight-line depreciation rate and average useful life to the calculation of depreciation for a group of disparate fixed assets. The method is used to calculate depreciation for an entire asset class , such as office equipment or production equipment.

Accounting Tools

OCTOBER 27, 2023

Related Courses Bookkeeping Guidebook Corporate Cash Management How to Audit Cash Optimal Accounting for Cash What are Undeposited Checks? Undeposited checks are checks that have been received from customers , but not yet deposited. There are several possible reasons why a business might have undeposited checks, including the following: The business operates on the cash basis of accounting , and does not want to record any additional income in the current reporting period.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Let's personalize your content