Financial advisors are divided over this RMD tax strategy

Accounting Today

MAY 12, 2025

A little-known feature of RMD tax withholdings could help minimize a client's effective tax burden. Not all financial advisors are on board with the strategy.

Accounting Today

MAY 12, 2025

A little-known feature of RMD tax withholdings could help minimize a client's effective tax burden. Not all financial advisors are on board with the strategy.

Insightful Accountant

MAY 12, 2025

The tax profession faces unprecedented recruiting challenges in 2025. As specialized tax expertise becomes increasingly valuable amid evolving legislation, firms struggle with a diminishing pipeline of qualified candidates.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

MAY 12, 2025

The Internal Revenue Service has not yet satisfied the goal of the Payment Integrity Information Act to reduce improper payment rates to less than 10%.

Gaviti

MAY 12, 2025

Effective credit management has always been essential to business success, but as the world evolves, traditional approaches are giving way to technological approaches. Today, artificial intelligence (AI) has become a transformative force, reshaping how businesses handle credit management. AI-driven solutions not only streamline credit processes but significantly reduce risks, create more objective decision making and enhance overall financial health.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Accounting Today

MAY 12, 2025

Approximately three-quarters of large global companies are receiving assurance services on their sustainability reporting, according to a new report.

Ace Cloud Hosting

MAY 12, 2025

The accounting industry has long been known for its relentless work ethic. With the evolution of the global business landscape, companies now dont look at accountants as just number crunchers.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

AvidXchange

MAY 12, 2025

Adopting new technology quickly is the name of the game in fintech, but not everyone in your organization including your customers will be on board at first. In this episode, Michael Praeger sits down with Blake Sanford , VP of Association and Strategic Partners at Property Management, Inc. (PMI) , to discuss how h e s led PMIs franchise owners through technology advancements.

Accounting Today

MAY 12, 2025

The Financial Accounting Standards Board released an update to improve the requirements for identifying the accounting acquirer in business combinations.

Insightful Accountant

MAY 12, 2025

Each year, Insightful Accountant honors the most dedicated, innovative, and impactful professionals in accounting through our Top 100 ProAdvisor Awards Program. And this year, were bringing that celebration to life in an unforgettable way.

Accounting Today

MAY 12, 2025

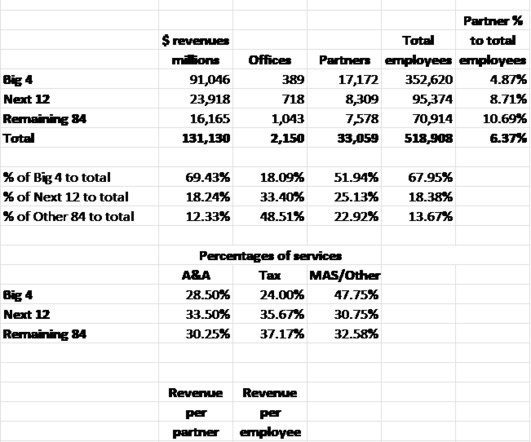

Public accounting is a vibrant and strong profession and also a business, as shown in data from the latest rankings on firm revenues, partners and staff size.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Trade Credit & Liquidity Management

MAY 12, 2025

It is not unusual for a customer with a good payment history to have short-term cash flow issues that drive up their past due balances. As a credit executive, you are on the front line to protect your company from losses. Equally important is to do whatever you can to enhance revenue opportunities. When a customer is seriously past due with a significant balance, a way to avoid third-party collection or legal action is to work with the customer and reconfigure the debt.

Fit Small Business

MAY 12, 2025

Starting a bakery takes more than just great recipes you need a solid plan, the right licenses, smart pricing, and a strategy to attract loyal customers. You’ll begin by choosing your bakery type and designing a menu that sells. Then, youll create a detailed business plan, handle legal requirements, estimate your startup costs, and. The post How to Start a Bakery and Make It Profitable appeared first on Fit Small Business.

Outsourced Bookeeping

MAY 12, 2025

For a property management company, it might be difficult to oversee the financial operations while focusing on the core activities. When the company grows, maintaining financial records, handling compliances, risk mitigation, and other such tasks becomes challenging. Companies need to hire a separate team for managing the finances which can cost them a lot.

accountingfly

MAY 12, 2025

As you head into May and beyond, your firm is likely settling into a post-tax season rhythm, and the focus can shift to ensuring your new hires are set up for long-term success. Having onboarding and retention strategies are critical to maintaining a high-performing, engaged team, so it’s essential to have strategies in place to help them thrive in their new roles.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Stephanie Peterson

MAY 12, 2025

As a small business owner, finding smart ways to reduce your tax burden while planning for the future is essential. One powerful strategy that often gets overlooked is investing in retirement plansnot just for your own retirement, but also as a valuable financial and tax-saving tool for your business.

Accounting Today

MAY 12, 2025

The proposal calls for increasing the maximum child tax credit to $2,500 and raising the estate tax exemption to $15 million.

Accounting Today

MAY 12, 2025

House Republicans are struggling to resolve issues with President Trump's multitrillion-dollar tax package, including the deduction for state and local taxes.

Accounting Today

MAY 12, 2025

A powerful House committee has tucked language preventing states from regulating artificial intelligence into President Trump's massive tax and spending bill.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Accounting Today

MAY 12, 2025

The House tax committee is seeking to increase the state and local deduction and make official several of President Trump's campaign tax pledges.

Accounting Today

MAY 12, 2025

The committee also proposes limiting states' ability to pay their share of Medicaid by placing a moratorium on new or increased taxes on medical providers.

Accounting Today

MAY 12, 2025

The findings come after a net loss of $31.7 million for the first quarter, which ended with cash, cash equivalents and short-term investments of $759 million.

Accounting Today

MAY 12, 2025

President Donald Trump's Hollywood ambassadors asked the White House to expand and extend tax incentives as part of an upcoming budget reconciliation bill.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Accounting Today

MAY 12, 2025

Billions of dollars allocated under former President Biden's Inflation Reduction Act would be rescinded under a portion of Trump's sweeping tax package.

Let's personalize your content