How we’re making it easier for practices in the UK to manage clients in Xero

Xero

JUNE 18, 2023

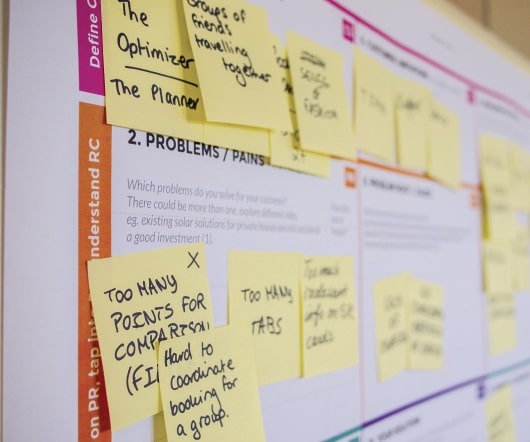

We’ve made some great progress towards creating a single source of truth for your client data. It’s all part of our work to connect our practice tools, so that in the future, as you manage your clients’ tax obligations in Xero, the data flows seamlessly into our practice management tools. This will help you work more efficiently, collaborate with your clients more effectively, and manage everything for your practice within Xero.

Let's personalize your content