Tech news: FloQast automates with AI

Accounting Today

MARCH 29, 2024

Plus, Settle offers three-way matching for purchase orders; Modern Treasury introduces Professional Services offering; and other accounting tech news.

Accounting Today

MARCH 29, 2024

Plus, Settle offers three-way matching for purchase orders; Modern Treasury introduces Professional Services offering; and other accounting tech news.

accountingfly

MARCH 29, 2024

Top Remote Accounting Candidates This Week Are you struggling to hire remote accountants? Accountingfly is ready to partner with you. With Always-On Recruiting , you can gain full access to a pool of highly skilled and experienced remote accountants. Plus, there’s no up-front cost! Below is a small selection of our available top accounting candidates this week.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

MARCH 29, 2024

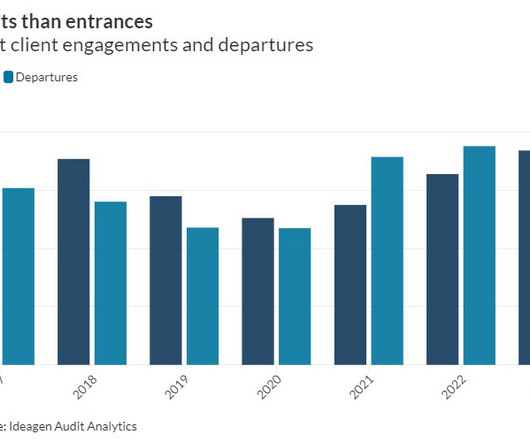

Overall new client additions – and departures – continue to rise, thanks to M&A.

Cloud Accounting Podcast

MARCH 29, 2024

Blake and David look at the potential impact of AI on the accounting profession and discuss how AI tools like ChatGPT can boost productivity by automating tasks, improving communication, and assisting with problem-solving. They also examine the implications of these efficiency gains on the billable hour, predicting that firms will need to adapt their pricing strategies as a result.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Accounting Today

MARCH 29, 2024

One of the major challenges in our field is retaining women after they take on another demanding role: becoming a mother.

Outsourced Bookeeping

MARCH 29, 2024

An effective accounts receivable process is essential for preserving financial stability and a healthy cash flow in today’s changing corporate environment. Nevertheless, many businesses have difficulties that impede their efforts to manage AR, including resource limitations, inconsistent invoices, and late payments. Businesses are increasingly using accounts receivable outsourcing as a strategic strategy in response to these difficulties.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Invoicera

MARCH 29, 2024

Introduction Small businesses offering professional services must invoice their clients frequently to get paid faster. Did you know? 61% of invoice late payments are the result of incorrect invoicing. Source: Amalto A service invoice must include all the necessary details to make a self-explanatory invoice. Including an itemized list of services, business transactions, last date for payments, and total balance is essential.

Accounting Today

MARCH 29, 2024

EY names Americas financial services organization leader; EisnerAmper adds technology and life sciences leaders; and more news from across the profession.

NextProcess

MARCH 29, 2024

In companies with a research and development (R&D) department, R&D often has very specific procurement needs. Getting R&D and procurement working together effectively can be a challenge, though. A breakdown in communication between the two departments can result in misunderstandings, frustration, and costly procurement issues, including inaccurate or duplicate orders and maverick spending.

Accounting Today

MARCH 29, 2024

WTF CPAs has used artificial intelligence to get a jump on busy season, just in time for April 1.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

Plooto

MARCH 29, 2024

Understanding accounts receivable (AR) is crucial for your company's finances. Efficiently managing your AR can help you manage your cash flow and ensure you don't lose out on cash.

The Successful Bookkeeper

MARCH 29, 2024

Discover the must-attend bookkeeping conferences in 2024, which will provide valuable insights and networking opportunities for professionals in the field.

Plooto

MARCH 29, 2024

Your accounts payable and cash flow are closely intertwined. As you pay off your accounts payable or increase your accounts payable with credit purchases, your cash flow is being affected.

Accounting Fun

MARCH 29, 2024

When you start searching in Google you may have noticed that it often offers to complete your search string. In effect the system recognises and offers you the rest of what other people have searched for even if the words are in a different order. Here are some of the suggestions Google offered me recently by reference to the few words I typed in each case: Are all accountants. the same?

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

SSI Healthcare Rev Cycle Solutions

MARCH 29, 2024

The SSI Group, LLC (SSI) Welcomes Industry Veteran Heather Dunn as President The SSI Group, LLC (SSI) Welcomes Industry Veteran Heather Dunn as President. Read More SSI Claims Direct Now Available SSI announces Claims Direct, a streamlined solution for those seeking a reliable clearinghouse alternative with a fast implementation timeframe. Read More The SSI Group, LLC (SSI) Announces Launch of Automated End-to-End Prior Authorization Solution The SSI Group, LLC (SSI), a leading provider of reven

Accounting Tools

MARCH 29, 2024

What are Cash Flows from Financing Activities? Cash flows from financing activities is a line item in the statement of cash flows. This statement is one of the documents comprising a company's financial statements. The line item contains the sum total of the changes that a company experienced during a designated reporting period that were caused by transactions with owners or lenders to either provide long-term funds to the business or to return those funds to the owners or lenders.

Accounting Tools

MARCH 29, 2024

What is Fixed Manufacturing Overhead Applied? Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production during a reporting period. This overhead application is conducted in order to include the full set of manufacturing costs in the cost of each item produced, rather than just the costs of direct materials and direct labor.

Accounting Tools

MARCH 29, 2024

What is Financial Position? Financial position is the current balances of the recorded assets , liabilities , and equity accounts of an organization. This information is recorded in the balance sheet , which is one of the financial statements. The financial position of an organization is stated in the balance sheet as of the date noted in the header of the report.

Advertisement

The status quo for AP in small and mid-market companies is broken. It consists of messy tech stacks of siloed solutions that give rise to manual work, a lack of control, wasted spend, and unnecessary risks. The benefits of shifting to spend management are tangible, measurable, and are felt across the whole organization. Spend management is a different way of thinking and an innovation whose time has come.

Accounting Tools

MARCH 29, 2024

What is a Foreign Currency? A foreign currency is the currency used by a foreign country as its recognized form of monetary exchange. This particular currency is the only form of exchange that the applicable government allows to be used for buying and selling within its borders.

Accounting Tools

MARCH 29, 2024

What is a Debit Memo? A debit memo is issued by a seller to a customer, notifying it of an additional billing to the customer’s account. This document is useful for clarifying the nature of any corrections to an existing billing, or any additional charges or penalties being applied by the seller. There are several uses of the term debit memo, which involve incremental billings, internal offsets, and bank transactions.

Accounting Tools

MARCH 29, 2024

What is the Percentage-of-Sales Method? The percentage-of-sales method is used to develop a budgeted set of financial statements. Each historical expense is converted into a percentage of net sales , and these percentages are then applied to the forecasted sales level in the budget period. For example, if the historical cost of goods sold as a percentage of sales has been 42%, then the same percentage is applied to the forecasted sales level.

Accounting Tools

MARCH 29, 2024

What is Freight In? Freight in is the transportation cost associated with the delivery of goods from a supplier to the receiving entity. Accounting for Freight In For accounting purposes, the recipient adds the cost of freight in to the cost of the received goods. This means adding freight in to the cost of received inventory, and to the cost of received fixed assets.

Speaker: Carolina Aponte - Owner and CEO, Caja Holdings LLC

In today's rapidly changing business environment, building a resilient balance sheet is crucial to the survival of any business. A resilient balance sheet allows a company to withstand financial shocks and adapt to changing market conditions. To achieve this, companies need to focus on key strategies such as maintaining adequate liquidity, managing debt levels, diversifying revenue streams, and prioritizing profitability over growth.

Accounting Tools

MARCH 29, 2024

What is Field Warehouse Financing? Under a field warehouse financing arrangement, a finance company segregates a portion of a borrower ’s warehouse area with a fence. All inventory within the fence is collateral for a loan from the finance company to the borrower. The finance company will pay for more raw materials as they are needed, and is paid back directly from accounts receivable as soon as customer payments are received.

Accounting Tools

MARCH 29, 2024

What is the Fixed Asset Turnover Ratio? The fixed asset turnover ratio compares net sales to net fixed assets. It is used to evaluate the ability of management to generate sales from its investment in fixed assets. A high ratio indicates that a business is doing an effective job of generating sales with a relatively small amount of fixed assets. In addition, it may be outsourcing work to avoid investing in fixed assets, or selling off excess fixed asset capacity.

Accounting Tools

MARCH 29, 2024

What is a Cash Equivalent? A cash equivalent is a highly liquid investment having a maturity of three months or less. It should be at minimal risk of a change in value. To be classified as a cash equivalent, an item must be unrestricted, so that it is available for immediate use. Examples of Cash Equivalents Examples of cash equivalents are bankers’ acceptances, certificates of deposit , commercial paper , marketable securities , money market funds , short-term government bonds, and treasury bil

Accounting Tools

MARCH 29, 2024

What is Face Value? Face value is the amount of a debt obligation that is stated as payable in a debt document. The face value does not include any of the interest or dividend payments that may later be paid over the term of the debt instrument. Face value may differ from the amount paid for a debt instrument, since the amount paid may incorporate a discount or premium from the face value.

Speaker: Wayne Spivak, President and CFO of SBA * Consulting Ltd., Industry Writer, Public Speaker

If you’re lost in the world of spend management needs and your GAP analysis is lacking perspective on the future state of your business performance, listen up! With the advancement of technology, the implementation of spend management best practices and concrete GAP analyses is more streamlined and accessible than ever before. And while this may sound like great news for you and your clients, it won’t be worthwhile unless you have the latest techniques to back up your ambitions!

Accounting Tools

MARCH 29, 2024

What are Sales Taxes Payable? Sales taxes payable is a liability account in which is stored the aggregate amount of sales taxes that a business has collected from customers on behalf of a governing tax authority. The business is the custodian of these funds, and is liable for remitting them to the government on a timely basis. The business is also liable for any sales made for which sales tax was not collected, but for which it should have been collected.

Accounting Tools

MARCH 29, 2024

What is a Borrower? A borrower is an individual or entity that is using money, assets , or services on credit. The concept most commonly applies to the lending of funds, where a borrower applies for a loan , and there is a credit evaluation by the lender. The lender may also require that the borrower provide collateral that the lender can access if the loan is not repaid in a timely manner.

Accounting Tools

MARCH 29, 2024

What is a Folio Number in Accounting? A folio number is a reference number used in accounting to uniquely identify an entry in a journal or ledger. This number is stored in a separate folio number field in an entry. The number may be numeric or alphanumeric. What is a Folio Number in Investing? Folio numbers are used in mutual funds, where they uniquely identify an investor’s account.

Let's personalize your content