10 big trends in SALT for 2024

Accounting Today

FEBRUARY 13, 2024

The Washington National Tax Office of Grant Thornton points out the most important state and local tax developments to keep an eye out for.

Accounting Today

FEBRUARY 13, 2024

The Washington National Tax Office of Grant Thornton points out the most important state and local tax developments to keep an eye out for.

Accounting Tools

FEBRUARY 13, 2024

What is the Sales Journal Entry? A sales journal entry records the revenue generated by the sale of goods or services. This journal entry needs to record three events, which are the recordation of a sale , the recordation of a reduction in the inventory that has been sold to the customer, and the recordation of a sales tax liability. The content of the entry differs, depending on whether the customer paid with cash or was extended credit.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

FEBRUARY 13, 2024

While passage in the Senate is uncertain, many of the changes could impact 2023 tax returns.

Insightful Accountant

FEBRUARY 13, 2024

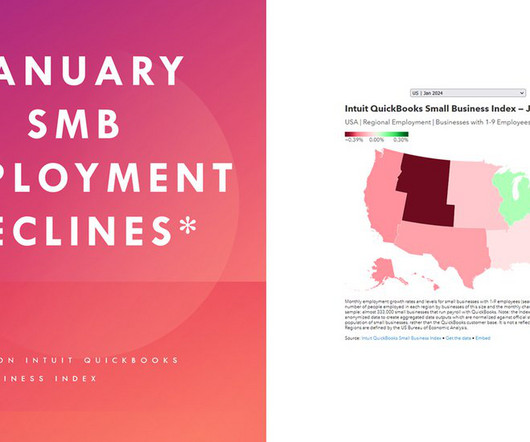

Based on the latest Intuit QuickBooks Small Business Index, employment for small businesses with one to nine employees decreased by 14,800 jobs in January, 2024.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Accounting Today

FEBRUARY 13, 2024

The IRS wants to help businesses know when they don't qualify for an Employee Retention Credit.

Accounting Tools

FEBRUARY 13, 2024

What is Opportunity Cost? Opportunity cost is the profit lost when one alternative is selected over another. The concept is useful simply as a reminder to examine all reasonable alternatives before making a decision. For example, you have $1,000,000 and choose to invest it in a product line that will generate a return of 5%. If you could have spent the money on a different investment that would have generated a return of 7%, then the 2% difference between the two alternatives is the foregone opp

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

FEBRUARY 13, 2024

What is Taking Inventory? Taking inventory is the process of counting the amount of inventory owned by a business. Taking inventory is needed to ensure that a firm’s inventory records match the physical count , to support materials management and to ensure that a correct ending inventory balance is reported on its balance sheet. Taking inventory can require that a company cease its normal warehousing and production activities in order to ensure an accurate count, so the count is commonly conduct

Accounting Today

FEBRUARY 13, 2024

The engagement partner and engagement quality review partner on the audit of Mexican steelmaker owe a combined $165,000.

Accounting Tools

FEBRUARY 13, 2024

What is a Dividend? A dividend is a payment made to shareholders that is proportional to the number of shares owned. Dividends are usually issued by companies that will not reap significant growth by reinvesting profits , and so instead choose to return funds to shareholders in the form of a dividend. Companies may also issue dividends in order to attract income investors, who are looking for a steady source of income, and which can be reliable long-term holders of company shares.

Accounting Today

FEBRUARY 13, 2024

The Internal Revenue Service is looking for both corporate income and employment taxes for a four-year period.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

Insightful Accountant

FEBRUARY 13, 2024

Early discussions on estate tax planning and planned giving are crucial for clients considering asset transitions later in life. They can lead to significant savings for clients and beneficiaries compared to delaying until after death.

Accounting Today

FEBRUARY 13, 2024

Who owns the business and who is going to run it are separate — but equally important — questions.

Insightful Accountant

FEBRUARY 13, 2024

There is one thing 'about time', it changes over time. and so too with our QB Talks monthly webinars. Please join our new host, Alicia Katz Pollock next Wednesday, February 21, 2024 as she presents the new 'QuickBooks Time' interface.

Accounting Today

FEBRUARY 13, 2024

Jim Lee, the head of IRS Criminal Investigation, will step down April 6.

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

AvidXchange

FEBRUARY 13, 2024

By choosing an enhanced direct deposit option , Leading Edge Construction Services Inc. maintains steady receivables Located in the San Jose and Central Valley areas of California, Leading Edge Construction Services, Inc. has a team comprised of over 100 years of experience providing general construction services for residential, commercial, public works and governmental projects.

Accounting Today

FEBRUARY 13, 2024

There are four critical areas to developing your chief information officer.

Counto

FEBRUARY 13, 2024

Applying for a Dormant Company In Singapore’s corporate landscape, the concept of a dormant company plays a crucial role for businesses that temporarily halt operations or have no active trading. Understanding the process and requirements for applying as a dormant company can streamline administrative tasks and alleviate unnecessary burdens. What Defines a Dormant Company?

Accounting Today

FEBRUARY 13, 2024

SALT benefits; taxing blockchain tech; how to onboard; and other highlights from our favorite tax bloggers.

Advertisement

The status quo for AP in small and mid-market companies is broken. It consists of messy tech stacks of siloed solutions that give rise to manual work, a lack of control, wasted spend, and unnecessary risks. The benefits of shifting to spend management are tangible, measurable, and are felt across the whole organization. Spend management is a different way of thinking and an innovation whose time has come.

Counto

FEBRUARY 13, 2024

Key Things Dormant Companies Need to Be Aware of When your Singapore company enters a dormant state, indicating no significant accounting transactions during the financial year, there are essential steps to heed to comply with regulations set by the Accounting and Corporate Regulatory Authority (ACRA). 1. Submit Annual Returns Despite dormancy, filing annual returns with ACRA within 30 days of the Annual General Meeting (AGM) or within 6 months after the financial year’s end is mandatory.

Jetpack Workflow

FEBRUARY 13, 2024

Running an accounting firm can be a stressful, but very rewarding business. You get to help clients, deliver value, and make a comfortable living. But running a firm, managing your team, and managing client expectations can also get overwhelming quickly. And especially if you are rapidly expanding your business. And it’s why accounting workflows are so important to your firm and client success.

Nanonets

FEBRUARY 13, 2024

Welcome to Expense Policy 101! Whether you’re the captain of a startup ship or steering a more established enterprise, grappling with expenses is as inevitable as those awkward team-building exercises. This guide seeks to demystify the enigma of creating and implementing a business expense policy that doesn’t just sit pretty in a company handbook but actually works.

Insightful Accountant

FEBRUARY 13, 2024

No touch tax returns are the way of the future, or the present depending on who you ask. In either case, firms need to be jumping on the bandwagon.

Speaker: Carolina Aponte - Owner and CEO, Caja Holdings LLC

In today's rapidly changing business environment, building a resilient balance sheet is crucial to the survival of any business. A resilient balance sheet allows a company to withstand financial shocks and adapt to changing market conditions. To achieve this, companies need to focus on key strategies such as maintaining adequate liquidity, managing debt levels, diversifying revenue streams, and prioritizing profitability over growth.

finout

FEBRUARY 13, 2024

Discover practical tips for integrating DevOps and FinOps to boost cost efficiency and operational excellence in cloud environments.

Accounting Tools

FEBRUARY 13, 2024

What is an Activity Cost Pool? An activity cost pool is an account in which is aggregated a number of costs that are related to a certain type of activity. The grand total of these costs is then allocated to products and other cost objects in order to gain a better understanding of the total costs incurred by a product or cost object. The cost pool concept is most heavily used in an activity-based costing system, and least used when there are few overhead costs to be allocated.

Nanonets

FEBRUARY 13, 2024

Smart entrepreneurs know the devil is in the details—particularly when it comes to financial clarity. At the heart of such clarity is the strategic step of categorizing business expenses. This means meticulously sorting every dollar spent into clearly defined buckets, enabling a bird's eye view of where funds flow. In this blog, we're diving into why and how to categorize your business expenses.

Accounting Tools

FEBRUARY 13, 2024

What is the Actuarial Basis of Accounting? The actuarial basis of accounting is the method used to calculate the amount of ongoing, periodic contributions to be made into a pension fund. This basis of accounting mandates that the amount of contributions plus the assumed investment earnings must at least equal the amount of payments made by the fund to pensioners.

Speaker: Wayne Spivak, President and CFO of SBA * Consulting Ltd., Industry Writer, Public Speaker

If you’re lost in the world of spend management needs and your GAP analysis is lacking perspective on the future state of your business performance, listen up! With the advancement of technology, the implementation of spend management best practices and concrete GAP analyses is more streamlined and accessible than ever before. And while this may sound like great news for you and your clients, it won’t be worthwhile unless you have the latest techniques to back up your ambitions!

Invoicera

FEBRUARY 13, 2024

Summary A payment software solution makes paying and receiving money online easier and more organized. Payment software enhances financial transactions and overall efficiency for small businesses. Notable options include Square, PayPal, Stripe, and more, with the best security and integration capabilities. Invoicera stands out as a comprehensive invoicing solution, offering core features, customization options, and seamless payment integrations.

Accounting Tools

FEBRUARY 13, 2024

What is Materiality? Materiality is the threshold above which missing or incorrect information in financial statements is considered to have an impact on the decision making of users. When this is not the case, then missing or incorrect information is considered to be immaterial. Materiality is sometimes construed in terms of net impact on reported profits , or the percentage or dollar change in a specific line item in the financial statements.

NACM

FEBRUARY 13, 2024

Your success can be measured by a multitude of factors: your desire, how big your goals are and how you bounce back from adversity are just a few to name. But in the B2B credit world, credit professionals' success can be measured through educational goals—pushing their career goalpost even further. Dan Erickson, CBA, collections representative at D.

Accounting Tools

FEBRUARY 13, 2024

What is Activity Analysis? Activity analysis is the examination of the process steps within a selected area of an organization. This analysis determines the following items: Which process steps are being executed Which personnel are involved with each step The amount of time required to complete each step The amount of resources consumed by each step Which process steps should be measured and which measurements to use The value produced by each step How to Use Activity Analysis Activity analysis

Advertisement

Developing a consistent month-end close doesn’t need to be a mystery. We’re sharing our top 10 secrets (plus one bonus!) for streamlining your close.

Let's personalize your content