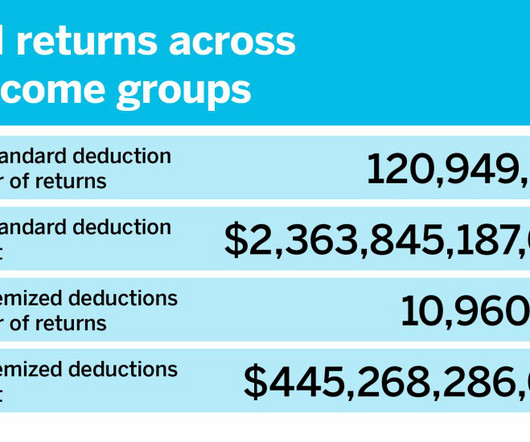

Standard vs. itemized: Who deducts what?

Accounting Today

SEPTEMBER 16, 2024

Taxpayers earning more are more likely to choose to itemize their deductions, while taxpayers earning less tend to favor the standard deduction.

Accounting Today

SEPTEMBER 16, 2024

Taxpayers earning more are more likely to choose to itemize their deductions, while taxpayers earning less tend to favor the standard deduction.

Xero

SEPTEMBER 16, 2024

We know how important it is for small businesses to have access to powerful insights to help them run their business better, no matter the economic environment they’re facing. To accelerate our mission to provide powerful insights, we are thrilled to share that Xero is acquiring Syft, a leading global cloud-based reporting, insights and analytics platform for small businesses, accountants and bookkeepers.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

SEPTEMBER 16, 2024

The Treasury Inspector General for Tax Administration, in two reports, critiqued the IRS on cybersecurity for both its data warehouse and its cloud infrastructure.

The Successful Bookkeeper

SEPTEMBER 16, 2024

From hiring processes to creative production, artificial intelligence is transforming many demanding aspects of business.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Accounting Today

SEPTEMBER 16, 2024

Find out what the client needs and then figure out how to fill that need.

Insightful Accountant

SEPTEMBER 16, 2024

As Congress reconvenes this month, tax practitioners find themselves navigating an uncertain legislative landscape with the looming threat of a government shutdown and its potential impact on year-end tax legislation.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Ace Cloud Hosting

SEPTEMBER 16, 2024

Cloud technology is a game-changing innovation in the IT/ITES industry. It has transformed the way businesses manage and operate, allowing them to store and process data on remote servers hosted.

Accounting Today

SEPTEMBER 16, 2024

John Napolitano of Napier Financial takes a long look at the host of unusual investment opportunities available to your wealthier clients.

Nanonets

SEPTEMBER 16, 2024

Managing and reviewing contracts throughout their lifecycle is quite a challenging task for businesses. Especially since contract data is often scattered across different systems or departments - making it hard to get a quick comprehensive view of contractual obligations. Consider the volume of contracts that businesses typically deal with, the effort required to manually review dense unstructured legal information, and the (legal) expertise required to interpret the data within contracts.

Accounting Today

SEPTEMBER 16, 2024

In the latest example of accounting firms taking on outside investments, the internationally focused firm has sold a minority stake to an Indian billionaire.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Less Accounting

SEPTEMBER 16, 2024

In today’s rapidly evolving business landscape, the role of bookkeeping in small businesses has undergone significant transformations. Gone are the days of relying solely on manual spreadsheets and paper-based record-keeping. Modern technology has revolutionized bookkeeping practices, offering small business owners powerful tools to streamline operations, improve accuracy, and drive growth.

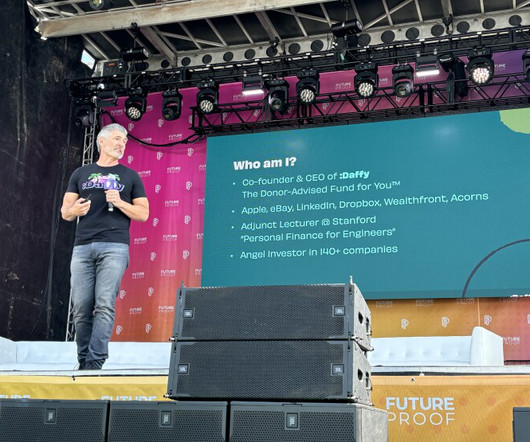

Accounting Today

SEPTEMBER 16, 2024

The accounts are expected to grow by another trillion dollars over the next decade because of their tax and flexibility advantages, Daffy CEO Adam Nash said.

Ace Cloud Hosting

SEPTEMBER 16, 2024

As a business owner, you are always looking for technological solutions to make the process streamlined and error-free. However, with various options available in the market, it becomes challenging to.

Accounting Today

SEPTEMBER 16, 2024

The IRS has postponed payment and filing deadlines for those affected by the storm.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Insightful Accountant

SEPTEMBER 16, 2024

You still have plenty of time to apply for the International ProAdvisor Awards, but why wait. you can start your application and come and go as you complete new training, earn certifications and use/learn new Apps.

Accounting Today

SEPTEMBER 16, 2024

Hong Kong's Accounting and Financial Reporting Council said its review of PwC's local practice, which is separate from China's probe, is still "in progress.

Insightful Accountant

SEPTEMBER 16, 2024

Murph will host Dawn Brolin, Kelly Gonsalves, and Jeff Siegel to review the Top 100 ProAdvisors' Top 10 most popular eCommerce Connector Apps today, September 17 at 2 PM Eastern.

Counto

SEPTEMBER 16, 2024

Double Taxation: DTAs vs. UTCs for Singaporean Businesses As a small business owner navigating international operations, managing tax liabilities can be complex. Double Taxation Agreements (DTAs) and Unilateral Tax Credits (UTCs) are two mechanisms designed to alleviate the burden of being taxed twice on the same income. Understanding their differences is crucial for effective tax planning.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Billah and Associates

SEPTEMBER 16, 2024

In Canada, the tax authorities apply capital gains tax to the profit earned from selling or disposing of capital property, such as real estate, stocks, or other investments. When the sale price of an asset exceeds its original purchase price, the difference is considered a capital gain. Currently, 50% of your capital gains are taxable, regardless of the total amount.

Counto

SEPTEMBER 16, 2024

Corporate Social Responsibility (CSR) in Singapore: Why It Matters and How SMEs Can Get Started As a small business owner in Singapore, you might wonder how engaging in Corporate Social Responsibility (CSR) can benefit your business. CSR is not just a buzzword but a vital strategy that can enhance your brand reputation, build trust with stakeholders, and contribute positively to your community and the environment.

IMA's Count Me

SEPTEMBER 16, 2024

Join Adam Larson as he sits down with Christian Hyatt , co-founder and CEO of risk 3sixty , in this eye-opening episode of the Count Me In. From starting out in the world of public accounting to leading a successful cybersecurity firm, Christian shares his unique journey and offers valuable insights into the complex world of cyber threats. Discover who the real "bad guys" are, the surprising sophistication of criminal organizations, and how businesses can better protect themselves in an increasi

Counto

SEPTEMBER 16, 2024

Navigating Cross-Border Taxation for Singapore-Based SMEs As Singapore-based SMEs venture into international markets, understanding cross-border taxation becomes crucial. Managing tax obligations across different jurisdictions can be complex, but with the right knowledge and strategies, you can navigate these challenges effectively. This guide offers essential insights to help you handle cross-border taxation with confidence. 1.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Accounting Today

SEPTEMBER 16, 2024

Former President Donald Trump's agenda of higher tariffs on U.S. imports would help offset his expanding tax-cut proposals if he's reelected in November, according to his running mate, Ohio Senator JD Vance.

Counto

SEPTEMBER 16, 2024

How Double Taxation Agreements (DTAs) Benefit Singaporean Businesses Investing Abroad For Singaporean businesses eyeing international expansion, managing taxes across borders can be complex. Double Taxation Agreements (DTAs) are designed to simplify these challenges by preventing income from being taxed in both Singapore and the foreign country. Understanding the benefits of DTAs can help streamline international operations and enhance investment opportunities. 1.

Let's personalize your content