Senators propose fixes to IRS administration

Accounting Today

JANUARY 30, 2025

Senate Finance Committee chairman Mike Crapo. R-Idaho, and ranking member Ron Wyden, D-Oregon, issued a discussion draft of bipartisan legislation.

Accounting Today

JANUARY 30, 2025

Senate Finance Committee chairman Mike Crapo. R-Idaho, and ranking member Ron Wyden, D-Oregon, issued a discussion draft of bipartisan legislation.

Accounting Department

JANUARY 30, 2025

Effective accounting data management isn't just about tidy spreadsheets and balancing your books. It's about safeguarding your business's financial health while ensuring seamless operations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JANUARY 30, 2025

FASB regulations requiring companies to record digital assets at fair value go into effect this year, but earlier adoption is permitted.

Compleatable

JANUARY 30, 2025

Did you know that some accounting software and ERP solutions have been around since the 1960s and 1970s when the first computerised accounting systems were developed! makes you feel old doesn’t it. The History In the 1980s came along the creation of the personal computers and therefore accounting software became more accessible to smaller business, which saw the likes of Peachtree (now Sage 50 North America) released in 1981 and QuickBooks in 1983 which were primarily designed to simply fi

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Accounting Today

JANUARY 30, 2025

The Internal Revenue Service made progress on its customer service and systems last year, but it's still facing challenges with processing tax returns on time.

oAppsNet

JANUARY 30, 2025

Managing supplier relationships can often be complex and resource-intensive. Enter the supplier portal: a solution that simplifies processes saves time and fosters smoother, more productive vendor interactions while supporting your organization’s digitization goals. Acting as a centralized workspace, a supplier portal enables efficient collaboration , streamlined information exchange, and optimized steps from onboarding and document submission to order tracking and communication.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

The Successful Bookkeeper

JANUARY 30, 2025

The bookkeeping industry is undergoing a seismic shift. With advances in technology, automation, and the rise of cloud-based platforms, bookkeepers worldwide are reimagining how they deliver value to clients. This transformation is not only an opportunity for innovation but also a chance to redefine the role of bookkeepers as strategic partners to small businesses.

Accounting Today

JANUARY 30, 2025

TIGTA report suggests the IRS needs to do more to enable whistleblowers to report on fraud, waste and abuse, even if they've signed nondisclosure agreements.

Fit Small Business

JANUARY 30, 2025

Keep reading to learn more about who the Gen Alpha are, what their consumer behaviors and preferences are, and how your business can appeal to their needs and convert them into customers. Get to Know the Alpha Generation of Consumers The alpha generation of consumers, or Gen Alpha, are people born between the years of. The post Gen Alpha Consumers: Who They Are, Key Behaviors & How to Market appeared first on Fit Small Business.

Accounting Today

JANUARY 30, 2025

Cloud ERP solutions provider Acumatica announced several updates and enhancements for 2025 that align with the company's new AI-first product strategy.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Outsourced Bookeeping

JANUARY 30, 2025

In todays fast-paced digital world, businesses of all sizes are turning to virtual bookkeeping services to manage their financial records efficiently. Every business size needs to track its financial transactions, invoices, and tax documents to maintain good financial health. The selection of appropriate bookkeeping services becomes complicated because of the many options which exist today.

Accounting Today

JANUARY 30, 2025

Future accountants should be as proficient in performing variance analyses and using data visualization software as they are with general ledgers.

Blake Oliver

JANUARY 30, 2025

What does the White House buyout offer mean for the Internal Revenue Service? IRS employees can resign by Feb 6 and get 7-8 months' full pay/benefits through September. Those who stay should expect to return to the office five days a week. The White House expects 5-10% of federal workers to accept the buyout offer. It also froze federal hiring in January.

Accounting Today

JANUARY 30, 2025

A draft report from auditing firm Deloitte raised questions about more than 80 million of financial transactions by Pro-Gest and its owners, members of the Zago family, involving payments for a yacht and cash used to fund a prosecco winery.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Insightful Accountant

JANUARY 30, 2025

Vertex has released their 2024 Year-End Sales Tax Rates and Rules report, highlighting significant shifts in local tax structures and the growing complexity of tax compliance across the United States.

Accounting Today

JANUARY 30, 2025

AP-focused financial automation platform Stampli announced the release of an AI-driven procure-to-pay solution that works through dynamic conversations with the system itself.

Insightful Accountant

JANUARY 30, 2025

Ignition has names their Global President Greg Strickland as their new CEO, and Amy Food as their new CFO.

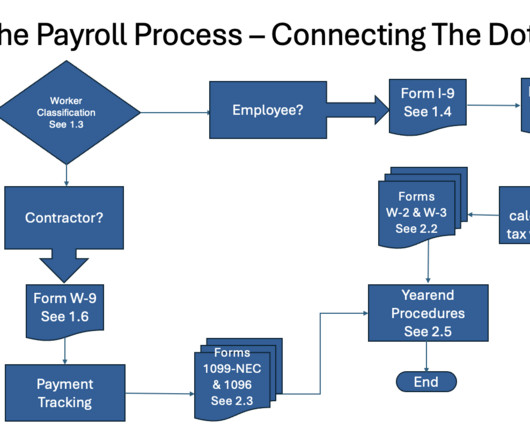

Bookkeeping Essentials

JANUARY 30, 2025

Small business payroll (under 10 employees) made easy. Essential tasks, W-2/1099 compliance, and practical tips. Learn and stay compliant!

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Insightful Accountant

JANUARY 30, 2025

Contributing author Katie Thomas gives you five strategies you can use to ensure steady revenue all year long.

Tipalti

JANUARY 30, 2025

Discover the fundamentals of liquidity management, its importance for businesses, and strategies to optimize cash flow and financial stability.

Insightful Accountant

JANUARY 30, 2025

In many industries, businesses must navigate complex regulatory landscapes to avoid costly penalties and ensure their operations are running smoothly. High-regulation industries are subject to strict compliance standards.

Future Firm

JANUARY 30, 2025

Want to pull in new tax clients for your firm? Do these 13 actionable strategies that I've tried and tested over the years. The post How to Get Tax Clients: 13 Practical Tips appeared first on Future Firm.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Bookkeeping Essentials

JANUARY 30, 2025

Learn payroll setup and management for US small businesses with under 10 employees. Covers compliance, worker classification, documentation, and best practices.

Insightful Accountant

JANUARY 30, 2025

Groundhog day anyone? While the Supreme Court recently granted a stay against one injunction, a separate nationwide pause remains in effect, creating a nuanced compliance environment that demands careful navigation.

Bookkeeping Essentials

JANUARY 30, 2025

Simplify payroll compliance for your small business (under 10 employees). Avoid penalties. Part 2 of this manual covers W-2s, 1099s, year-end procedures, and.

Black Ink Tax & Accounting

JANUARY 30, 2025

Table of Contents Difference Between Auditing and Assurance Services Starting a business, whether it’s a for-profit institution or not-for-profit institution, […] The post Difference Between Auditing And Assurance Services appeared first on bitaccounting.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Ascend Software blog

JANUARY 30, 2025

Managing finances is a critical part of running any business, but supplier payments often dont get the attention they deserve. For many companies, the process is still manual, filled with repetitive tasks like cutting checks or reconciling invoices. Not only is this time-consuming, but its also expensive and prone to mistakes that can delay payments or strain vendor relationships.

Black Ink Tax & Accounting

JANUARY 30, 2025

Table of Contents Difference Between Auditing and Assurance Services Starting a business, whether it’s a for-profit institution or not-for-profit institution, […] The post Tax benefits of real estate appeared first on bitaccounting.

5 Minute Bookkeeping

JANUARY 30, 2025

Ever had a client hand you a set of books so messy you didnt know where to start ? When they come to us for help, cleanup projects often turn out to be more complex than they first appear. Without a clear process bookkeepers risk undercharging, overworking and taking on clients who arent a good fit. Thats where the paid diagnostic review can be the key to unlocking profitable QBO cleanups.

Let's personalize your content