IRS loses track of tax info between processing centers

Accounting Today

AUGUST 3, 2023

The service isn't doing enough to safeguard sensitive information when it's shipped between tax processing centers, according to a new report.

Accounting Today

AUGUST 3, 2023

The service isn't doing enough to safeguard sensitive information when it's shipped between tax processing centers, according to a new report.

Intuit

AUGUST 3, 2023

Every day, our employees set out to solve customer problems and deliver seamless experiences, propelled by our AI-driven expert platform strategy and mission to power prosperity around the world. Part of delivering on this means delivering industry-leading customer experiences for more than 100 million consumer and small business customers with Intuit TurboTax , Credit Karma , QuickBooks , and Mailchimp.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

AUGUST 3, 2023

According to a plea agreement, Biden was well aware of his tax liabilities from an accountant he hired. The accountant prepared Biden's returns and sent them to him for review and signature. Despite repeated encouragement by his accountant, Biden never signed or submitted his returns.

Xero

AUGUST 3, 2023

Xerocon is fast approaching: the best forum to hear about the latest innovations within Xero, get inspired and connect with other accountants and bookkeepers. Plus, with more than 70 app partners from the Xero ecosystem exhibiting at Xerocon Sydney on 23-24 August, it’s also the best opportunity you’ll have all year to connect with and learn about apps that can take your practice to the next level.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Accounting Today

AUGUST 3, 2023

The Internal Revenue Service and the Treasury want to curb the use of some types of monetized installment sale transactions by listing them as potentially abusive tax dodges.

Accounting Department

AUGUST 3, 2023

Some business decisions are obvious. Others can seem like 50/50 propositions that make doing nothing a good third option. Deciding what to do about your bookkeeping, fortunately, is not a dilemma when you know what to factor into your considerations. So, how can you determine whether you would be better off with outsourced bookkeeping services or continuing it onsite at this stage of your growth?

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Insightful Accountant

AUGUST 3, 2023

American Institute of CPAs pushes for more ERC accountability following Capitol Hill committee hearing.

Accounting Today

AUGUST 3, 2023

The service is trying to fully staff its in-person TACs around the country, but first it has to make them easier to locate.

Insightful Accountant

AUGUST 3, 2023

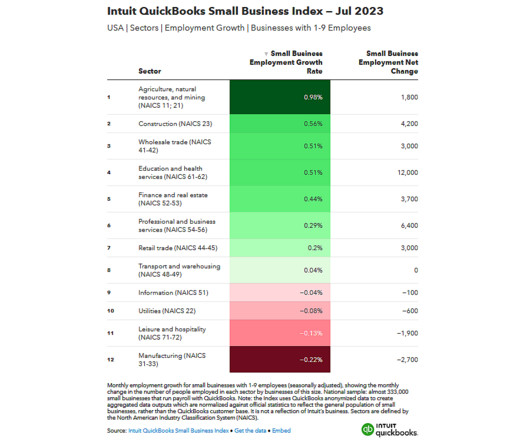

Intuit has released the July 2023 QuickBooks Small Business Index, which provides unparalleled insight into employment and hiring activity among the smallest of businesses in the US, Canada and UK.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

SLC Bookkeeping

AUGUST 3, 2023

In the dynamic and competitive restaurant business world, two essential elements play a significant role in captivating customers: smart pricing and food plating.

Accounting Today

AUGUST 3, 2023

Business entities subject to the CTA will face significant new reporting and related record-keeping obligations. There are several things advisors should consider.

LedgerDocs

AUGUST 3, 2023

What is a Payroll Deduction Payroll deductions are an amount of money withheld from a paycheck by an employer to be used to pay taxes and cover any benefits that are provided such as retirement contributions or health insurance premiums. It is the responsibility of the employer to calculate and collect the correct amount from the employee’s gross pay before issuing a paycheck Common Types of Payroll Deductions: There are a few reasons why an employer may need to deduct money from an employeeR

Accounting Today

AUGUST 3, 2023

A recent KPMG survey shows that business leaders are split over whether mass adoption of generative AI will reduce or expand headcount at their organizations.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Accounting Tools

AUGUST 3, 2023

Related Courses Accountants’ Guidebook Bookkeeper Education Bundle Bookkeeping Guidebook What is Expensing? A cost is the expenditure required to create and sell products and services, or to acquire assets. When a cost is associated with an expenditure that is consumed at once, then it is charged to expense. When this happens, the expense is reported on the firm’s income statement.

Accounting Today

AUGUST 3, 2023

Since Altice co-founder Armando Pereira was detained in Portugal as part of a criminal investigation into alleged corruption, tax fraud and money laundering, the company has suspended contracts with about 60 suppliers, launched internal audits, and has put its U.S. head of procurement on leave.

Accounting Tools

AUGUST 3, 2023

Related Courses Budgeting Cost Management Guidebook Financial Forecasting and Modeling What is the Breakeven Formula? Break even is the point at which a business generates enough sales to earn a profit of zero. This is an important concept, because managers need to know the threshold sales level above which a company will start to earn a profit. With this information, they can engage in activities to enhance profit levels, such as cutting fixed expenses or initiating marketing campaigns to incre

Billing Platform

AUGUST 3, 2023

Described as software that enables companies to, at its most basic level, generate and send invoices, collect payments, and calculate taxes – billing software is now capable of so much more. Regardless of whether you run a small and-medium sized business (SMB), a large enterprise, or something in between – implementing the right billing solution enables you to drive operational efficiencies, reduce errors, and boost profitability.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Accounting Tools

AUGUST 3, 2023

Related Courses Bankruptcy Tax Guide Essentials of Corporate Bankruptcy Shareholders' funds refers to the amount of equity in a company, which belongs to the shareholders. The amount of shareholders' funds yields an approximation of theoretically how much the shareholders would receive if a business were to liquidate. The amount of shareholders' funds can be calculated by subtracting the total amount of liabilities on a company's balance sheet from the total amount of assets.

Tipalti

AUGUST 3, 2023

From invoice processing to supplier onboarding, learn how AI is revolutionizing accounting. We’ll walk through AI accounting use cases, software, and how to start using AI today.

Insightful Accountant

AUGUST 3, 2023

The Dancing Accountant's Nancy McClelland joins Tax Practice News' Christine Gervais on this edition of the Accounting Insiders to discuss what makes her practice so unique.

Blake Oliver

AUGUST 3, 2023

Did you see the Barbie movie? In the movie, Barbie's creator Ruth Handler makes an off-hand mention of her IRS problems — but that’s wrong. The real-life Ruth Handler ran into legal issues with the SEC, not the IRS. And it wasn’t tax problems. The Securities and Exchange Commission came after the Barbie creator for financial fraud while she was president of Mattel.

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Jetpack Workflow

AUGUST 3, 2023

Podcast Summary Leveraging Insurance Products Establishing Wealth Management Partnerships Experiencing Time & Money Resources JEnsley Financial Cash Value Life Insurance Double Your Accounting Firm About John Ensley John is the president of JEnsley Financial , a fiduciary financial planning firm based out of Vancouver, WA. John started his firm in 2012 after a U-turn move from corporate America to financial services.

Accounting Tools

AUGUST 3, 2023

Related Courses Bookkeeper Education Bundle Bookkeeping Guidebook What is Paid-In Capital? Paid-in capital is a component of a company’s equity , and contains the amounts received from investors when they buy shares directly from the company. When investors buy these shares from other parties (frequently through a stock exchange ), the amounts paid do not go back to the company, and so have no impact on its paid-in capital account.

Accounting Today

AUGUST 3, 2023

Digital World Acquisition Corp. blasted Marcum for not adhering to "requisite audit procedures" that would have identified the accounting errors sooner.

Accounting Tools

AUGUST 3, 2023

Related Courses Budgeting Capital Budgeting Effective Sales Forecasting A business may need a budget in order to model what its future results and cash flows will look like. Doing so gives management a reasonable idea of how much it can spend, and how much new revenue it should expect. This information can be used in the following ways: Management should only authorize that amount of expenditures for which there will be an offsetting amount of incoming cash flows.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Accounting Tools

AUGUST 3, 2023

Related Courses Effective Sales Forecasting Financial Analysis Financial Forecasting and Modeling What is Quantitative Analysis? Quantitative analysis is the use of mathematical models to analyze data points, with the intent of understanding a condition. This analysis is used to predict future outcomes, and is a key concept in financial modeling and other areas.

Accounting Tools

AUGUST 3, 2023

Related Courses Accountants' Guidebook Bookkeeper Education Bundle Bookkeeping Guidebook What is the Timeliness of Accounting Information? The timeliness of accounting information refers to the provision of information to users quickly enough for them to take action. The timeliness concept is of particular importance in four areas of a business, which are noted below.

Accounting Tools

AUGUST 3, 2023

Related Courses Fixed Asset Accounting Fixed Asset Controls How to Audit Fixed Assets What are Assets? An asset is an expenditure that has utility through multiple future accounting periods. If an expenditure does not have such utility, it is instead considered an expense. Examples of assets are cash , trade receivables , inventory , and prepaid expenses.

Accounting Tools

AUGUST 3, 2023

Related Courses Accountants’ Guidebook Bookkeeper Education Bundle Bookkeeping Guidebook What is Income? Income is the earnings gained from the provision of services or goods, or from the use of assets. What is Profit? Profit is the positive amount remaining after subtracting expenses incurred from the revenues generated over a designated period of time.

Advertiser: Paycor

Before you can achieve success, you have to define it. Objectives and Key Results (OKRs) give you the framework to do just that. Paycor’s free guide includes a step-by-step process leaders can use to work toward – and achieve – their loftiest business goals.

Let's personalize your content