IRS audit rates plummet, especially for wealthy

Accounting Today

MAY 17, 2022

Xero

MAY 17, 2022

Tax time will look a little different this year compared to last, with the conclusion of the JobMaker and JobKeeper schemes and business slowly returning to normal. However, most of us will have completed an EOFY using Single Touch Payroll (STP) before, so wrapping up the 2021/22 financial year should be smooth sailing. . Whether this is your first time finalising your EOFY with STP, you’re an old hand, or you need to submit payment summaries for your employees – by following these steps y

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CloudZero

MAY 20, 2022

The purpose of cloud monitoring is to identify, observe, track, and manage cloud infrastructure components and services. Cloud monitoring helps organizations ensure their services meet customer expectations of performance, availability, and security.

Future Firm

MAY 17, 2022

If you’re looking for the best marketing for accountants’ strategies, you’ve come to the right place. In this post, I’m going to outline 18 of the top strategies working well right now to help you attract clients. Most of these methods I’ve personally used myself to help take my cloud accounting firm from scratch to sale in just 5 years. Let’s check them out!

Speaker: Dylan Secrest, Founder of Alamo Innovation and Construction Digital Transformation Consultant

Construction payment workflows are notoriously complex when you consider juggling multiple stakeholders, compliance requirements, and evolving project scopes. Delays in approvals or misaligned data between budgets, lien waivers, and pay applications can grind progress to a halt. The good news? It doesn't have to be this way! Join expert Dylan Secrest to discover how leading contractors are turning payment chaos into clarity using digital workflows, integrated systems, and automation strategies.

Xero

MAY 17, 2022

While it may be lacking the fireworks and champagne of New Year’s Eve, come 1 July the new financial year ushers in fresh opportunities for Australia’s small businesses. Along with the new calendar, there are often regulatory changes for you to manage or implement. And this year is no different, with updates coming to payroll in FY23. . Starting from 1 July 2022, there are a number of government requirements that will impact how you manage payroll (including superannuation) for employees.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

CloudZero

MAY 16, 2022

Containers are one of the most popular ways for businesses to deploy applications. They provide an easy method of packaging applications into self-sufficient units that can be used, moved around, and re-used in any number of ways without breaking the overall functionality of your software.

Xero

MAY 15, 2022

In less than a week, millions of Australians will cast their ballot in this year’s Federal Election. This is a chance for eligible voters to have their say about who will be our next prime minister and which parties will have the most influence in Federal Parliament. . For our nation’s self-employed community – comprising 2.4 million people or roughly 10 percent of the voting population – this election outcome feels especially important.

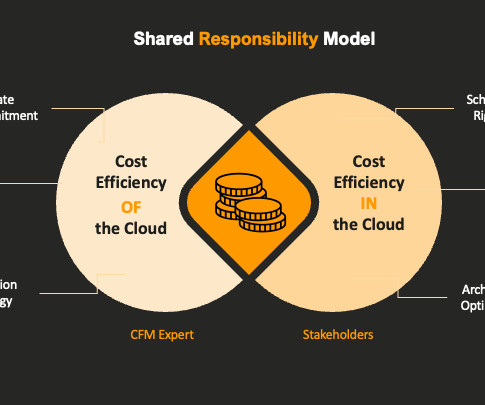

The FinOps Alliance

MAY 19, 2022

The theory When someone starts their journey into the AWS cloud resources and services, one of the first things they are bound to run into is the AWS Shared Responsibility Model for security. The model describes how it is both up to AWS and the end user to ensure that their cloud workloads are sufficiently secure. AWS makes the destinction between security of the cloud and security in the cloud.

Advertisement

You wouldn’t keep using a 2009 flip phone - so why settle for outdated close processes? It’s time for an upgrade. SkyStem's Guide to Month-End Close Software walks you through what today’s best tools can do (and what your team shouldn’t have to deal with anymore). Get smart, fast, and a whole lot less stressed when it’s time to close the books.

CloudZero

MAY 18, 2022

Cloud computing offers nearly limitless capacity on-demand, but left unmanaged, that flexibility can lead to surprisingly high monthly cloud bills.

Xero

MAY 16, 2022

The hospitality industry is no stranger to new challenges. From pandemic restrictions to Making Tax Digital (MTD), hospitality businesses have had to stay agile and adapt to many changes in the past few years. In this guide, we’ll look at what the government’s Making Tax Digital initiative means for your hospitality business in practical terms. We’ll also explore how the additional benefits of digitisation and cloud-based accounting software can help you run a healthier business.

Oversight

MAY 19, 2022

The Foreign Corrupt Practices Act (FCPA) , enacted in 1977, generally prohibits the payment of bribes to foreign officials to assist in obtaining or retaining business. The FCPA can apply to prohibited conduct anywhere in the world and extends to publicly traded companies and their officers, directors, employees, stockholders, and agents. Agents can include third-party agents, consultants, distributors, joint-venture partners, and others.

Speaker: Jason Chester, Director, Product Management

In today’s manufacturing landscape, staying competitive means moving beyond reactive quality checks and toward real-time, data-driven process control. But what does true manufacturing process optimization look like—and why is it more urgent now than ever? Join Jason Chester in this new, thought-provoking session on how modern manufacturers are rethinking quality operations from the ground up.

accountingfly

MAY 16, 2022

Is your firm struggling with retaining accounting talent or making hires? If so, your firm is not alone. The problem is real! CPA firm turnover is at record levels, leaving firm staff overwhelmed and struggling to deliver for clients. To combat this, Jeff Phillips will give your firm the playbook to immediately decrease your talent loss, retain your best staff, and fill your open roles.

Xero

MAY 16, 2022

It’s hard to overstate how damaging the global pandemic was for local pubs. Many of these businesses are institutions – not simply a place to get a cold pint, but a home away from home, with friendly staff, possibly a sleepy dog and, if you’re lucky, a roaring fire. . Yet, forced to shut their doors as the pandemic ripped through our lives, many struggled to cope with the restrictions that kept customers away.

EasyBooks

MAY 16, 2022

When a customer pays an amount at regular intervals for a subscription or membership fee, this is known as a recurring transaction. For instance, spending $10 per month to access premium content on your website is a recurring transaction.

Speaker: Gerald Ratigan

The accounts payable (AP) function is evolving and AI is leading the charge. As finance teams face rising invoice volumes and expectations for speed and accuracy, AI-powered automation has shifted from a futuristic concept to the most practical solution. But for finance leaders, success isn’t just about selecting the right tools, it’s about implementing the right strategy.

FreshBooks

MAY 16, 2022

Unless you filed an extension (which is a great idea by the way), tax season might feel like it was months ago…wait, it was right? Now that it is, it’s time to start thinking about getting ready and staying ready for next year. Whether you had things in order or not, it’s never too early […] The post Switch to FreshBooks in May to Track Business Expenses the Easy Way appeared first on FreshBooks Blog - Resources & Advice for Small Business Owners.

Xero

MAY 16, 2022

As a small business owner getting to grips with what’s needed to comply with Making Tax Digital (MTD) for VAT, you’d be forgiven for feeling a little overwhelmed by the number of actions and items you’ve likely never encountered before. From bridging software to HMRC-compliant solutions , you may still be playing catch up. Now, we turn to digital links , which have been mandatory for MTD for VAT compliance since April 2021 and play a vital role in connecting software packages and submitting MTD-

Cloud Accounting Podcast

MAY 20, 2022

Sponsors OnPay: [link] FreshBooks: [link] Canopy: [link] Need CPE? Subscribe to the Earmark Accounting Podcast: [link] Get CPE for listening to podcasts with Earmark CPE: [link] Show Notes 2:57 – Tether (USDT) stablecoin drops below $1 peg [link] Bitcoin plunged to its lowest level since December 2020 as a cryptocurrency selloff gathered steam [link] 10:46 – Crypto investors likely pay less than half the taxes they owe [link] 12:05 – Web3 accounting firm officially launches on Tactic.com

Speaker: Sean Yoder

Nonprofits are under more pressure than ever to demonstrate financial accountability while continuing to expand their impact. Traditional budgeting models often fall short, reinforcing silos, limiting flexibility, and stalling growth. Enter collaborative budgeting: a dynamic, team-driven process that enables smarter resource allocation and builds financial resilience at scale.

NACM

MAY 18, 2022

The housing market is showing signs of cooling, as U.S. homebuilding permits dropped to a five-month low last month, Reuters reports. "Homebuilding was already being constrained by soaring prices as well as shortages of materials," the article reads. "The housing market is the sector of the economy most sensitive to interest rates, with building pe.

IMA's Count Me

MAY 15, 2022

Connect with Casey: [link] Full Episode Transcript: Adam: (00:05) Welcome back to the Count Me In podcast. I'm your host. Adam Larson in today's guest is really interesting. Casey. Woo. Casey's been a strategic financial leader in Silicon valley for the past two decades, investing in an operating high growth tech and tech enabled companies. He is the CFO of landing, the former head of strategic finance at WeWork and the co-founder of operators Guild, a knowledge sharing community for CFOs and ot

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Accounting Today

MAY 17, 2022

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Let's personalize your content