TIGTA celebrates 25th anniversary

Accounting Today

NOVEMBER 19, 2024

The Treasury Inspector General for Tax Administration has launched a social media campaign, even as the Senate is vetting its next head.

Accounting Today

NOVEMBER 19, 2024

The Treasury Inspector General for Tax Administration has launched a social media campaign, even as the Senate is vetting its next head.

Accounting Department

NOVEMBER 20, 2024

Driver-based planning is a type of management that zeros in on a company's key value drivers and key business drivers. It helps create budgeting and business plans based on these factors. The goal of this type of planning is to center on the factors that are important to fueling success. Mathematical models can be created to project business. Driver-based planning is helpful for finance executives when they are planning long-range strategic strategies.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Xero

NOVEMBER 18, 2024

We’re excited to announce that partnership tax has arrived in Xero Tax. You can now manage most of your clients’ tax needs – corporate, personal, and ordinary partnerships – in one simple, secure platform. No more juggling multiple tools or battling complicated software. By managing partnership tax in Xero, you can remove some of the stress around tax time for your practice and your clients.

FinOps Foundation

NOVEMBER 22, 2024

Key Insight: The practice of FinOps continues to evolve around several key themes that all point to its deeper integration into existing processes, business frameworks, and technology environments. Across the globe from the Americas, to Europe, and to Asia, FinOps is shaping up to be the driver of value realization for all kinds of organizations. The FinOps Foundation was thrilled to bring FinOps X to Europe this year, where we found a community eager to engage with and learn from each other.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Accounting Today

NOVEMBER 22, 2024

Audit and finance skills are heavily in demand on corporate boards, according to a survey by BDO.

Accounting Department

NOVEMBER 21, 2024

In the dynamic business world, financial strategy plays a pivotal role in determining success. But what if your small or medium-sized business (SMB) can't afford a full-time financial executive? Enter CFO Support Services —a game-changer for SMBs and startups alike. This blog uncovers the essence of a CFO support service provider, the immense value they bring, and why your business might need one.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

FinOps Foundation

NOVEMBER 22, 2024

Key Insight: Day 2 of FinOps X Europe was full of FinOps, FOCUS, and sustainability content. We were reminded that while a lot of organizations have been on their FinOps journeys for many years, others are still getting started. FOCUS is making an impact already today, but there is unlimited potential for the Specification to support additional use-cases in the future, such as normalizing carbon emissions data.

Accounting Today

NOVEMBER 18, 2024

Accounting software development cycles will accelerate with generative AI, but so will competitive pressures.

Fidesic blog

NOVEMBER 22, 2024

Accounts payable is a roller coaster… Ok, maybe it’s not quite that exciting, but those of us who work in AP everyday know how volatile it can be. We also know the dangers that a poorly managed accounts payable process can pose. With that in mind, this post will offer up some tips and best practices to create a killer accounts payable procedures policy handbook.

Gaviti

NOVEMBER 18, 2024

Automation delivers finance departments many benefits, including accurate predictions and insights related to revenue and sales so that CFOs and their teams can make better business decisions. Despite this, automation in accounts receivable has met its fair share of skepticism from business leaders worldwide. Some of the main concerns include change management and employee adaptability to new technologies, adherence to compliance, how easily the automation technology integrates with other financ

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Xero

NOVEMBER 19, 2024

Bank feeds have transformed how small businesses manage their bookkeeping. Gone are the days of manually comparing bank statements with accounting records. Today, with cloud accounting, you can securely and automatically import bank transaction data and easily reconcile it, so you have a single, up-to-date view of your transactions and cash flow. Bank feeds reduce manual admin and automate data entry.

Accounting Today

NOVEMBER 22, 2024

The American Institute of CPAs is still concerned about the Public Company Accounting Oversight Board's new firm and engagement metrics standard, despite some modifications from the original proposal.

Fidesic blog

NOVEMBER 22, 2024

Accounts payable is a roller coaster… Ok, maybe it’s not quite that exciting, but it’s not the wet blanket that some people think it is (looking at you sales team). Those of us who work in AP everyday know how volatile it can be and the dangers that a poorly managed accounts payable process can pose. With that in mind, this post will offer up some tips and best practices to create a killer accounts payable procedures policy handbook.

Fit Small Business

NOVEMBER 20, 2024

EverBank (formerly TIAA Bank) is an excellent choice if you’re looking for a bank with various interest-earning checking options. You can choose among five EverBank business checking accounts. All of which earn interest on all balances except for the entry-level Business Checking product. In addition, the bank also offers full-service banking products and services, including.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Ascend Software blog

NOVEMBER 19, 2024

Accounts payable (AP) automation has the potential to revolutionize financial operations, driving efficiency, accuracy, and cost savings. However, despite the many advantages of automating AP processes, not all implementations are successful. Several factors can cause AP automation solutions to fail or fall short of expectations. Understanding these common challenges can help organizations avoid costly mistakes and ensure a smoother, more effective transition to automated AP.

Accounting Today

NOVEMBER 21, 2024

The tax prep giant is once again looking to bring on close to 20,000 seasonal workers.

Jetpack Workflow

NOVEMBER 21, 2024

Podcast Summary In this episode of Growing Your Firm, host David Cristello welcomes Tim Brackney , the Chief Executive Officer of Springline Advisory , a firm backed by private equity. They delve into the philosophy of utilizing talent from small firms to enhance shared services, while also discussing the complexities and nuances of private equity in the industry.

Fit Small Business

NOVEMBER 19, 2024

BankUnited provides decent business checking products for organizations that generate a low to moderate monthly transaction volume. There are two types of regular checking accounts: A $12-per-month basic account with 150 free monthly transactions and a monthly cash processing allowance of $10,000. A $20-per-month premium account with 300 free monthly transactions and a monthly cash.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Nanonets

NOVEMBER 19, 2024

Are you finding Sensible's pricing steep, or is its technical setup tedious? While Sensible offers robust document processing capabilities, it’s not always the best fit for every business. Whether you're a non-technical team needing a no-code solution or a business looking for better customization, this buyer’s guide on the top 7 Sensible alternatives will help you find the best choice for your challenges.

Accounting Today

NOVEMBER 18, 2024

Aprio acquires Kirsch Kohn Bridge; Opsahl Dawson adds Hauser Jones & Sas; and Doeren Mayhew acquires BHT&D CPAs.

oAppsNet

NOVEMBER 22, 2024

Artificial Intelligence (AI) is evolving rapidly, revolutionizing how industries operate, and the fraud detection landscape is no exception. With the increasing sophistication of fraud tactics, traditional systems have struggled to keep up. But with AI’s ability to learn, adapt, and analyze massive datasets in real time, organizations are starting to turn the tide against fraudulent activity.

Counto

NOVEMBER 22, 2024

Starting a Cloud Kitchen in Singapore: Legal and Financial Considerations Starting a cloud kitchen in Singapore offers a unique opportunity to tap into the booming food delivery market. This business model allows you to operate a kitchen without a physical storefront, focusing on delivery-only services. To ensure success, it’s crucial to understand the legal and financial considerations involved in setting up a cloud kitchen.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Nanonets

NOVEMBER 18, 2024

Founded in 2016, Rossum has quickly become a major player in the document processing and automation space. It offers a cloud-based platform for AI-driven data extraction and workflow automation. However, every organization has unique needs, and not every tool would fit perfectly into all your workflows. If you’re exploring Rossum alternatives, it could be due to considerations such as: 1.

Accounting Today

NOVEMBER 22, 2024

Plus, Deloitte releases four new accelerators on Workiva marketplace; KPMG invests $100 million in Google Cloud Alliance; and other accounting tech news.

Analytix Finance & Accounting

NOVEMBER 20, 2024

Costs are up: 98% of operators say higher labor costs are an issue for their restaurant. 97% cite higher food costs. 38% say their restaurants were not profitable last year. These are some of the statistics reported by National Restaurant Accounting. However, the report also says given a choice between people and technology, consumers continue to crave human hospitality in their culinary experiences.

Less Accounting

NOVEMBER 18, 2024

As tax season approaches, many small business owners find themselves scrambling to organize their financial records and ensure they comply with the intricate web of tax regulations. Accurate bookkeeping is not just a seasonal task but a year-round commitment that can significantly impact a business’s financial health and stability. In this blog post, we will explore the importance of accurate bookkeeping for tax season, highlighting its benefits and offering practical tips for maintainin

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

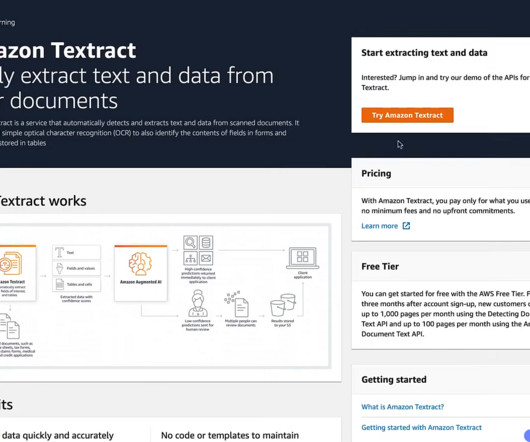

Nanonets

NOVEMBER 18, 2024

Amazon Textract is AWS's machine learning service that reads and processes documents automatically. It does more than just turn images into text like basic OCR tools. You can use it to pull data from forms and tables, process both typed and handwritten text, work with PDFs and scanned images, and handle documents in multiple languages. It even comes with ready-to-use tools for specific documents like invoices, IDs, and lending paperwork.

Accounting Today

NOVEMBER 21, 2024

Who controls how many branches of government is having repercussions at every level.

Fidesic blog

NOVEMBER 19, 2024

Companies using Fidesic AP Service Suite now have a simpler and more cost effective way to enable more users and locations to approve invoices with the release of its new “Approver” user level and single environment pricing for multi-entity companies.

Billah and Associates

NOVEMBER 22, 2024

About Climate Action Incentive Payment (CAIP) / CCR The Climate Action Incentive Payment (CAIP) also known as the Canada Carbon Rebate (CCR) is a federal tax-free benefit introduced to offset the cost of the federal carbon pricing system. Essentially, it returns proceeds from carbon taxes directly to individuals and families. The program aims to incentivize greener choices and make sustainable living more accessible and affordable.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Let's personalize your content