State of FinOps 2025

FinOps Foundation

FEBRUARY 21, 2025

Understand the state of FinOps and data behind the collaborative, real-time cloud financial management discipline.

FinOps Foundation

FEBRUARY 21, 2025

Understand the state of FinOps and data behind the collaborative, real-time cloud financial management discipline.

Accounting Department

FEBRUARY 19, 2025

Accounting disruptions can strike without warning. Whether its a provider suddenly shutting down, platform glitches, or other unforeseen issues, these disruptions can leave your business scrambling. With cases like the sudden closure of Bench, which left businesses without their books, its more apparent than ever that entrepreneurs and business owners need a plan to safeguard their financial processes.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Intuit

FEBRUARY 20, 2025

Keeping income and expenses balanced from week to week is a common small business challenge. For many years, Intuit has empowered millions of small business owners with a clear understanding of their cash flow by incorporating future money-in-and-out events, such as upcoming invoices and recurring expenses. Intuit also provides an AI-driven cash flow outlook and recommendations, such as sending invoice reminders on overdue invoices, adding late fees to customers who take a long time to pay, and

Accounting Today

FEBRUARY 20, 2025

The threatened layoffs of Internal Revenue Service employees appeared to be underway Thursday, with estimates of between 6,000 and 7,000 employees being laid off at the agency in the middle of tax-filing season.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Compleatable

FEBRUARY 20, 2025

The healthcare and aged care sectors are under increasing pressure to provide high-quality patient care while managing rising costs, staffing challenges, and strict regulatory requirements. Investing in the right software solutions is no longer optional, its essential for ensuring efficiency, compliance, and patient satisfaction. As we move into 2025, here are five must-have software solutions for UK healthcare and aged care providers. 1.

Accounting Department

FEBRUARY 20, 2025

In the fast-paced world of entrepreneurship and business management, the importance of maintaining impeccable financial records cannot be overstated. Accounting and controller services are the backbone of a well-oiled business machine, guiding entrepreneurs toward clarity and strategic growth.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

The Successful Bookkeeper

FEBRUARY 18, 2025

As a solo bookkeeper, your business depends entirely on you. But what happens if you suddenly cant work due to an emergency? Whether its an unexpected illness, a family crisis, or another unforeseen event, your businessand your clientscould be left in limbo.

Ascend Software blog

FEBRUARY 19, 2025

If your finance team is overwhelmed with invoices, constantly chasing approvals, and dealing with late payments, youre not alone. According to Ardent Partners State of ePayables Report, nearly 60% of businesses still rely on manual AP processes, leading to unnecessary delays, missed discounts, and compliance risks.

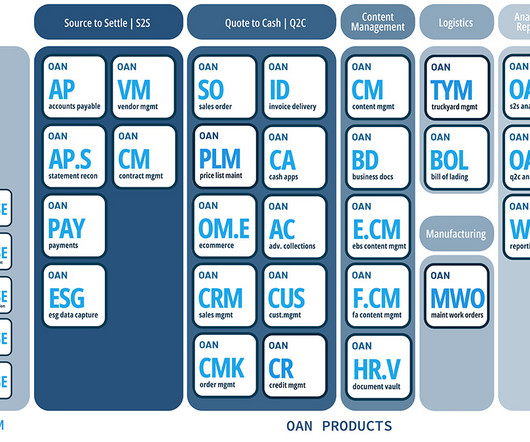

oAppsNet

FEBRUARY 20, 2025

In the dynamic landscape of 2025, businesses must stay ahead of emerging trends to maintain a competitive edge. Accounts Receivable (AR) management is a critical area where innovation can significantly impact cash flow and operational efficiency. By embracing the latest AR trends, businesses can optimize receivables workflows, reduce manual errors, and gain real-time insights into their financial operations.

Intuit

FEBRUARY 18, 2025

Check out the inspiring stories of entrepreneurs who participated in the Intuit IDEAS program and are making a difference in their communities. Providing accessible learning experiences for underserved communities Brandon Bailey didnt let a challenging upbringing define his destiny. Instead, he channeled his experiences into creating TutorD , an ed-tech company motivated by a profound belief in the power of culturally relevant educational experiences and tech-integrated learning solutions.

Speaker: Victor C. Barnes, CPA, MBA

Accounting Today

FEBRUARY 19, 2025

A federal district court in Texas has stayed an injunction that had prevented enforcement of the Corporate Transparency Act and its reporting requirement.

Nolan Accounting Center

FEBRUARY 15, 2025

Remote work has become a staple for businesses worldwide. While the pendulum in the U.S. is now swinging back to more in-person in-office work, remote work in some form is sure to continue because it works well for many employees and businesses. For remote workers, taking advantage of work-from-home tax deductions is important to have more money left over after taxes that can be saved, invested , or spent.

Jetpack Workflow

FEBRUARY 20, 2025

Podcast Summary In this episode of Growing Your Firm, host David Cristello welcomes back returning guest Loren Fogelman , a sports psychologist turned business coach specializing in helping accounting professionals. Loren shares her insights on a crucial yet often overlooked topic: raising fees for existing clients. She emphasizes the importance of understanding client hesitations, particularly when they respond with, “I’ll think about it,” suggesting that this often indicates

Xero

FEBRUARY 20, 2025

As a Xero partner, youre always looking for ways to help boost your efficiency and better serve your clients. Thats where Ignite comes in our new Xero plan which streamlines the old GST Cashbook and Starter plans. Discover the benefits and pricing of Ignite and see how its already helping partners and their clients across Australia and New Zealand improve insight into their cash flow.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Accounting Today

FEBRUARY 20, 2025

AI can help reduce a company's environmental impact through data-driven analytics and optimization, though the energy burden of AI itself remains a challenge.

Enterprise Recovery: Accounts Receivable

FEBRUARY 18, 2025

Ending a client relationship is never easy, as it often involves navigating complex emotions and potential conflicts. However, handling the situation with professionalism and tact can significantly preserve your reputation and safeguard future business prospects. By approaching the termination with a clear strategy and respectful communication, you demonstrate integrity and reliability, which are highly valued qualities in the business world.

Counto

FEBRUARY 18, 2025

Salary, Payroll, and Tax Compliance: What Small Businesses in Singapore Need to Know Managing payroll effectively is crucial for small businesses in Singapore. Ensuring that employees receive their salary on time, meeting tax compliance obligations, and keeping up with CPF contributions may seem complex. However, understanding the process can help business owners stay compliant and avoid penalties. 1.

Blake Oliver

FEBRUARY 18, 2025

Virginia just became the second state to create an alternative CPA pathway. Starting in January 2026 , accountants will have two options: A Bachelor's degree plus 2 years of experience A Master's degree plus 1 year of experience. Either way, you'll need to have an accounting concentration or equivalent , as defined by the Virginia Board of Accountancy.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Accounting Today

FEBRUARY 20, 2025

Members of the Tennessee Society of CPAs visited the state capital in Nashville this week to lobby for changes in the licensure and mobility laws.

Fit Small Business

FEBRUARY 20, 2025

What Is A Reasonable Accommodation? A reasonable accommodation is any workplace adjustment or modification that allows an employee with a disability equal opportunity in recruitment, hiring, compensation, benefits, training, job changes, and separation. Reasonable accommodations are a significant aspect of the Americans with Disabilities Act (ADA), a federal law prohibiting discrimination against employees with disabilities.

Counto

FEBRUARY 20, 2025

Singapore Budget 2025: Key Benefits for Small Businesses The Singapore Budget 2025, presented by Prime Minister Lawrence Wong on February 18, brings welcome relief for small businesses facing rising costs while also providing support for long-term growth. As your accounting partner, we’ve analysed the key measures that matter most to small business owners.

Invoicera

FEBRUARY 19, 2025

Manually processing expense reports isn’t just time-consumingits expensive. Research by GBTA reveals that manual expense report processing brings total expenses to $58 per report, while every fifth wrong report requires $52 to correct. These inefficiencies multiply into substantial drains of time and resources. Small business management depends heavily on financial tracking, yet traditional monitoring creates problems with both budgeting and financial control.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Accounting Today

FEBRUARY 21, 2025

A technical glitch prevented Internal Revenue Service officials from notifying laid-off employees by email, so the IRS will be sending them letters, instead.

Fit Small Business

FEBRUARY 20, 2025

An applicable federal rate, also commonly known as an “AFR,” is the minimum interest rate required of a private loan. It is enforced and designated by the IRS and applies to loans with an interest rate lower than the tax rate if the loan is considered income. There are differing AFRs assigned to various loan. The post What Is an Applicable Federal Rate (AFR)?

Counto

FEBRUARY 19, 2025

Bill Payment Fraud: How to Protect Your Business from Scams and Unauthorised Transactions Bill payment fraud is a growing threat to small businesses in Singapore. Scammers are becoming more sophisticated, using phishing emails, fake invoices, and unauthorised transactions to exploit vulnerabilities in payment processes. If not addressed, fraudulent activities can lead to significant financial losses, operational disruptions, and reputational damage.

accountingfly

FEBRUARY 20, 2025

Top Remote Candidates This Week Are you in need of remote accountants? Accountingfly can assist you! Our ‘ Always-On Recruiting ‘ program allows you to connect with highly skilled and experienced remote accounting candidates without any upfront costs. Here are some of this week’s top remote tax and accounting candidates. Sign up now to receive the full list of available top accounting candidates on a weekly basis!

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Accounting Today

FEBRUARY 20, 2025

Major changes are afoot for companies that want to claim the research tax credit.

Billing Platform

FEBRUARY 17, 2025

Accrued revenue is a cornerstone of accrual accounting, playing a vital role in accurately reflecting a company’s financial performance. For businesses operating in dynamic industries, understanding the concept is essential for aligning with Generally Accepted Accounting Principles (GAAP) and maintaining transparency with stakeholders. This article explores the meaning, examples, and importance of accrued revenue, while comparing it with deferred revenue and accounts receivable.

Counto

FEBRUARY 19, 2025

How Bill Payments Impact Business Credit Scores: A Guide for SMEs For small businesses in Singapore, maintaining a strong business credit score is essential. This score determines your ability to secure financing, negotiate favourable payment terms, and build credibility with suppliers. One of the most significant factors influencing your credit score?

Insightful Accountant

FEBRUARY 19, 2025

Tax practitioners are bracing for significant operational changes at the IRS as the agency prepares for both staffing reductions and increased enforcement focus during the current filing season.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Let's personalize your content