Maximizing Profitability: A Comprehensive Guide to Job Costing

Accounting Department

MAY 29, 2025

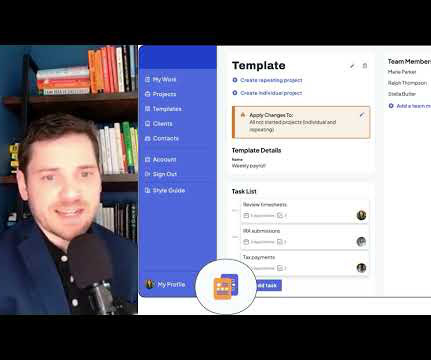

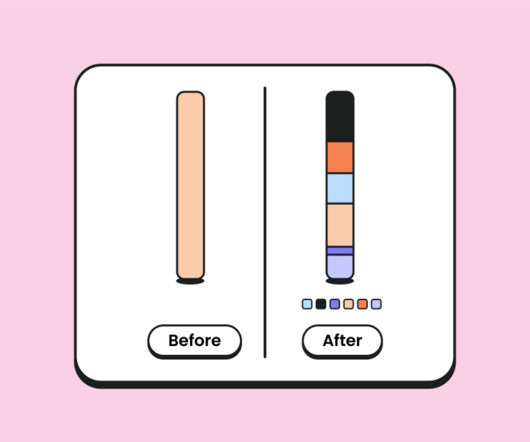

Understanding exactly how much each job or project costs your business is essential for maximizing profitability. However, many business owners struggle to track costs accurately, leading to mispriced jobs and unexpected expenses later on. This is where job costing comes into play.

Let's personalize your content