Why Cloud-Based Invoicing is the Future of Small Business Finance

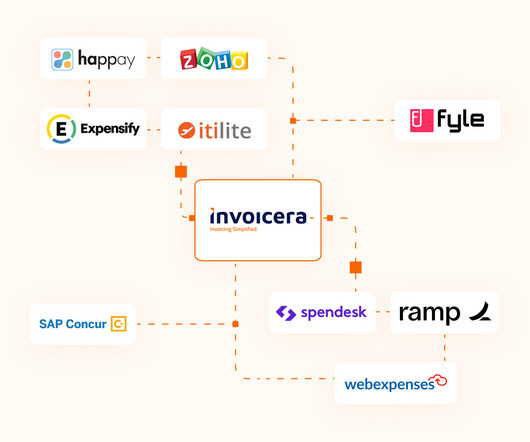

Invoicera

MAY 8, 2024

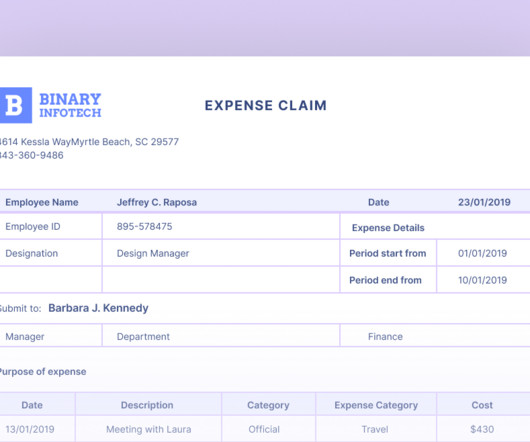

Cloud-based invoicing, for one, helps small businesses stay financially healthy. Many business owners overlook the importance of their invoicing systems, which is understandable as their focus is often on networking, strategizing, and boosting sales. Late Payments 54% of small businesses experience late invoice payments.

Let's personalize your content