Navigating an Audit by the Canada Revenue Agency: What Documents Are Needed?

LedgerDocs

APRIL 19, 2023

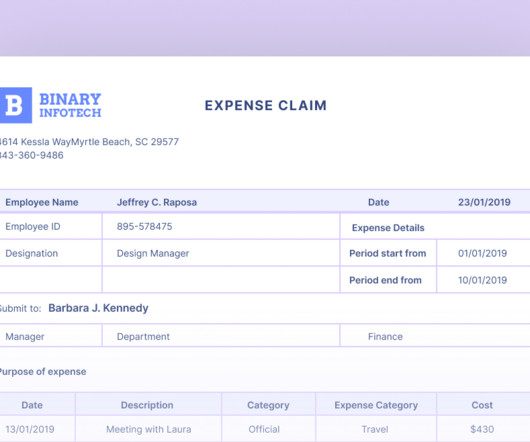

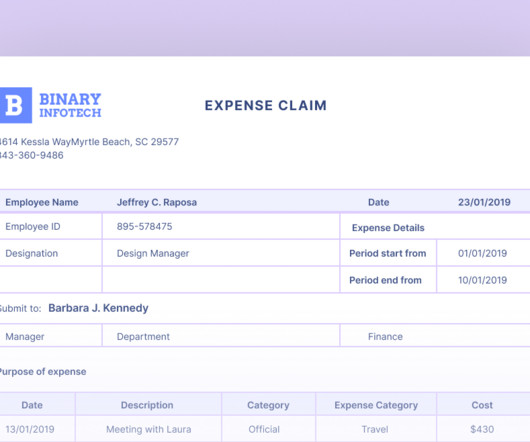

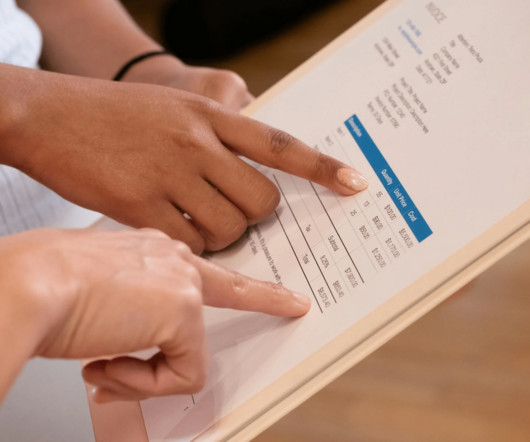

The first thing to understand is that the CRA is entitled to review all financial records from the period under review. The first thing to do is to organize and prepare to provide all of the documents that relate to your income and expenses. These documents will include bank statements, invoices, T4 slips, and tax returns.

Let's personalize your content