What Is General Ledger Reconciliation?

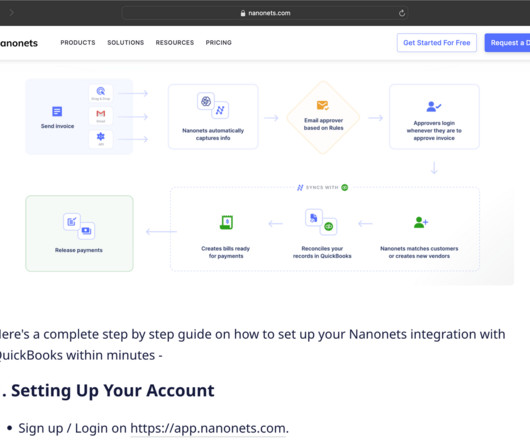

Nanonets

MAY 6, 2024

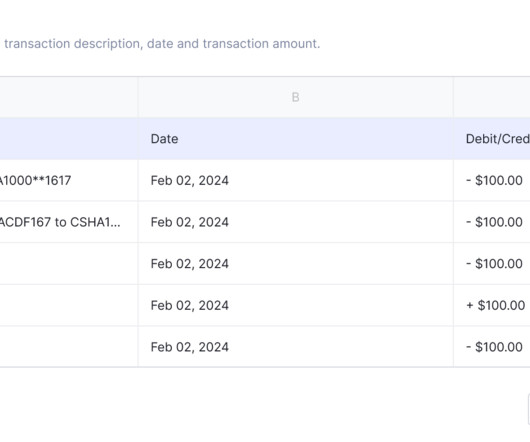

General Ledger Reconciliation The General Ledger (GL) is a silent custodian of a company's financial narrative. It is a record of all financial transactions of an enterprise and provides a comprehensive account of the organization's monetary activities. What is the General Ledger?

Let's personalize your content