Financial statement preparation

Accounting Tools

OCTOBER 9, 2023

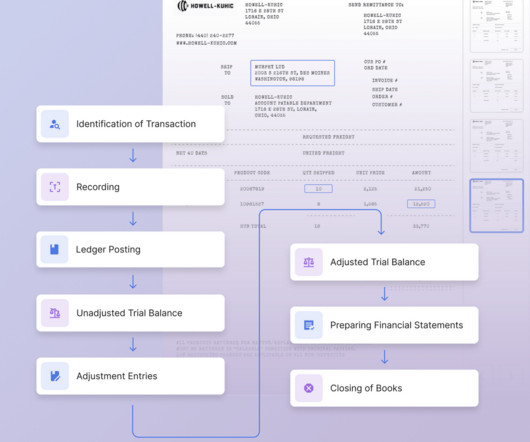

Related Courses Closing the Books The Soft Close The Year-End Close How to Prepare Financial Statements The preparation of financial statements involves the process of aggregating accounting information into a standardized set of financials. Based on this information, write footnotes to accompany the statements.

Let's personalize your content