BDO's Berson to retire in 2026

Accounting Today

MAY 29, 2025

BDO USA's CEO Wayne Berson will retire effective June 30, 2026, and national managing principal of tax Matthew Becker has been tapped to succeed him.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accounting Today

MAY 29, 2025

BDO USA's CEO Wayne Berson will retire effective June 30, 2026, and national managing principal of tax Matthew Becker has been tapped to succeed him.

Accounting Today

JUNE 6, 2025

We must confront a critical question: If we continue to train accountants solely to file tax reports, are we truly equipping them for the challenges of todays world? The recent announcement of the CIMA/CGMA 2026 syllabus has made it unmistakably clear: Merely knowing how to post journal entries is insufficient. All rights reserved.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Xero

FEBRUARY 26, 2025

The next phase of Making Tax Digital is coming. In April 2026, Making Tax Digital for Income Tax (MTD for IT) will be introduced, and its set to shake up the record keeping, reporting and tax requirements for self-employed people and landlords. MTD for IT filing will be available in all Xero business plans.)

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

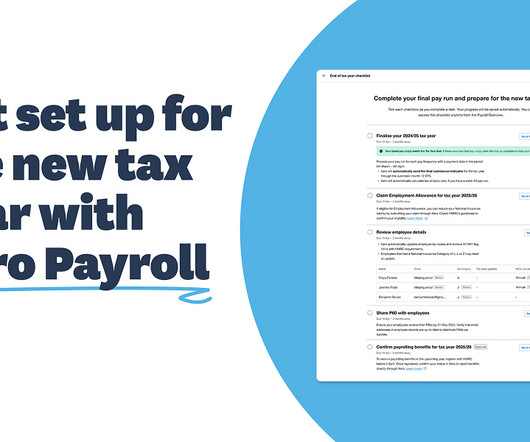

Xero

MARCH 25, 2025

With another tax year almost wrapped up, are you ready to tackle year-end payroll? Finalising your 2024/2025 tax year Wrap up outstanding items Before processing your last pay run for the 2024/25 tax year, approve any outstanding leave requests, timesheets and overtime to ensure your employees’ final pay is accurate.

Accounting Today

SEPTEMBER 11, 2024

The OZ program allows investors to defer their capital gains from sales of appreciated real estate, stocks, businesses, personal residences, collectibles and even crypto through 2026.

Xero

JUNE 3, 2025

From April 2026, small businesses, sole traders and landlords will need to change how they report income tax to HMRC. New legislation, known as Making Tax Digital for Income Tax (MTD for IT ), is set to be introduced, sparking a shift in financial reporting requirements. The MTD for IT rollout will happen in phases.

Accounting Today

NOVEMBER 25, 2024

The Internal Revenue Service is extending the transition period for revising claims for the research and development tax credit through Jan. 10, 2026.

Accounting Today

FEBRUARY 27, 2025

Wolters Kluwer CEO Nancy McKinstry said she will retire in 2026. Wolters Kluwer intends for Stacey Caywood, current CEO of Wolters Kluwer Health, to be the new CEO next year.

Xero

DECEMBER 20, 2022

HMRC has announced that Making Tax Digital (MTD) for Income Tax Self Assessment (ITSA) has been delayed until April 2026. This can only be a good thing, because regardless of this delay, it remains a vital part of the Government’s journey to digitise the tax process. Why has this happened? The new MTD for ITSA timeline.

Accounting Today

OCTOBER 4, 2022

(..)

Fidesic blog

APRIL 4, 2023

(UPDATE) Microsoft has announced new customer sales of Microsoft Dynamics GP will end April 2026. They can continue to purchase new licenses and modules beyond 2026. "We They can continue to purchase new licenses and modules beyond 2026. Starting April 1, 2026 new customer sales of Dynamics GP end.

Accounting Today

AUGUST 25, 2023

The Internal Revenue Service is giving people until 2026 to comply with a new requirement for Roth catch-up contributions.

Counto

MARCH 5, 2024

Singapore to Raise Retirement Age to 64 by 2026 In a move towards fostering inclusive and progressive workplaces, Singapore’s retirement age is set to rise to 64 years old in 2026, announced by Minister of Manpower Tan See Leng during the Committee of Supply debate in Parliament.

Fidesic blog

DECEMBER 5, 2024

The date has been extend from September 2029 to the end of 2029 so users can meet their 2029 year-end payroll and tax obligations. Be ready for 2029 end of product enhancements, regulatory (tax) updates, service packs and technical support. Microsoft has announced new customer sales of Microsoft Dynamics GP will end April 2026.

Counto

FEBRUARY 20, 2025

Corporate Tax Relief and Cash Grant Good news for your bottom line – you’ll receive a 50% corporate income tax rebate for YA 2025. The government will now co-fund 40% of wage increases in 2025 (up from 30%) and 20% in 2026 (up from 15%) for lower-wage workers. Tired of surprise fees from accounting services?

Counto

MARCH 4, 2024

However, the implementation for renewal cases will be delayed, with the new thresholds taking effect on January 1, 2026. Impact on Renewal Applications It’s essential to note that these revised qualifying salary levels will also apply to EP renewal applications. Experience a smarter way to outsource your accounting with confidence.

Invoicera

APRIL 10, 2024

Knowing these rules matters if you want to ensure tax compliance, accurate financial reporting, and legal validity. Tax systems vary worldwide. Some of those contextual policies include Value Added Tax (VAT), Goods and Services Tax (GST), and sales tax.

CSI Accounting & Payroll

SEPTEMBER 15, 2024

If you’re a small business owner who has provided paid FMLA leave to an employee, you may have heard about this credit. It can be a great way to earn back some of the wages you paid your employee while they were gone.

Counto

JANUARY 11, 2024

Increase in CPF Ordinary Wage Ceiling (a) The CPF Ordinary Wage (OW) ceiling, which determines the amount of wages subject to CPF contributions, is set to increase from $6,000 to $8,000 by 2026. Let the pro team at Counto take care of your incorporation, accounting and taxes. Time is money.

Cloud Accounting Podcast

DECEMBER 14, 2018

Show Notes KPMG Moves into Small Business Tax and Accounting Services with Spark — Accounting Today — Big 4 accounting and business consulting firm KPMG LLP, is making a play for the small business tax and accounting services market with the launch of a new online system called KPMG Spark. His mission? Preparing America for automation.

Counto

JANUARY 10, 2024

Maintaining accurate and organised records is crucial to ensure compliance with tax obligations, manage finances effectively, and provide transparency in your company’s financial affairs. Refer to this Record Keeping Checklist for a list of the different types of records required. How Long Should Company Records Be Kept For?

Counto

FEBRUARY 17, 2024

Expansion of Wage Ceiling: Additionally, the gross monthly wage ceiling for PWCS co-funding will be raised from S$2,500 to S$3,000 in qualifying years 2025 and 2026. Experience a smarter way to outsource your accounting with confidence.

Counto

MARCH 24, 2024

billion by 2026. Counto’s tax experts are backed by in-house proprietary AI tax software, which has achieved IRAS ASR+ Tier 3 qualification , the highest possible accreditation in Singapore. According to Statista, the dropshipping e-commerce market is projected to reach a value of US$476.1 Did you know? Happy dropshipping!

Counto

SEPTEMBER 11, 2024

By April 2026, the total paid parental leave will rise from 20 weeks to 30 weeks, with the additional 10 weeks being government-paid shared parental leave (SPL). Our expert accountants deliver comprehensive services—from bookkeeping to tax filing—at transparent rates. At Counto, we prioritise your bottom line.

CapActix

OCTOBER 10, 2023

This advanced software offers a comprehensive range of features, including payroll management, report generation, expense tracking, and even tools for auditing and tax preparation support. Investing in the best accounting software for CPAs and accounting firms designed to facilitate the operations of accounting business is a prudent decision.

Nanonets

JUNE 15, 2023

This could explain the high growth of the accounting software industry, estimated to reach $12 billion by 2026. Difficulty in compliance It can be hard to keep up with regulatory requirements and tax laws if you rely on manual accounting methods. They also assist in calculating deductions, providing a clear view of tax obligations.

CapActix

SEPTEMBER 21, 2023

and applying them in the practice Calculate and make accurate deductions for employees and file details to the government on time Create an income tax return and file it as per the deadline And many more There is a lot of hassle to manage all accounting jobs and it needs real experience and expertise. Billion US Dollars by 2026.

Accounting Today

MAY 7, 2025

The Internal Revenue Service announced the inflation-adjusted amounts for health savings accounts in 2026.

Accounting Today

MAY 21, 2025

The revised version of President Donald Trump's economic package would move up work requirements to December 2026 from 2029.

Counto

MAY 6, 2025

This years budget introduces key updates that directly impact SMEs, from tax reliefs and wage support to innovation grants and compliance expectations. The right preparation can translate these schemes into real financial benefits from tax rebates and wage credits to innovation support and digital compliance. Nows the time.

Blake Oliver

JANUARY 19, 2025

The referendum means the project is stalled until 2026(!). year in tax revenue Thousands of homes One of Arizona's biggest companies This is because some people worry that the character of the community will change for the worse because of the addition of apartments. Classic NIMBY arguments. So we might lose: 5,500 new jobs $11.5M/year

Accounting Today

JANUARY 15, 2025

The Internal Revenue Service ended 2024 with new regulations on reporting cryptocurrency transactions, amendments for outdated provisions and more.

Counto

APRIL 13, 2025

Bonuses and Additional Wages Record all year-end bonuses, including Annual Wage Supplement (AWS) Confirm payment dates bonuses paid after 31 Dec 2024 fall into YA 2026 Ensure CPF is applied correctly Additional Wages are subject to a separate CPF ceiling Reconcile year-to-date bonus payments to avoid excess or missed CPF 2.

Counto

JANUARY 13, 2025

Under Singapore’s tax laws, businesses can claim a tax deduction of up to 2.5 Here’s how you can ensure compliance with tax regulations and maximise your charitable giving: 1. ” This helps keep your donations separate from other business expenses, making it easier to track and report them during tax season.

Counto

MAY 6, 2025

Our team of seasoned compliance professionals expertly handles everything from company registration and nominee director services, to tax filing at unbeatable rates. Discover more about our cost-effective company incorporation packages here.

Counto

MARCH 12, 2025

Updates to CPF Wage Ceiling (2025) Date OW Ceiling Before Sep 2023 $6,000 1 Sep 2023 $6,300 1 Jan 2024 $6,800 1 Jan 2025 $7,400 1 Jan 2026 $8,000 These increases mean that payroll systems must automatically account for CPF ceiling changes to ensure compliance. From calculations to tax deposits, our in-house team handles everything.

Cloud Accounting Podcast

FEBRUARY 27, 2025

You'll also discover why the $400 million PCAOB budget might be on the chopping block, how AI research tools like Perplexity Deep Research are revolutionizing tax research, and get the latest update on the ever-shifting BOI reporting deadlines.

Cloud Accounting Podcast

MAY 22, 2025

Could the Pope be on the hook for US taxes? Check out our new website - accountingconferences.com Limited edition shirts, stickers, and other necessities TeePublic Store: [link] Subscribe Apple Podcasts: [link] YouTube: Could the Pope be on the hook for US taxes?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content