Xero Simple is here for small businesses

Xero

JUNE 3, 2025

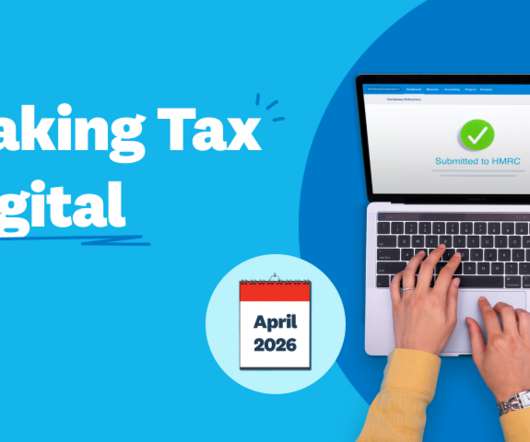

From April 2026, small businesses, sole traders and landlords will need to change how they report income tax to HMRC. New legislation, known as Making Tax Digital for Income Tax (MTD for IT ), is set to be introduced, sparking a shift in financial reporting requirements. The MTD for IT rollout will happen in phases.

Let's personalize your content