How to record a returned deposit on a bank reconciliation

Accounting Tools

APRIL 4, 2023

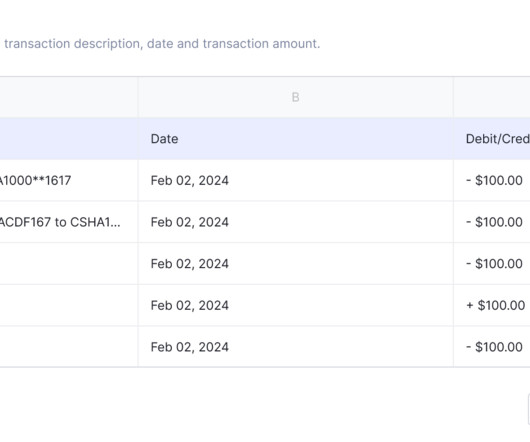

Related Courses Bookkeeping Guidebook Corporate Cash Management How to Audit Cash A returned deposit arises when a company deposits a check with its bank, and the bank refuses to deposit the related amount of cash in the company's bank account.

Let's personalize your content