Accounting department responsibilities

Accounting Tools

APRIL 6, 2024

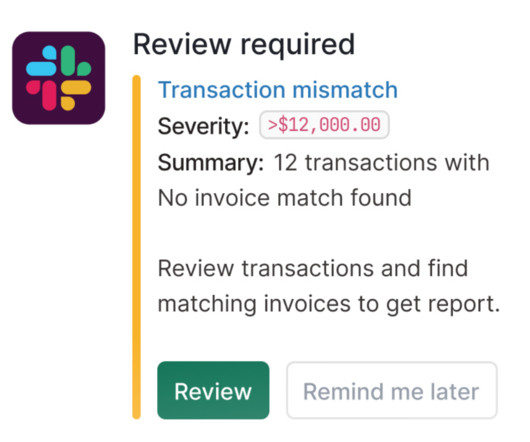

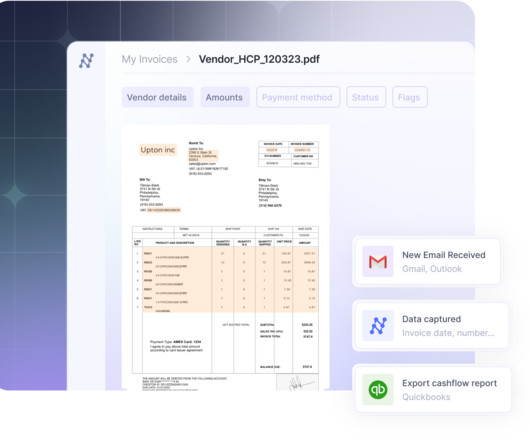

Accounts Payable Processing The payables staff collects supplier invoices and employee expense reports , verifies that the billed amounts are authorized for payment, and issues payments to recipients on scheduled payment dates.

Let's personalize your content