What is the Accounts Payable Process?

Nanonets

MARCH 20, 2023

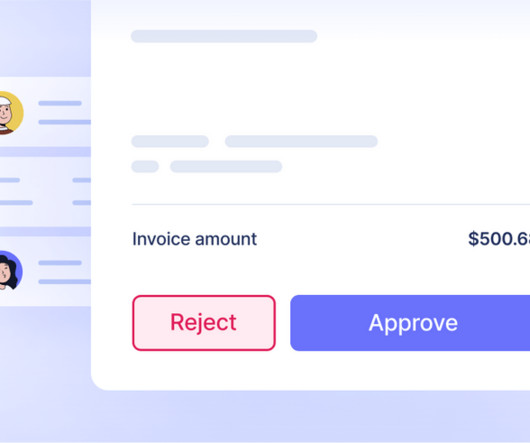

What is the accounts payable process? The accounts payable process of a company is the management of its short-term payment obligations to vendors/suppliers. The accounts payable or AP is the amount of money that a business owes to its vendors/suppliers for availing their goods/services.

Let's personalize your content