Accounts payable controls

Accounting Tools

FEBRUARY 5, 2024

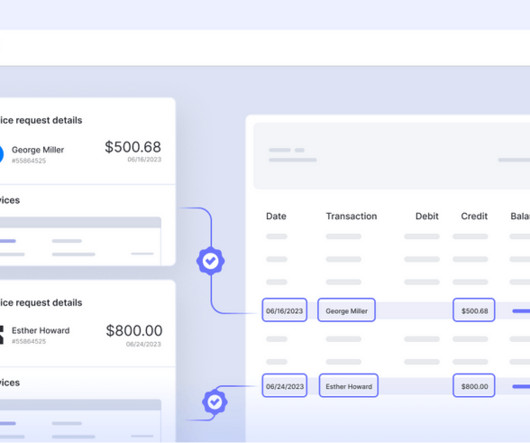

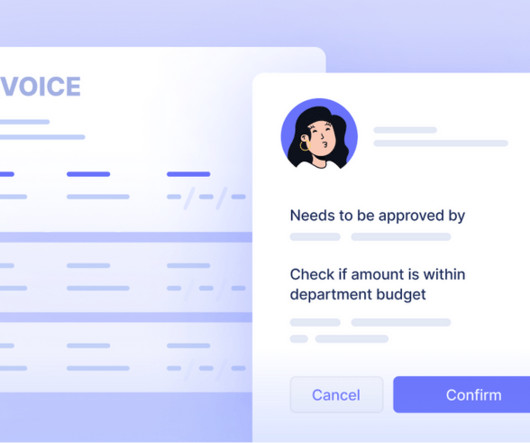

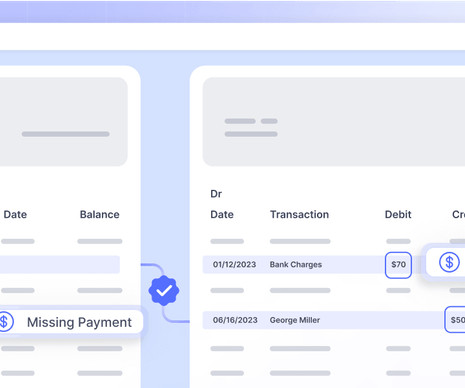

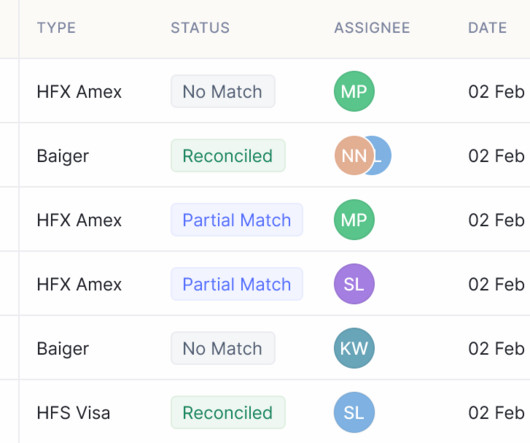

Approve Supplier Invoices The person in a position to authorize payment signifies his or her approval of a supplier invoice. Complete a Three-Way Match The payables staff matches the supplier invoice to the related purchase order and proof of receipt before authorizing payment. What are the Accounts Payable Controls?

Let's personalize your content