The Guide to Invoice Audit in 2024

Nanonets

JANUARY 1, 2024

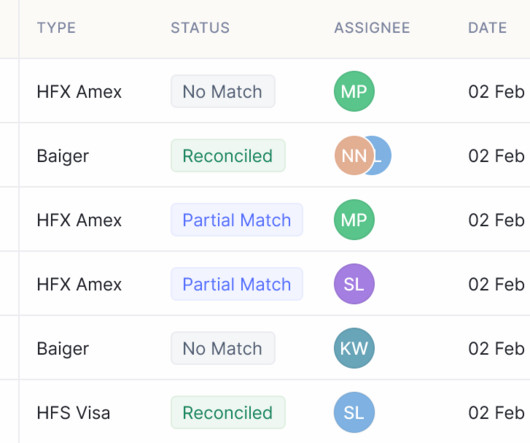

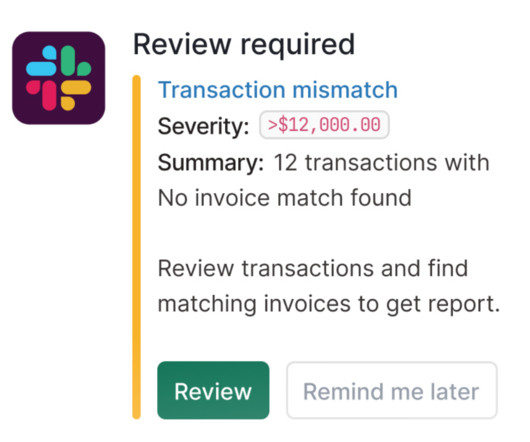

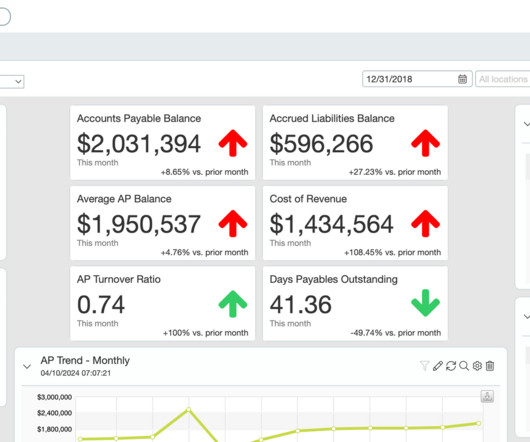

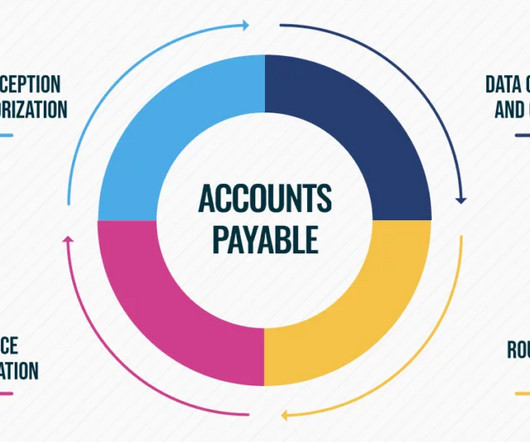

In this blog, we'll delve into what invoice audits entail and why they are crucial for the financial integrity of businesses. What is an Accounts Payable Audit? An Account Payable Audit is a process by which the financial records of the accounts payable department are examined by an auditor.

Let's personalize your content