Analyse GR/IR into Current Asset or Current Liability

SAP Accounts Payable

JANUARY 4, 2024

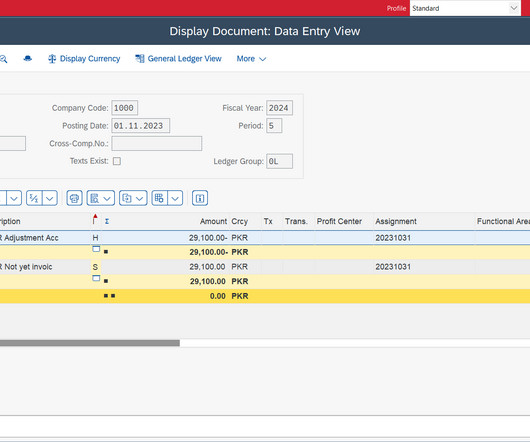

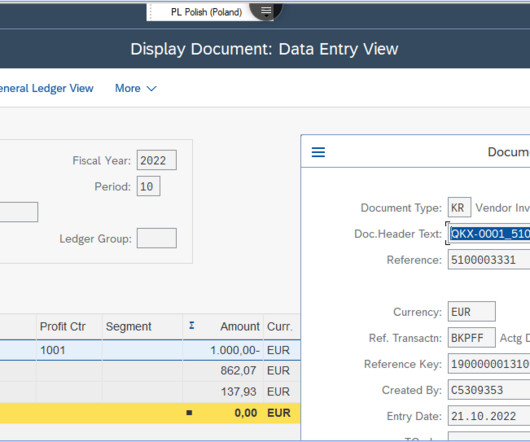

The purpose of the blog is to solve the confusing situation of the business process where goods are received (MIGO) without the invoice. Also, where invoices are issued in advance (MIRO) before the goods were received. The accounting treatment of WE is of an asset, whereas for RE is of liability. Then run F.13

Let's personalize your content