Different Types of Accounting Methods (And How to Choose the Right One for Your Business)

Analytix Finance & Accounting

MAY 7, 2025

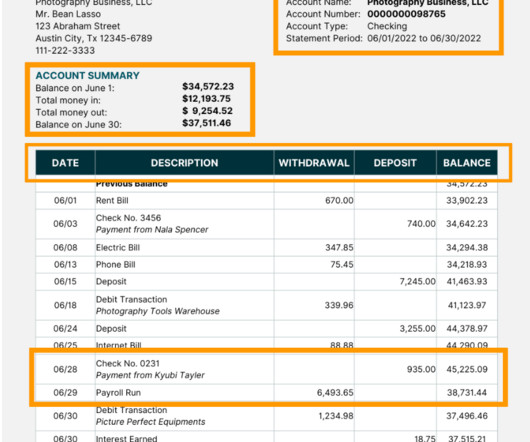

This direct connection means you always know exactly where you stand cash-wise – no reconciling or additional reports needed. Masks future obligations Since expenses only appear when paid, cash basis accounting provides zero visibility into upcoming financial commitments.

Let's personalize your content