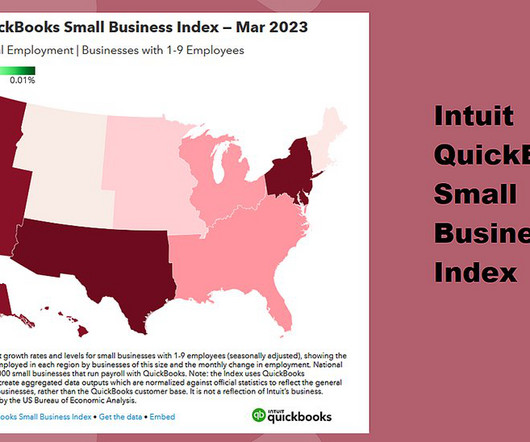

Intuit’s Focus on Financial Literacy in 2023

Intuit

APRIL 5, 2023

It’s April once again, and Intuit is celebrating Financial Literacy Month with a focus on helping students, individuals and small businesses develop financial habits and improve their financial literacy. Named by The World Economic Forum as one of the most critical, durable skills every student needs to succeed, financial literacy helps to prepare people for the jobs of the future, so they can live more successful and prosperous lives.

Let's personalize your content