Watch Out for Everything 'AI', a Murph Commentary

Insightful Accountant

JUNE 12, 2023

Murph cautions us against accepting the results of 'AI' like ChatGPT. the data these AI machines produce may be more 'artificial' than 'intelligent'.

Insightful Accountant

JUNE 12, 2023

Murph cautions us against accepting the results of 'AI' like ChatGPT. the data these AI machines produce may be more 'artificial' than 'intelligent'.

Compleatable

JUNE 12, 2023

For small business owners, cash flow is the lifeblood that keeps their ventures running smoothly. Managing invoices and ensuring timely payments from clients and customers is crucial to maintaining a healthy cash flow. But if you’re a new business owner or perhaps snoozed through your accountancy classes at University (we’re not judging!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Insightful Accountant

JUNE 12, 2023

Intuit Ventures has announced an investment in Finch, the No. 1 API for employment systems. The investment will allow Finch to build deeper integrations with the Intuit QuickBooks ecosystem.

Nanonets

JUNE 12, 2023

Optical character recognition (OCR) software help convert non-editable document formats such as PDFs, images or paper documents into machine-readable formats that are editable & searchable. OCR applications are commonly used to capture text from PDFs & images and convert the text into editable formats such as Word, Excel or a plain text file.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Accounting Tools

JUNE 12, 2023

Related Courses How to Conduct a Compilation Engagement How to Conduct a Review Engagement How to Conduct an Audit Engagement What is a Financial Statement Audit? A financial statement audit is the examination of an entity's financial statements and accompanying disclosures by an independent auditor. The result of this examination is a report by the auditor, attesting to the fairness of presentation of the financial statements and related disclosures.

Outsourced Bookeeping

JUNE 12, 2023

Tax deductions are a beneficial tactic to decrease your taxable income and reduce expenses when filing taxes. This writing digs into ten clever tax deductions that individuals and businesses should know. You can improve your financial status by integrating these deductions into your tax planning strategy. We will also explore the advantages that come with using outsourced bookkeeping and accounting services , such as outsourced management of accounts payable, to guarantee precise deduction monit

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Remote Quality Bookkeeping

JUNE 12, 2023

You may think there is nothing to fret about now that the tax season is over. Newsflash: Fraudsters are always plotting ways to trap taxpayers in tax scams. While it is true that their lucrative schemes are at their peak during filing season, that doesn’t mean they are sitting idle the rest of the year. Considering this, the Internal Revenue Service (IRS) compiles a yearly list titled “Dirty Dozens” that brings forward the worst tax scams.

Accounting Tools

JUNE 12, 2023

Related Courses Cost Accounting Fundamentals Financial Analysis Operations Management How to Calculate Efficiency The efficiency equation is a comparison of the work output from an operation to the work input to that same operation. The amount of "work" could refer to time, effort, capacity , or more tangible items. A high level of efficiency implies a minimal amount of wasted time, effort, capacity, materials, and so forth.

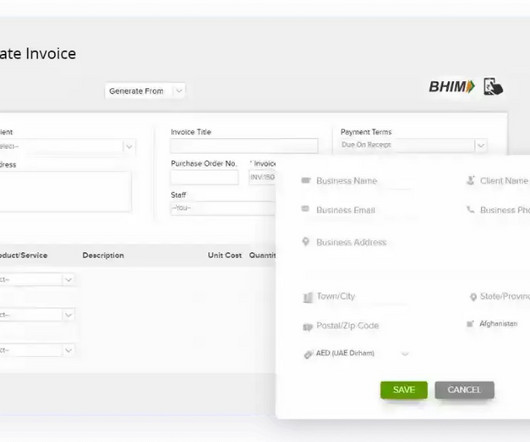

Invoicera

JUNE 12, 2023

Are you tired of the hassle of traditional utility billing methods? Have you been searching for an efficient & streamlined process to manage your business’s utility bills? Look no further! Cloud-based utility billing software is the answer to all your problems. With its numerous benefits, switching to cloud-based utility billing software can lead to: Increase in productivity Cost savings Improve accuracy and more This blog post will explain – Why should your business make a move

Accounting Tools

JUNE 12, 2023

Related Courses Capital Budgeting Corporate Finance Treasurer's Guidebook What is the Simple Rate of Return? The simple rate of return is the incremental amount of net income expected from a prospective investment opportunity, divided by the investment in it. The simple rate of return is used for capital budgeting analysis, to determine whether a business should invest in a fixed asset and any incremental change in working capital associated with the asset.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Remote Quality Bookkeeping

JUNE 12, 2023

You may think there is nothing to fret about now that the tax season is over. Newsflash: Fraudsters are always plotting ways to trap taxpayers in tax scams. While it is true that their lucrative schemes are at their peak during filing season, that doesn’t mean they are sitting idle the rest of the year. Considering this, the Internal Revenue Service (IRS) compiles a yearly list titled “Dirty Dozens” that brings forward the worst tax scams.

Accounting Tools

JUNE 12, 2023

Related Courses Accounting for Inventory How to Audit Inventory How to Account for a Consignment Consignment occurs when goods are sent by their owner (the consignor ) to an agent (the consignee ), who undertakes to sell the goods. The consignor continues to own the goods until they are sold, so the goods appear as inventory in the accounting records of the consignor, not the consignee.

Nanonets

JUNE 12, 2023

Introduction Zapier is a web-based automation tool that connects applications and simplifies workflow. It enables users to automate repetitive tasks, by "zapping" information between different online services without needing to manually perform the actions. Through a concept known as "Zaps," the software allows seamless data integration across multiple platforms such as Gmail, Slack, Dropbox, and many more.

Accounting Tools

JUNE 12, 2023

Related Courses Accountants’ Guidebook Bookkeeper Education Bundle Bookkeeping Guidebook What is a Subsidiary Ledger? A subsidiary ledger stores the details for a general ledger control account. Once information has been recorded in a subsidiary ledger, it is periodically summarized and posted to a control account in the general ledger , which in turn is used to construct the financial statements of a company.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Insightful Accountant

JUNE 12, 2023

As taxpayers start seeing the 5 million to 8 million collection notices hitting the mail, your phone is going to start ringing. Are you ready for the rush?

Accounting Tools

JUNE 12, 2023

Related Courses Business Ratios Guidebook The Interpretation of Financial Statements The total equity of a business is derived by subtracting its liabilities from its assets. The information for this calculation can be found on a company's balance sheet , which is one of its financial statements. The asset line items to be aggregated for the calculation are cash , marketable securities , accounts receivable , prepaid expenses , inventory , fixed assets , goodwill , and other assets.

Insightful Accountant

JUNE 12, 2023

You can use your potential as a CEO Whisperer to offer differentiated advisory services. In Part 3 of G76's Peter Mares' four-part series, unlock the secrets to managing your business. Sign up for the June 14 webinar here.

5 Minute Bookkeeping

JUNE 12, 2023

Are you ready to take your bookkeeping knowledge to the next level? As bookkeepers, our clients come in an assorted variety of legal entities. Legal entities and owner compensation might not sound like the most exciting topic, but trust me, it’s essential knowledge for any bookkeeper looking to grow, gain confidence, or tackle clean-up projects. Understanding your client’s legal entity and how they should be compensated can make a world of difference in your work with US clients.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Nanonets

JUNE 12, 2023

Introduction OneDrive is Microsoft's cloud storage solution that allows users to save files and personal data like Windows settings across all their Windows PCs. It also offers a simple way to store, sync, and share various types of files, with others, and across multiple devices. A major advantage of OneDrive is its seamless integration with Microsoft products like Windows 10 and Office 365.

Jetpack Workflow

JUNE 12, 2023

Competing against big-name tax preparers like H&R Block or Jackson Hewitt can be challenging for smaller firms building their tax filing services. You may think it’ll break the bank to implement strategies that effectively expand your tax client base. However, you don’t always need access to endless resources for your tax preparation business to flourish.

Economize

JUNE 12, 2023

Navigate the complex landscape of cloud cost management with our comprehensive guide on the best open-source cloud cost optimization tools of 2023. We unpack the strengths and weaknesses of each tool, discuss what to consider when choosing a tool, and provide insights into the leading players in the field.

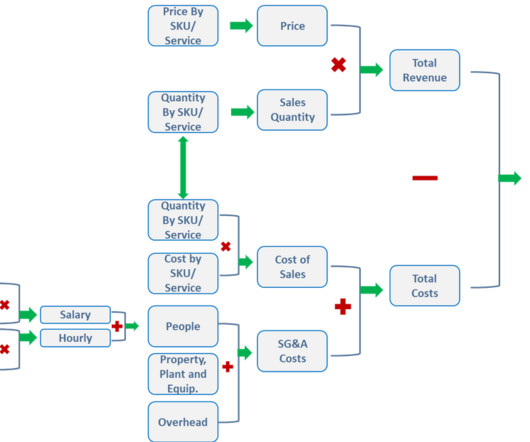

CloudZero

JUNE 12, 2023

Achieving SaaS profitability can seem daunting without the right tools in your toolbox. Here’s how to maximize your margins in today’s economy.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Counto

JUNE 12, 2023

Wise vs Aspire vs Airwallex: Which is the best business account in Singapore? Choosing the right business account provider is an important decision that can have a significant impact on your company’s financial operations. Wise, Aspire and Airwallex are among the more modern solutions available here in Singapore. These are fintech companies that can transform the banking experience for small and medium businesses, enabling them to open a multi-currency account in minutes, and move money cheaper

Invoicera

JUNE 12, 2023

Are you tired of the hassle of traditional utility billing methods? Have you been searching for an efficient & streamlined process to manage your business’s utility bills? Look no further! Cloud-based utility billing software is the answer to all your problems. With its numerous benefits, switching to cloud-based utility billing software can lead to: Increase in productivity Cost savings Improve accuracy and more This blog post will explain – Why should your business make a move

Nanonets

JUNE 12, 2023

Introduction to Microsoft Power Automate Power Automate, formerly known as Microsoft Flow, is a cloud-based service offered by Microsoft to help users create and automate workflows across multiple applications and services. Its aim is to boost user productivity in business processes and automate repetitive manual tasks. Using Power Automate, you can design workflows that connect to over 300 services, such as SharePoint, Outlook, Excel, OneDrive, Dynamics 365, and third-party applications like Tw

Accounting Tools

JUNE 12, 2023

Related Courses Financial Analysis The Interpretation of Financial Statements Break even sales is the dollar amount of revenue at which a business earns a profit of zero. This sales amount exactly covers the underlying fixed expenses of a business, plus all of the variable expenses associated with the sales. It is useful to know the break even sales level, so that management has a baseline for the minimum amount of sales that must be generated in each reporting period to avoid incurring losses.

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Accounting Tools

JUNE 12, 2023

Related Courses Corporate Finance Treasurer's Guidebook The implied interest rate is the difference between the spot rate and the forward rate or futures rate on a transaction. When the spot rate is lower than the forward or futures rate, this implies that interest rates will increase in the future. Implied Interest Rate Example For example, if a forward rate is 7% and the spot rate is 5%, the difference of 2% is the implied interest rate.

Accounting Tools

JUNE 12, 2023

Related Courses Closing the Books Payroll Management The Year-End Close What is Accrued Salaries? Accrued salaries refers to the amount of liability remaining at the end of a reporting period for salaries that have been earned by employees but not yet paid to them. This information is used to determine the residual compensation liability of a business as of a specific point in time.

Accounting Tools

JUNE 12, 2023

Related Courses Accounting for Inventory Activity-Based Costing Cost Accounting Fundamentals What is Applied Overhead? Applied overhead is the amount of overhead cost that has been applied to a cost object. Overhead application is required to meet certain accounting requirements, but is not needed for most decision-making activities. Applied overhead costs include any cost that cannot be directly assigned to a cost object, such as rent, administrative staff compensation, and insurance.

Accounting Tools

JUNE 12, 2023

Related Courses Accountants’ Guidebook Bookkeeper Education Bundle Bookkeeping Guidebook What are Books of Original Entry? Books of original entry refers to the accounting journals in which business transactions are initially recorded. The information in these books is then summarized and posted into a general ledger , from which financial statements are produced.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Let's personalize your content