The top tax developments of 2023 — so far

Accounting Today

JULY 18, 2023

Forty of the most important court cases, revenue rulings, laws, regs and other guidance in the world of tax.

Accounting Today

JULY 18, 2023

Forty of the most important court cases, revenue rulings, laws, regs and other guidance in the world of tax.

Accounting Department

JULY 18, 2023

In the competitive world of manufacturing, success hinges on the ability to measure and improve crucial metrics that drive operational efficiency, quality, and profitability. Key performance indicators (KPIs) provide valuable insights into the performance of various aspects within a manufacturing company, enabling data-driven decision-making and fostering continuous improvement.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JULY 18, 2023

The more KAMs disclosed in an audit report, the higher the distress level of a company, according to a new study

Nanonets

JULY 18, 2023

Text Recognition in 2023 In many companies and organizations, plenty of valuable business data is stored in documents. This data is at the heart of digital transformation. Unfortunately, according to statistics, 80% of all this data is embedded in unstructured formats like business invoices, emails, receipts, PDF documents, and many more. Therefore, to extract and make the most out of information from these documents, companies slowly started relying on Artificial intelligence (AI) based service

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Accounting Today

JULY 18, 2023

The Internal Revenue Service wants practitioners, particularly in smaller tax practices, to use a new template to create a data security plan.

Blake Oliver

JULY 18, 2023

Tax pros - want an inside look at TurboTax's new full-service offering for business returns? My business partner David Leary and I just went through the process of using TurboTax LIVE Full Service for our partnership return and recorded our experience in a new video. Watch to see: How the onboarding and document collection process works Where the experience fell short compared to working directly with a CPA/EA The surprise requirements needed before our preparer could file How responsive and ava

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Insightful Accountant

JULY 18, 2023

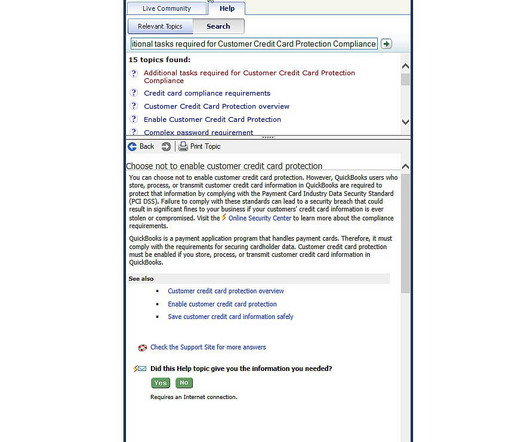

The newest email from Intuit QuickBooks is a Final Reminder to Become PCI Compliant Today. I have one and don't even have an active Payments Account.

Accounting Today

JULY 18, 2023

These experts aren't only helping businesses and investors uncover fraud — they also can help people who are going through a divorce trace assets.

CloudZero

JULY 18, 2023

Getting the right information at the right time can dramatically change the direction of your business. Yet, you may not have enough time to keep up with everything.

Accounting Today

JULY 18, 2023

A recent study said that the Great Recession caused not just economic pain but long term physical pain in certain individuals as well, an effect that persists well into the present day.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Insightful Accountant

JULY 18, 2023

Ignition's Matt Kanas explains how firm owners can build or transition their business to have zero AR.

Accounting Today

JULY 18, 2023

Ottawa has pledged to implement a new digital services tax in early 2024, unless a global tax agreement is ratified by OECD countries.

Accounting Tools

JULY 18, 2023

Related Courses Bookkeeper Education Bundle Bookkeeping Guidebook Journal entries are used to record business transactions. The following journal entry examples provide an outline of the more common entries encountered. It is impossible to provide a complete set of journal entries that address every variation on every situation, since there are thousands of possible entries.

Accounting Today

JULY 18, 2023

Green is costing green; Moore to come; disaster disbelief; and other highlights from our favorite tax bloggers.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Accounting Tools

JULY 18, 2023

Related Courses CFO Guidebook Investor Relations Guidebook What is a Shareholder? Shareholders and stakeholders are both associated with a corporation , but their interests in the organization differ. A shareholder is a person or entity that owns shares in the corporation. A shareholder is entitled to vote for the board of directors and a small number of additional issues, as well as receive dividends from the business and share in any residual cash if the entity is sold or dissolved.

Accounting Today

JULY 18, 2023

Familiarity with the Capability Maturity Model empowers companies to proactively prepare for audits by equipping them with knowledge about specific audit challenges associated with each level.

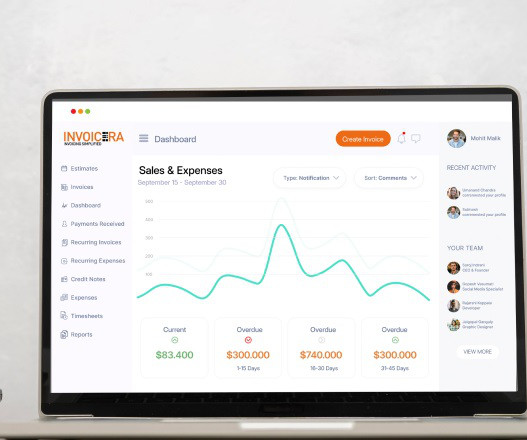

Invoicera

JULY 18, 2023

Managing payments efficiently is important to maintain a healthy cash flow for any business. If you are struggling with payment workflow issues, we will be happy to help you streamline payment workflow with recurring invoices and automatic billing. We are living in the age of technology, where you can automate invoicing process to positively impact the bottom line.

Ontrack Bookkeeping

JULY 18, 2023

MBIE have approved 5 applications from unions to start bargaining for Fair Pay Agreements (FPAs). If a company employs people in an occupation or industry you are in which is covered by a Fair Pay Agreement where bargaining has started, there are specific actions you need to take – and now. More details are below. The industries and occupations include the following: Early childhood education industry — Public notice of approval of application [PDF 145 KB] Commercial cleaner occupation —

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Nanonets

JULY 18, 2023

The traditional approach to accounts payable can be time-consuming, error-prone, and resource-intensive, hindering the organization's ability to focus on strategic initiatives. Fortunately, cutting-edge advancements in automation technology have revolutionized the accounts payable landscape, offering businesses an opportunity to streamline their workflows and achieve unprecedented levels of efficiency.

Ontrack Bookkeeping

JULY 18, 2023

This is a question that has come up in our Payroll Essentials Training Course that is currently running. Scenario: An employee comes to work for 2 hours on a public holiday, then has to go home early due to being ill. This is what they would receive for the day 2 hrs at time and half 1 x alternative day IF the day is a otherwise working day for the employee What happens to the rest of day?

Invoicera

JULY 18, 2023

Managing payments efficiently is important to maintain a healthy cash flow for any business. If you are struggling with payment workflow issues, we will be happy to help you streamline payment workflow with recurring invoices and automatic billing. We are living in the age of technology, where you can automate invoicing process to positively impact the bottom line.

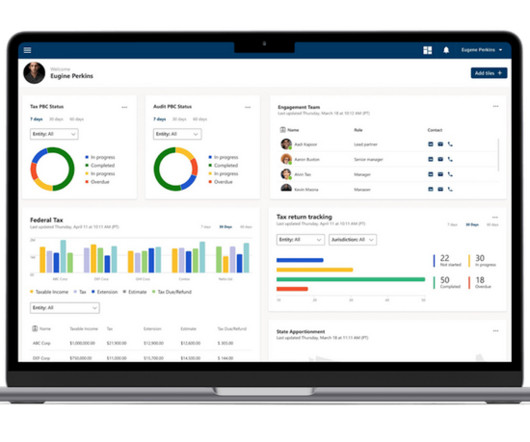

Insightful Accountant

JULY 18, 2023

The integrated and centralized dashboard helps enhance client engagement and provides CPA firms of all sizes with 360-degree visibility across operations.

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Cloud Accounting Podcast

JULY 18, 2023

Join Blake Oliver, CPA, and David Leary as they review using TurboTax Live Full Service for their business taxes. See their candid reactions and feedback as they go through the process of filing their 2022 taxes with TurboTax for the first time. Blake and David walk through the steps of getting matched with a tax expert, gathering documents, communicating with their preparer, and finally filing their partnership return.

Analytix Finance & Accounting

JULY 18, 2023

CPA firms play a critical role in today’s complex financial landscape. They provide essential services ranging from audits and tax preparation to consulting and advisory services. However, operating a successful CPA firm comes with its fair share of challenges. From constantly changing regulatory requirements to fierce competition, CPA firms often face obstacles that can hinder their growth and profitability.

Economize

JULY 18, 2023

Learn how to leverage Trusted Advisor, one of AWS's key tools, to optimize costs, improve performance, and secure your systems. This article provides detailed steps on how to use Trusted Advisor for cost optimization, highlighting its key features and functionalities.

CloudZero

JULY 18, 2023

Amazon’s CloudHealth and VMware’s CloudHealth are two of the most popular cloud management and system monitoring platforms today. But which platform does what, and are they even direct competitors?

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Accounting Tools

JULY 18, 2023

What is Margin? Margin is the difference between revenue and the associated cost of sales. There are several variations on the concept, which are noted below. These margins are closely followed by managers and investors, since even a small decline in any of them can be a precursor to ongoing losses. Gross Margin Gross margin is revenues minus both the fixed and variable components of the cost of goods sold.

NACM

JULY 18, 2023

NACM's 127th Credit Congress provided an opportunity for credit professionals to experience educational sessions, networking and fun! Several attendees were present as first-timers this year in Grapevine, TX."Credit congress really exceeded my expectations," said Araceli Magana, CBA, credit analyst at Joseph T Ryerson & Son, Inc. (Vernon, CA).

Accounting Tools

JULY 18, 2023

Related Courses Human Resources Guidebook Payroll Management What is an Incentive Wage Plan? An incentive wage plan offers an increased level of compensation when employee performance exceeds a threshold level. These plans are intended to incentivize employees to become more efficient and effective in completing their designated tasks. A plan could involve either an increase in output or a reduction in expenses.

Accounting Tools

JULY 18, 2023

Related Courses Accounting for Merchandising Operations Retail Management What is a Merchandiser? A merchandiser is an entity that acquires and resells inventory. The focus of this business model is to have an efficient inventory acquisition method and the ability to market and sell the goods to the end consumer. There are several ways in which a merchandiser can obtain inventory, which are noted below.

Advertiser: Paycor

Before you can achieve success, you have to define it. Objectives and Key Results (OKRs) give you the framework to do just that. Paycor’s free guide includes a step-by-step process leaders can use to work toward – and achieve – their loftiest business goals.

Let's personalize your content