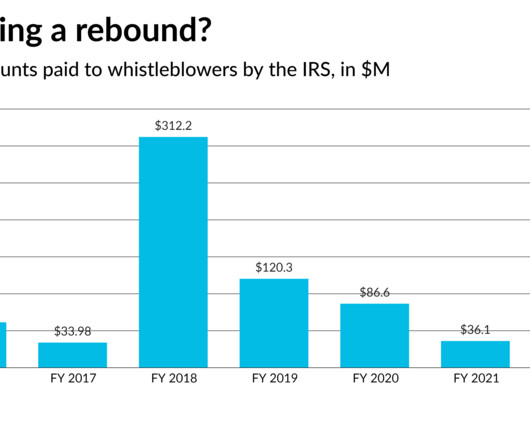

IRS whistleblower awards tick up

Accounting Today

JULY 10, 2023

They still haven't recovered their levels of three years ago, though

Accounting Today

JULY 10, 2023

They still haven't recovered their levels of three years ago, though

CloudZero

JULY 10, 2023

Picture the last time you were sitting at your desk trying to make sense out of the multiple cloud provider bills you just received. The amounts all change from month to month, and you can’t really compare them against each other because they all use different formats.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JULY 10, 2023

Jen Cryder, CEO of PICPA, shares the innovative ways the profession in her state is dealing with the pipeline problem.

Insightful Accountant

JULY 10, 2023

QuickBooks Professional Advisor Rich Kane explains why it is important to take the next generation of accounting professionals under your wing.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Accounting Today

JULY 10, 2023

Becoming a partner is the next step in the evolution of your career.

Accounting Tools

JULY 10, 2023

Related Courses Bookkeeper Education Bundle Bookkeeping Guidebook Property Management Accounting Straight-line rent is the concept that the total liability under a rental arrangement should be charged to expense on an even periodic basis over the term of the contract. The concept is similar to straight-line depreciation , where the cost of an asset is charged to expense on an even basis over the useful life of the asset.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

JULY 10, 2023

Related Courses Accounting for Inventory How to Audit Inventory Inventory Management The Balance Sheet What is Finished Goods Inventory? Finished goods are goods that have been completed by the manufacturing process, or purchased in a completed form, but which have not yet been sold to customers. Goods that have been purchased in completed form are known as merchandise.

Accounting Today

JULY 10, 2023

The Governmental Accounting Standards Board released implementation guidance to clarify, explain and elaborate on its GASB statements, using a series of questions and answers.

Accounting Tools

JULY 10, 2023

Related Courses CFO Guidebook Corporate Finance Treasurer's Guidebook What are Dividends? Dividends are a portion of a company's earnings which it returns to investors , usually as a cash payment. The company has a choice of returning some portion of its earnings to investors as dividends, or of retaining the cash to fund internal development projects or acquisitions.

Accounting Today

JULY 10, 2023

The institute kicked off its annual international conference, highlighting its international growth and the ways in which internal auditors are helping companies.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Insightful Accountant

JULY 10, 2023

Intuit will continue to pay cost of migrating the current and previous fiscal year of QuickBooks (UK) Desktop data to QBO (UK) using 'Movemybooks' until July 31, 2023.

Invoicera

JULY 10, 2023

Effective expense management plays a vital role in making any business reach the heights of success. Tracking each and every expense is, however, a long-drawn-out task. To streamline this process, businesses are embracing automated invoicing, which facilitates efficient expense management while saving valuable time you would have otherwise spent on manual invoicing.

Tipalti

JULY 10, 2023

A self-serve supplier/vendor portal is a viable solution that provides value for all stakeholders. It offers your vendors and your in-house accounting team a simple, easy-to-use web-based interface that they can access at any time, from anywhere.

Oversight

JULY 10, 2023

Should Audit and Finance professionals have concern for the present AI revolution, and the associated nervous feelings about being ‘replaced’, sooner than later, by machines? Just the opposite: it will be your most powerful asset.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Tipalti

JULY 10, 2023

Understand the framework of FX accounting and how it differs from domestic accounting. Learn best practices for optimizing your FX accounting processes.

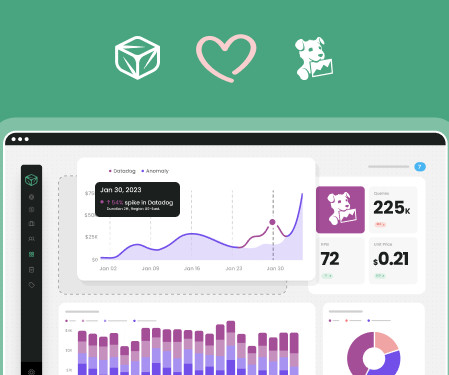

finout

JULY 10, 2023

Discover the pricing structure of Datadog and understand how much it costs. Explore the key factors influencing the pricing.

5 Minute Bookkeeping

JULY 10, 2023

It’s not news that QuickBooks is widely used among small business owners. When I started my business, I realized my limited knowledge of QuickBooks put me at a disadvantage. To grow, I needed to understand what was important to my clients. That was QuickBooks. Today, I’ll discuss the valuable resources provided by Intuit that are beneficial whether you’re new to bookkeeping or experienced.

Invoicera

JULY 10, 2023

Effective expense management plays a vital role in making any business reach the heights of success. Tracking each and every expense is, however, a long-drawn-out task. To streamline this process, businesses are embracing automated invoicing, which facilitates efficient expense management while saving valuable time you would have otherwise spent on manual invoicing.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Accounting Tools

JULY 10, 2023

Related Courses Investor Relations Guidebook Public Company Accounting and Finance What is a Forward Looking Statement? A forward looking statement describes future events or results. When made by a company, these statements can trigger shareholder lawsuits, so safe harbor provisions are now used to mitigate a company's risk. For many years, it was very risky for a publicly-held company to make any type of statement about the financial results that it expected to see in the future.

Insightful Accountant

JULY 10, 2023

New Invoiced A/P solution automates all aspects of payments, reporting and approvals, making it easier than ever for businesses to make payments on time.

Accounting Tools

JULY 10, 2023

Related Courses Corporate Cash Management Corporate Finance Working Capital Management What is Cash Management? Cash management involves the oversight of every cash inflow and outflow that a business experiences, with the goals of always having enough liquidity to operate the business, and finding the best possible use for any remaining liquidity. The key aspects of cash management are noted below.

Accounting Tools

JULY 10, 2023

Related Courses Business Ratios Guidebook Business Strategy Effective Customer Service What is Churn Rate? Churn rate is the rate at which customers leave a business. This is a critical issue, since it is more expensive to find new customers than it is to hold onto old ones. Also, the only way to increase sales is to add new customers faster than the rate at which you are losing existing ones.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Accounting Tools

JULY 10, 2023

Related Courses Business Ratios Guidebook The Interpretation of Financial Statements What is the Equity Ratio? The equity ratio measures the amount of leverage that a business employs. It does so by comparing the total investment in assets to the total amount of equity. If the outcome of the calculation is high, this implies that management has minimized the use of debt to fund its asset requirements, which represents a conservative way to run the entity.

Accounting Tools

JULY 10, 2023

Related Courses Financial Forecasting and Modeling What is a Forecast? A forecast is a projection of an entity's future results. It is used as the basis for planning fixed asset purchases, adding to or reducing staffing levels, and obtaining funding. A forecast is based on certain assumptions about future conditions which may not turn out to be accurate; to mitigate the risk of inaccuracy, forecasts may be revised at regular intervals.

Accounting Tools

JULY 10, 2023

Related Courses Accounting for Intangible Assets What is a Soft Asset? A soft asset is an intangible asset , such as brand recognition and intellectual capital. Soft assets are also considered to include the human resources of a business, which are its employees and their skills and experience. Soft assets are not normally recognized in an organization's balance sheet , unless they were obtained in an acquisition.

Accounting Tools

JULY 10, 2023

Related Courses Money Laundering What is a Money Services Business? A money services business (MSB) is any organization that transmits or converts money. These services can involve currency exchange, check cashing, issuing traveler’s checks, and/or transmitting money. The best-known MSB is Western Union, but there are thousands of smaller operators, frequently specializing in wire transfers to specific countries.

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Accounting Tools

JULY 10, 2023

Related Courses Money Laundering What is Smurfing in Money Laundering? Smurfing is the practice of executing financial transactions in order to avoid formal bank reporting requirements. The usual practice is to break down a large amount of cash into smaller amounts that fall beneath the $10,000 reporting threshold of the Bank Secrecy Act, and deposit these smaller amounts in a variety of financial institutions.

Accounting Tools

JULY 10, 2023

Related Courses Investor Relations Guidebook Public Company Accounting and Finance What is Regulation Fair Disclosure? Regulation Fair Disclosure (FD) requires that a company immediately release to the general public any material non-public information that it has disclosed to certain individuals outside of the company. It was designed to ensure that the general public obtains information that has also been shared with select individuals.

Accounting Tools

JULY 10, 2023

Related Courses How to Audit Outsourced Functions Investor Relations Guidebook Public Company Accounting and Finance Should You Outsource Investor Relations? There are a vast number of activities that the investor relations function might be responsible for – so many that it is nearly impossible to retain a sufficient level of in-house expertise to competently address them all.

Accounting Tools

JULY 10, 2023

Related Courses Investor Relations Guidebook Public Company Accounting and Finance What are Institutional Investor Relations? An institutional investor is an organization that buys and sells securities in sufficiently large volume to qualify for lower commissions and other forms of preferential treatment. An example is a pension fund. Institutional investors are always looking for profitable new investments in which they can generate a return on their cash, and so are continually being pursued b

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Let's personalize your content