Beryl victims in Texas get tax relief

Accounting Today

JULY 23, 2024

Individuals and businesses in the affected counties now have until next Feb. 3 to file various federal individual and business tax returns and make tax payments.

Accounting Today

JULY 23, 2024

Individuals and businesses in the affected counties now have until next Feb. 3 to file various federal individual and business tax returns and make tax payments.

Accounting Department

JULY 23, 2024

In today's competitive business landscape, staying ahead of the competition requires more than just a great product or service. Entrepreneurs, small business owners, and financial analysts must focus on tracking key financial metrics to ensure their company's growth and financial health.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JULY 23, 2024

Preliminary results of a recent survey suggest that the location — and sources — of dissatisfaction in accounting firms may be surprising.

Xero

JULY 23, 2024

This guest blog was written by the team at GoCardless. Running a small business can mean moving between being a general manager to a customer services contact, marketing lead and, in some cases, debt collector. Without the proper processes in place, managing payments can take up too much time and even result in bigger problems. In fact, the Office of National Statistics shared that poor cash flow is responsible for up to 90% of new businesses failing.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Accounting Today

JULY 23, 2024

Going concern opinions have slowly decreased over the last two decades, with the exception of spikes during the 2008 financial crisis and the years of the COVID-19 pandemic.

Compleatable

JULY 23, 2024

Watch: Automate Purchasing & Invoice Matching Seamlessly into MIP Fill in the form to access the video recording of our Compleat for Non-Profits webinar looking specifically at our API integration with MIP Fund Accounting. Name Work Email Address Job Title Watch the video Automate Purchasing & Invoice Matching Seamlessly into MIP The post Automate Purchasing & Invoice Matching Seamlessly into MIP first appeared on Compleat Software.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

JULY 23, 2024

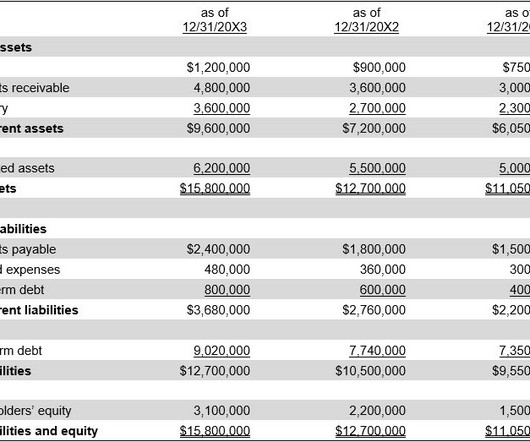

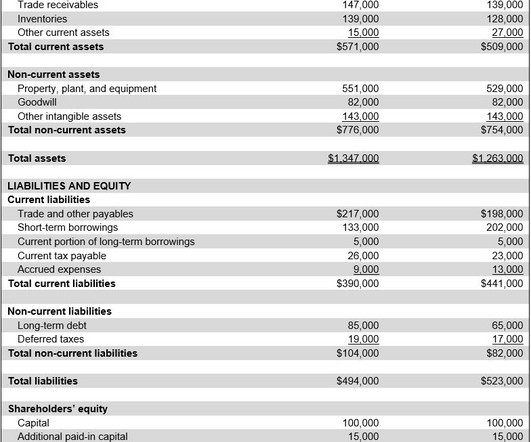

What are Comparative Financial Statements? Comparative financial statements are the complete set of financial statements that an entity issues, revealing information for more than one reporting period. The financial statements that may be included in this package are as follows: The income statement (showing results for multiple periods) The balance sheet (showing the financial position of the entity as of more than one balance sheet date) The statement of cash flows (showing the cash flows for

Accounting Today

JULY 23, 2024

The landscape of talent acquisition is rapidly shifting due to intense competition for top talent and the rise of the gig economy.

Billing Platform

JULY 23, 2024

TechTarget defines consumption-based pricing – also referred to as pay-as-you-go billing, metered billing or usage-based pricing – as a service provision and payment scheme in which customers pay according to the resources they use. Historically, this pricing model was the choice for utility companies. However, since its pioneering days by companies like Amazon Web Services (AWS) and Azure, this pricing scheme gained popularity and become commonplace among cloud computing, SaaS, PaaS, and IaaS c

Accounting Today

JULY 23, 2024

AitM; IRS strategies after Chevron; the taxman's jackpot; and other highlights from our favorite tax bloggers.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Billing Platform

JULY 23, 2024

TechTarget defines consumption-based pricing – also referred to as pay-as-you-go billing, metered billing or usage-based pricing – as a service provision and payment scheme in which customers pay according to the resources they use. Historically, this pricing model was the choice for utility companies. However, since its pioneering days by companies like Amazon Web Services (AWS) and Azure, this pricing scheme gained popularity and become commonplace among cloud computing, SaaS, PaaS, and IaaS c

Accounting Tools

JULY 23, 2024

What is a Self-Constructed Asset? A self-constructed asset is one that a business elects to build under its own management. A common example of a self-constructed asset is when a company chooses to build an entire facility. Or, the management team might elect to design its own production equipment, usually because its products are so unique that there are no standardized machines on the market that can manufacture them.

LedgerDocs

JULY 23, 2024

Creating a system for document management is a great way to improve the accuracy and efficiency of your bookkeeping process, but there are a few common mistakes that can be made when setting up your system that can prevent you from experiencing the positive improvements. 1. Not Standardizing Document Naming Conventions The first and most common pitfall is using inconsistent naming conventions.

Accounting Tools

JULY 23, 2024

A fixed asset is written off when it is determined that there is no further use for the asset, or if the asset is sold off or otherwise disposed of. A write off involves removing all traces of the fixed asset from the balance sheet , so that the related fixed asset account and accumulated depreciation account are reduced. There are two scenarios under which a fixed asset may be written off.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

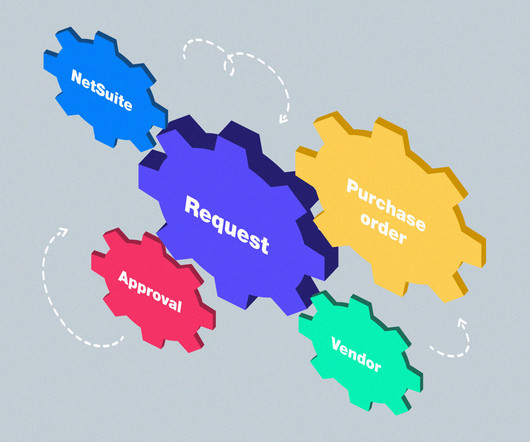

Tipalti

JULY 23, 2024

Whether you’re part of a purchasing team, a procurement department, or an employee making a purchase, odds are you’re following some kind of outlined requisition process. There’s no one correct way to initiate a requisition process, but having a working process in place is essential to making smooth, and smart, purchases in most companies.

Accounting Tools

JULY 23, 2024

What are Market Value Ratios? Market value ratios are used to evaluate the current share price of a publicly-held company's stock. These ratios are employed by current and potential investors to determine whether a company's shares are over-priced or under-priced. The most common market value ratios are noted below. Book Value Per Share The book value per share is calculated as the aggregate amount of stockholders' equity , divided by the number of shares outstanding.

Nanonets

JULY 23, 2024

Snapping or clicking an image is the easiest way to capture text from paper documents conveniently in your phone or computer. Imagine having a bunch of handwritten notes that you need to organize for a project, or a bunch of receipts that you want to digitize to better track your expenses. While storing text as an image is convenient, you can't readily modify, copy or edit the text in an image.

Accounting Tools

JULY 23, 2024

What is an Inventory Cutoff? An inventory cutoff is a procedure that is designed to ensure that all inventory transactions associated with a reporting period are actually recorded within that period. Without careful attention to this procedure, it is quite likely that some transactions will be recorded in the wrong period, resulting in an incorrect cost of goods sold figure for the targeted reporting period.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Insightful Accountant

JULY 23, 2024

The Internal Revenue Service and the Security Summit partners today urged tax professionals to learn the signs of data theft so they can respond quickly to protect their business and their clients.

oAppsNet

JULY 23, 2024

Monitoring greenhouse gas (GHG) emissions is essential to comprehending and reducing the environmental damage caused by human activity. As concerns about climate change intensify, businesses, governments, and organizations worldwide focus on quantifying their carbon footprints. Accurate measurement of GHG emissions enables entities to identify significant sources of emissions, develop strategies to reduce them and comply with global standards and regulations.

Insightful Accountant

JULY 23, 2024

Murph shares how you can be a 'code-breaker' in the 2025 U.S. ProAdvisor Awards and potentially score more points by ensuring you get ranked in every applicable category for your practice.

Accounting Tools

JULY 23, 2024

What are the Objectives of Financial Reporting? The objectives of financial reporting cover three areas, dealing with useful information, cash flows, and liabilities. The objectives are noted below. Objective #1: Provide Useful Information The first objective is to provide useful information to the users of financial reports. The information should be useful from a number of perspectives, such as whether to provide credit to a customer , whether to lend to a borrower , and whether to invest in a

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

AvidXchange

JULY 23, 2024

In today’s fast-paced business environment, efficient financial management is crucial for success. Enter AI billing, a game-changer for invoicing and accounts receivable (AR). By leveraging artificial intelligence (AI) for billing, companies can streamline their accounting processes, cut costs, improve security, and enhance overall accuracy. Read on to learn more about AI billing, including related benefits and challenges.

Counto

JULY 23, 2024

Shareholders’ Agreements: Essential Protection for Singapore Small Businesses As a Singapore small business owner, have you considered the crucial role of a shareholders’ agreement? At Counto, our company secretary service often finds this vital document overlooked. Yet, it’s key to protecting your business and fostering shareholder harmony.

AvidXchange

JULY 23, 2024

With the advent of artificial intelligence (AI), procurement processes are poised to experience a significant transformation. AI in procurement leverages technologies like machine learning and predictive analytics to enhance decision-making, streamline operations, and reduce costs. Procurement plays a crucial role in supply chain management, helping organizations source the right products at the best prices.

Accounting Tools

JULY 23, 2024

What is Accounting Theory in Financial Reporting? Accounting theory is the cluster of accounting frameworks and historical practices that is used to apply principles of financial reporting. The bulk of accounting theory is based on the applicable accounting framework, such as Generally Accepted Accounting Principles or International Financial Reporting Standards.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Accounting Tools

JULY 23, 2024

What is Current Value Accounting? Current value accounting is the concept that assets and liabilities be measured at the current value at which they could be sold or settled as of the current date. This varies from the historically-used method of only recording assets and liabilities at the amounts at which they were originally acquired or incurred (which represents a more conservative viewpoint).

Accounting Tools

JULY 23, 2024

What is Material Costing? Material costing is the process of determining the costs at which inventory items are recorded into stock, as well as their subsequent valuation in the accounting records. We deal with these concepts separately. Material Costing for Initial Inventory Acquisition A company must decide whether it will record acquired materials at their purchased prices, or if additional costs will be added, such as freight in , sales taxes , and customs duties.

Accounting Tools

JULY 23, 2024

What is a Cost Object? A cost object is any item for which costs are being separately measured. It is a key concept used in managing the costs of a business. Several types of cost objects are noted below. Output-Related Cost Objects The most common cost objects are a company's products and services, since it wants to know the cost of its output for profitability analysis and price setting.

Accounting Tools

JULY 23, 2024

How to Process Cash Receipts The process of receiving cash is highly regimented, because the task of processing checks is loaded with controls. They are needed to ensure that checks are recorded correctly, deposited promptly, and not stolen or altered anywhere in the process. The procedure for check receipts processing is outlined below. Step 1. Record Checks and Cash When the daily mail delivery arrives, record all received checks and cash on the mailroom check receipts list.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Let's personalize your content