Senate report confirms data leakage from tax software

Accounting Today

JULY 13, 2023

A Senate investigation has concluded that major tax software providers have been sending sensitive personal information to tech companies like Meta and Google.

Accounting Today

JULY 13, 2023

A Senate investigation has concluded that major tax software providers have been sending sensitive personal information to tech companies like Meta and Google.

Xero

JULY 13, 2023

Sempar Accountancy and Tax have been crowned the Xero Mid-size Firm of the Year at the 2023 Xero Awards for UK and Ireland. This award recognises their innovative practice and unwavering commitment to delivering exceptional client service. We take a look at what sets Sempar apart, and how the firm has helped their clients achieve their business goals.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JULY 13, 2023

A draft of legislation aims at reducing double taxation for employees and businesses involved in cross-border investment between the two countries

Accounting Department

JULY 13, 2023

This article recaps the important role of inventory management in e-commerce and the vital ways it helps businesses control costs and improve customer relationships.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Accounting Today

JULY 13, 2023

Poor Quality; for king and country and cash; a penny saved; and other highlights of recent tax cases.

Fidesic blog

JULY 13, 2023

Microsoft Partners, We have launched a 6-question poll series exclusively on LinkedIn to find out where how the Dynamics GP Community is preparing for 2028 and Beyond. Check out and follow #2028andBeyondPoll for the current question.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

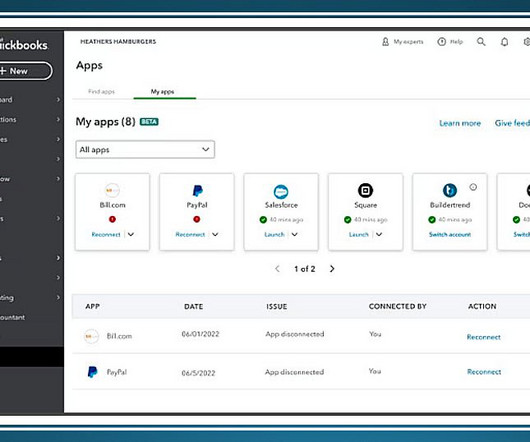

Insightful Accountant

JULY 13, 2023

This new app dashboard keeps you better informed regarding app-related connection issues.

Accounting Today

JULY 13, 2023

Victims will now have until Nov. 15, 2023, to file their individual and business tax returns and make tax payments, pushing back the Oct. 16 deadline.

Insightful Accountant

JULY 13, 2023

'The Unique CPA Conference 2023' unites accounting professionals seeking to enhance their careers and contribute to the advancement of the accounting profession.

Accounting Today

JULY 13, 2023

The service offers a wealth of resources that can be enormously useful to tax practitioners.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

LedgerDocs

JULY 13, 2023

Every successful business has been built on the back of a strong accounting and bookkeeping team. A strong financial team should be instrumental in ensuring that the books are accurate, the business is remaining compliant with tax regulations and is profitable and they are leading the charge in financial decision-making. But to create such successful bookkeeping requires planning, strategic hiring, and creating an environment that encourages collaboration and personal development.

Accounting Today

JULY 13, 2023

Seven ways to attract the right clients — and let go of the rest.

Reconciled Solutions

JULY 13, 2023

If you want to pay a bonus outside of your regular payroll, you should run a bonus payroll in Gusto. Here are some tips for doing it right. The post Talent Attraction and Retention Using Bonuses appeared first on Reconciled Solutions.

Accounting Today

JULY 13, 2023

The Cum-Ex strategy ultimately landed ED&F Man in the middle of one of the biggest financial scandals in modern European history.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Accounting Tools

JULY 13, 2023

Related Courses Accountants’ Guidebook Bookkeeping Guidebook Fixed Asset Accounting Capital expenditures are for fixed assets , which are expected to be productive assets for a long period of time. Revenue expenditures are for costs that are related to specific revenue transactions or operating periods, such as the cost of goods sold or repairs and maintenance expense.

Accounting Today

JULY 13, 2023

Today's leading cloud service platforms offer a multitude of tools that make it easier to leverage best-in-class technology with minimal IT management.

Accounting Tools

JULY 13, 2023

Related Courses Excel Formulas and Functions Financial Analysis Introduction to Excel What is the Formula for the Future Value of an Annuity Due? Future value is the value of a sum of cash to be paid on a specific date in the future. An annuity due is a series of payments made at the beginning of each period in the series. Therefore, the formula for the future value of an annuity due refers to the value on a specific future date of a series of periodic payments, where each payment is made at the

MineralTree

JULY 13, 2023

Accounts payable forecasting is a lot like gazing into a crystal ball — it enables businesses to predict and plan for upcoming financial obligations. By understanding how to forecast accounts payable accurately, organizations gain valuable insights into their data, which in return helps them make smarter financial decisions and avoid unforecasted expenses.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Accounting Tools

JULY 13, 2023

Related Courses Business Ratios Guidebook The Interpretation of Financial Statements What is the Cash Flow to Debt Ratio? The cash flow to debt ratio reveals the ability of a business to support its debt obligations from its operating cash flows. This is a type of debt coverage ratio. A higher percentage indicates that a business is more likely to be able to support its existing debt load.

Reconciled Solutions

JULY 13, 2023

Profit First asserts that we need to flip the generally accepted accounting principle for profit around. Here's why it works. The post A New Formula For Businesses To Follow In Pursuit Of Profit appeared first on Reconciled Solutions.

Accounting Tools

JULY 13, 2023

Related Courses Human Resources Guidebook Optimal Accounting for Payroll Payroll Management Understanding the Common Paymaster Concept When a parent company owns a number of subsidiaries , the company as a whole may pay more payroll taxes than is strictly necessary. This situation arises when the employees of one subsidiary transfer their employment to another subsidiary.

SSI Healthcare Rev Cycle Solutions

JULY 13, 2023

Leveraging the Power of Medical Claim Edits: Expediting Payments for Hospitals and Health Systems Home / July 13, 2023 As hospitals and health systems strive to optimize revenue cycle management, the role of edits in streamlining claims processing and expediting payments has become increasingly crucial. Medical claim edits serve multiple purposes, from preventing denials to ensuring compliance with regulations and enhancing revenue capture and standardization.

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Accounting Tools

JULY 13, 2023

Related Courses Bookkeeping Guidebook Closing the Books The Year-End Close What is an Unadjusted Trial Balance? The unadjusted trial balance is the listing of general ledger account balances at the end of a reporting period, before any adjusting entries are made to the balances to create financial statements. The unadjusted trial balance is used as the starting point for analyzing account balances and making adjusting entries.

Tipalti

JULY 13, 2023

Streaming has never been more relevant as a way of turning your passions and hobbies into an additional income stream.

finout

JULY 13, 2023

Discover Datadog pricing, explore debug, metrics, and monitoring features, and gain strategies to optimize Datadog costs without compromising functionality.

Nanonets

JULY 13, 2023

In the digital age, businesses rely on efficient expense management processes to maintain accurate financial records and ensure smooth operations. However, one challenge that organizations often encounter is the presence of duplicate receipts. These duplicates can lead to errors in reimbursement calculations, compliance concerns, and inefficient use of resources.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

AvidXchange

JULY 13, 2023

Although the COVID-19 Public Health Emergency has officially ended , workers and organizations in the real estate industry continue to grapple with the fallout. The residential real estate market reached staggering highs during the pandemic while commercial real estate suffered a lasting blow. Businesses in the industry are currently navigating the move towards hybrid work amidst a critical talent shortage and a surge in demand for rental property management.

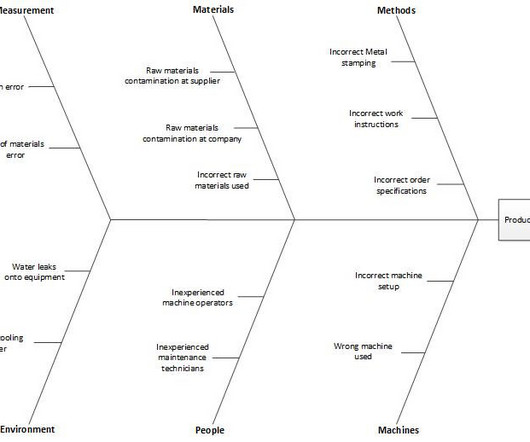

Accounting Tools

JULY 13, 2023

Related Courses Operations Management What is a Cause and Effect Diagram? A cause-and-effect diagram is a visual layout of the possible causes of a problem. It is structured to show a number of branches, and so looks somewhat like a fish skeleton (hence its alternate name of fishbone diagram). The diagram begins with a single line, at the end of which is stated the problem to be solved.

AvidXchange

JULY 13, 2023

The digital transformation of the finance function is top of mind for chief financial officers (CFOs). Not only do they want to drive growth, but amid economic headwinds and a tight labor market, they’re also looking for opportunities to create efficiencies. In a recent AvidXchange survey of finance professionals, 70% of respondents said investing in technology is a medium to high priority for their organization in 2023.

Blake Oliver

JULY 13, 2023

Thanks, Meryl Johnston , for having me on the Lifestyle Accountant Show! As an entrepreneur wearing multiple hats, I discussed how I manage my time across various projects and businesses, my transition from running a cloud bookkeeping firm to focusing on product marketing, and my approach to content creation and leveraging technology. In the episode, Meryl and I talk about: My journey from founding one of the first cloud bookkeeping firms in North America to now running an educational software s

Advertiser: Paycor

Before you can achieve success, you have to define it. Objectives and Key Results (OKRs) give you the framework to do just that. Paycor’s free guide includes a step-by-step process leaders can use to work toward – and achieve – their loftiest business goals.

Let's personalize your content