IRS to start tax season on Jan. 27

Accounting Today

JANUARY 10, 2025

Newly expanded and improved tools will be available when tax season kicks off this month.

Accounting Today

JANUARY 10, 2025

Newly expanded and improved tools will be available when tax season kicks off this month.

Enterprise Recovery: Accounts Receivable

JANUARY 10, 2025

As accounts receivable (A/R) become delinquent, your business expenses could fall behind. With every late-paying client, cash flow for payroll, rent, or other vendors falls short, threatening your company's bottom line and growth. The effectiveness of your A/R department may be one of the most important measurements to determine the success of your business.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JANUARY 10, 2025

Intuit guarantees tax refunds 5 Days early into any bank account; IRIS beefs up Firm Management solution, customer success function; and other accounting tech news and updates.

AvidXchange

JANUARY 10, 2025

Table of Contents: AP Automation ROI Calculator | Factors for Calculating Accounts Payable Automation ROI | How to Calculate AP Automation ROI | Intangible Benefits of AP Automation | Tips for Maximizing Accounts Payable Automation ROI | Take the Guesswork Out of Accounts Payable Automation ROI Automating accounts payable (AP) processes can result in many benefits for busy finance and accounting departments.

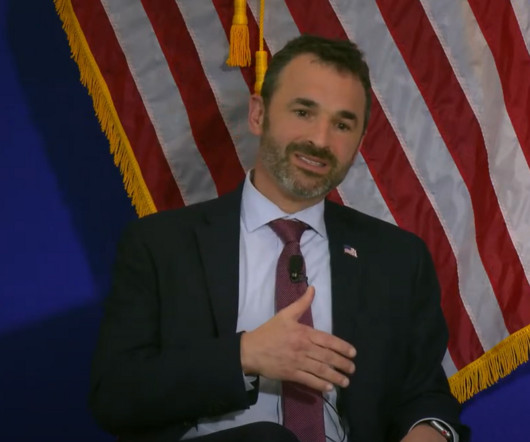

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Accounting Today

JANUARY 10, 2025

Ericksen Krentel elects sixth MP; Yeo & Yeo, Grassi and BMSS move offices; IFRS Foundation appoints three new trustees; and more news from across the profession.

Counto

JANUARY 10, 2025

Cryptocurrency Accounting for Small Businesses in Singapore As cryptocurrency continues to gain popularity worldwide, many small businesses in Singapore are exploring its potential as an alternative form of payment or an investment option. However, accounting for cryptocurrency can be complex, and understanding the proper treatment is essential for ensuring your business remains compliant and financially organised.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Cloud Accounting Podcast

JANUARY 10, 2025

Blake and David explore the controversial H-1B visa program's impact on the accounting profession, particularly how firms like Deloitte reportedly pay visa holders 10% less than U.S. workers and the potential implications for audit quality. They also examine Bench's sudden shutdown and subsequent acquisition and then discuss Barry Melancon's farewell interview with the Financial Times as he steps down as AICPA CEO, where he defended the 150-hour rule, his legacy, and his impact on the profession

Accounting Today

JANUARY 10, 2025

The deadline for our Top New Products list has been moved to Wednesday, Jan. 15.

Fit Small Business

JANUARY 10, 2025

Wildfire insurance in California or any other state is not a special type of policy. Any type of fire (including a wildfire) is a named loss covered under a standard commercial property policy. Commercial property insurance can be purchased either as a stand-alone policy or bundled with several other policies in whats called a business. The post Wildfire Insurance in California: How To Navigate, Costs & Coverage appeared first on Fit Small Business.

Accounting Today

JANUARY 10, 2025

The proposed regulations involve several provisions of the SECURE 2.0 Act, including auto enrollment in 401(k) and 403(b) plans, and the Roth IRA catchup rule.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Billing Platform

JANUARY 10, 2025

Customer churnthe rate at which customers stop doing business with a companyis a critical metric for companies across all industries. High churn rates can directly impact revenue growth, profitability and long-term sustainability. Tracking and reducing churn requires a deep understanding of how your business compares to industry benchmarks. This helps identify whether your churn is an anomaly or part of broader trends.

Accounting Today

JANUARY 10, 2025

Proposed new rules were issued for the tax credit for qualified commercial clean vehicles, along with guidance on claiming tax credits for clean fuel.

Blake Oliver

JANUARY 10, 2025

Heres a powerful piece by Drew Carrick of FloQast on the future of CPE in accounting. As our profession undergoes massive transformation, he asks: shouldn't our approach to professional education evolve, too? Drew writes: What if instead of being a tedious, burdensome, annual maintenance chore, continuing professional education was, like a college degree or technical credential, something that enabled you to advance in your career?

Accounting Today

JANUARY 10, 2025

The new administration has discussed creating a strategic Bitcoin reserve. What accounting changes would we see as a result?

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Blake Oliver

JANUARY 10, 2025

$839,000. That's what equity partners in the top 400 public accounting firms make on average now (excluding the Big Four). Want to know the hidden cost of that salary? Working more hours than anyone else in the firm - and being less happy for it. On the Earmark Podcast , I spoke with Yuri Kapilovich, CPA about this brutal reality. Equity partners work an average of 50+ hours per week, and their job satisfaction score is just 6.7 out of 10 - no better than managers making a fraction of their inco

Accounting Today

JANUARY 10, 2025

Regular reviews can determine whether a life insurance policy is performing according to expectations and meeting the client's current financial objectives.

Blake Oliver

JANUARY 10, 2025

Digital assets aren't just about crypto. On the Earmark Podcast, I talked with Noah D. Buxton from The Network Firm about how blockchain technology is starting to impact traditional assets like real estate and commodities. This creates a huge opportunity for CPAs. After all, someone needs to verify these assets actually exist - and we saw what happens when nobody does proper verification (looking at you, FTX).

Accounting Today

JANUARY 10, 2025

Officials are weighing whether the bank now owned by UBS breached a 2014 plea deal in which it paid $2.6 billion and admitted helping Americans evade taxes.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Blake Oliver

JANUARY 10, 2025

This is the best argument I've read yet as to why BOI reporting is unconstitutional. Essentially, the government is claiming they can force you to report your ownership information just because your business might engage in interstate commerce someday. But that's like saying they can regulate your newborn because the kid might grow up to be a truck driver.

Accounting Today

JANUARY 10, 2025

Weeks after Danish judges sentenced the hedge fund trader to 12 years in prison, the country's lawyers turned to a U.S. court to recoup about $500 million.

Insightful Accountant

JANUARY 10, 2025

As 1099 season approaches, accountants face the annual challenge of collecting W-9s from contractorsa task often fraught with inefficiencies and missed deadlines. Keeper offers a seamless solution to simplify this process.

Tipalti

JANUARY 10, 2025

Tipalti completely changed how the Pro Football Hall of Fames accounting team works. Streamlining its accounts payable process gave the Hall of Fame room to focus on what really matters.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Insightful Accountant

JANUARY 10, 2025

I.R.S. Free File opens today, Friday January 10, 2025. IRS Free File can only be started from the IRS Free File webpage at IRS.gov.

Black Ink Tax & Accounting

JANUARY 10, 2025

Table of Contents Common types of business licenses For those looking to kickstart a business, an important step is making […] The post Types of Business Licenses appeared first on bitaccounting.

Intuit

JANUARY 10, 2025

Meet James Harris A dozen years into a high-achieving financial services sales career, James Harris was ready for a new challenge. At companies including J.P Morgan, Wells Fargo, First Data Corp, Fiserv, and Equifax, James had built a reputation for commitment, ownership, and performance. Now, he wanted to find a company on the leading edge of innovation with ambitious goals for growth.

Black Ink Tax & Accounting

JANUARY 10, 2025

Table of Contents How long does an IRS audit take The IRS audit is a comprehensive examination of your business’s […] The post How long does an IRS audit take appeared first on bitaccounting.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Fit Small Business

JANUARY 10, 2025

Plumbing insurance coverage is an important part of a successful plumbing company and consists of general liability and equipment coverage. Depending on the size of the business, plumbing insurance will include workers compensation and commercial auto, too. Plumbing insurance costs between $45 and $100 a month for general liability. Plumbers will pay a lot less.

Counto

JANUARY 10, 2025

5 Stress Management Tips Every New Entrepreneur in Singapore Needs Starting a business is an exciting journey, but for new entrepreneurs in Singapore, it can also be a source of significant stress. From navigating complex regulations to managing tight deadlines, the pressure can quickly mount. Effective stress management is essential for staying productive and focused, and maintaining your well-being while building a successful business.

Let's personalize your content