Outstanding Checks and Bank Reconciliation: Simplifying Financial Processes with Automation

Nanonets

APRIL 1, 2024

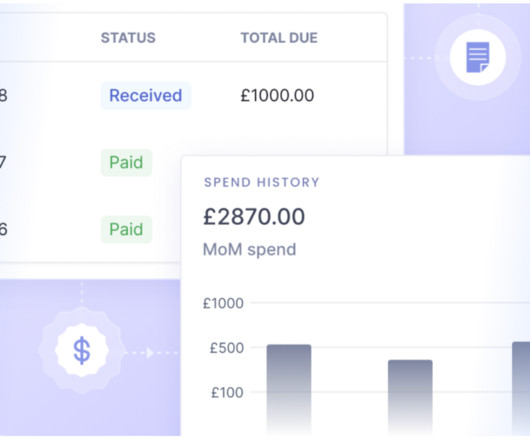

It poses a liability for the issuer until reconciled with financial records, potentially leading to overdraft risks if funds aren't maintained. Through these reconciliation processes, businesses can uphold financial transparency, mitigate risks, and maintain credibility in their financial operations.

Let's personalize your content